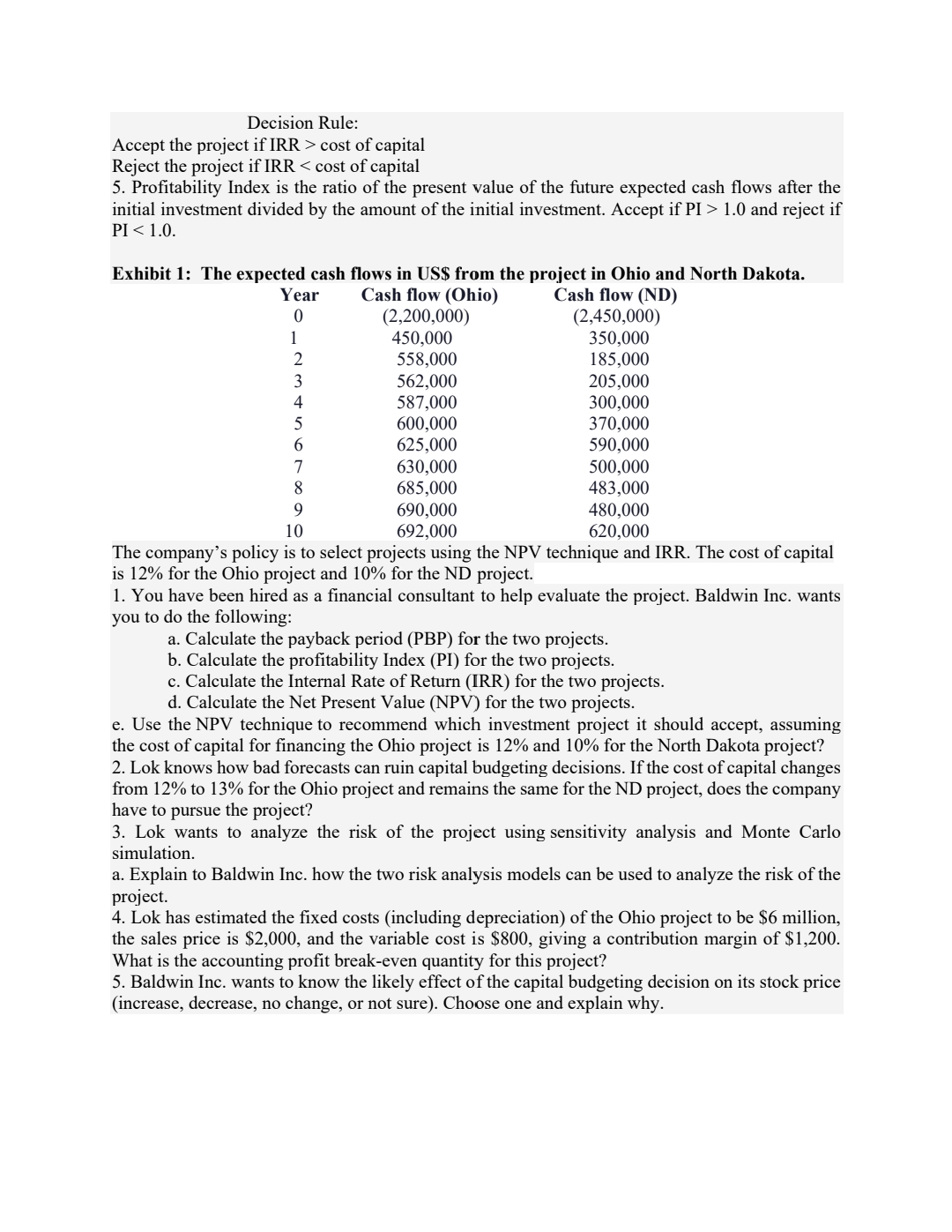

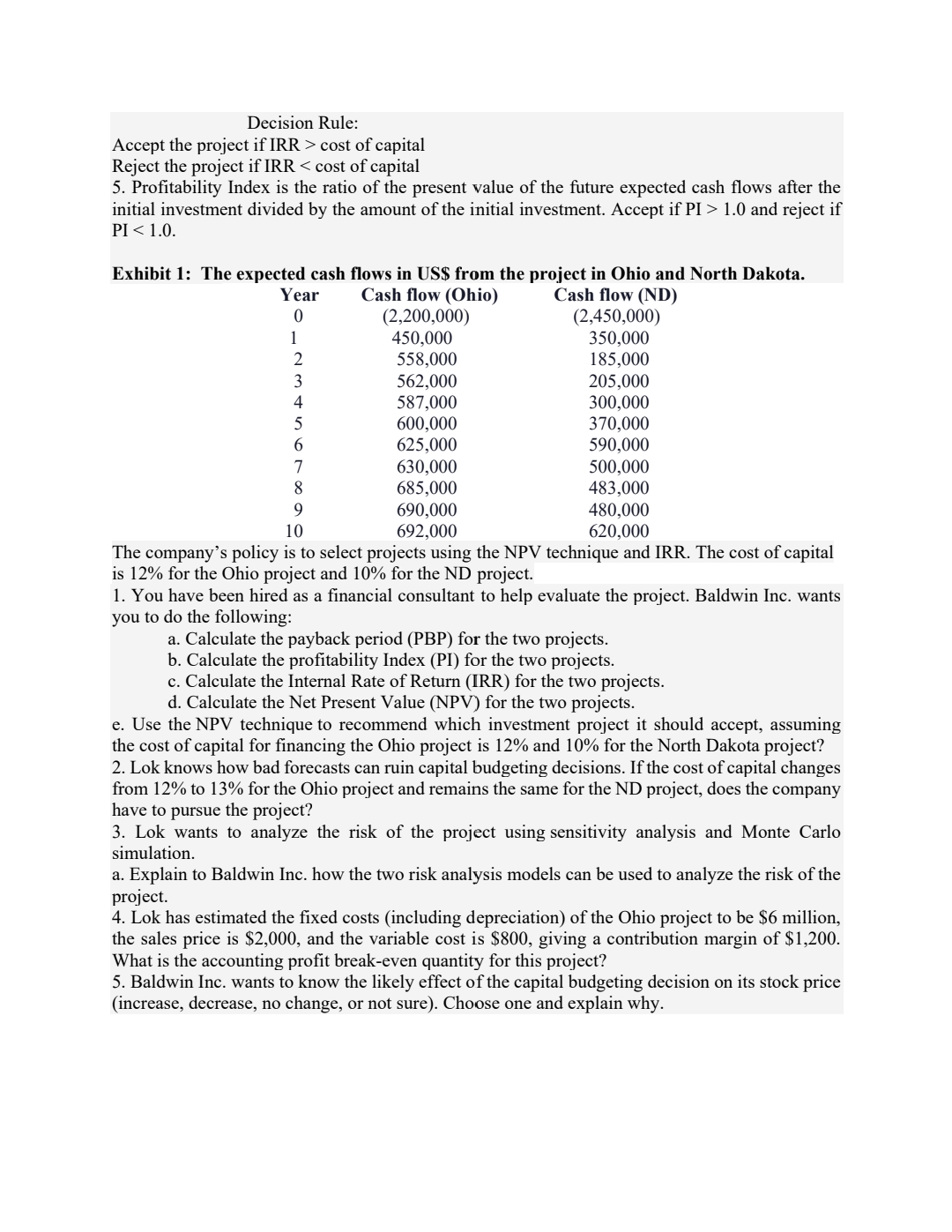

RISK ANALYSIS, REAL OPTIONS, AND CAPITAL BUDGETING Baldwin Corporation is a public corporation listed on New York Stock Exchange (NYSE) market. The company researches develops, manufactures, and sells various products in the healthcare industry worldwide. Baldwin Inc. operates in three main segments: consumer, pharmaceutical, and medical devices segments. The primary corporate objective of the company is to maximize the value of the owner's equity by increasing the price of its shares in the stock market. Unfortunately, the company's stock price has been declining over the past year because of declining sales, cash flow uncertainties, and weak financial ratios. The board of directors has hired a new CFO, Lok Acharya, to turn around the fortunes of the company. Lok earned his Ph.D. in Strategic Management from UC in 2018. After his MBA he worked for five years as a sales and marketing consultant for a pharmaceutical company. As a result, Lok does not have much work experience in corporate finance, although, in his graduate finance courses, he learned about the time value of money and its applications in finance and investment decisions. Despite his lack of experience in corporate finance, Lok wants to create value for the company through efficient management of working capital, and prudent capital budgeting activities by expanding the company's products into new markets. He is considering a capital investment either in the State of Ohio or North Dakota because of the growing market demand for the company's products in both States and the recent changes to the States' tax legislations that give tax incentives to new companies. The company has announced plans to invest about $2.2 million in its medical devices and pharmaceutical segments. Lok believes that decisions such as these, with price tags in the millions, are obviously major undertakings, and the risks and rewards must be carefully weighed. Lok knows that good financial decisions increase the value of a company's stock, and bad financial decisions decrease the value of the stock. Lok is working hard to make Baldwin Inc. one of the leading firms in the healthcare industry. Lok has been reading articles in financial journals on capital budgeting decisions and risk analysis. He has written down the following ideas on project evaluation techniques from book chapters and peer-reviewed articles: 1. The most popular capital budgeting techniques used in practice to evaluate and select projects are payback period, net present value (NPV), Profitability Index (PI), and internal rate of return (IRR). 2. Payback period is the number of years required for a company to recover the initial investment cost. The shorter the payback period, the better the project. 3. Net Present Value (NPV) technique: NPV is found by subtracting a project's initial cost of investment from the present value of its cash flows discounted using the firm's weighted average cost of capital. It shows the absolute amount of money in dollars that the project is expected to generate. Decision Criteria of NPV If NPV>0, accept the project If NPV cost of capital Reject the project if IRR 1.0 and reject if PI