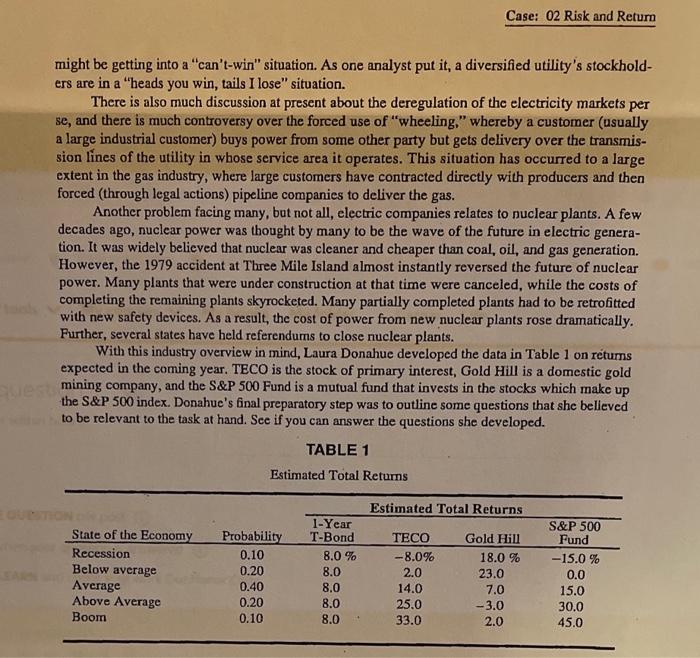

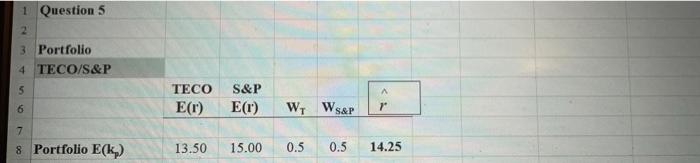

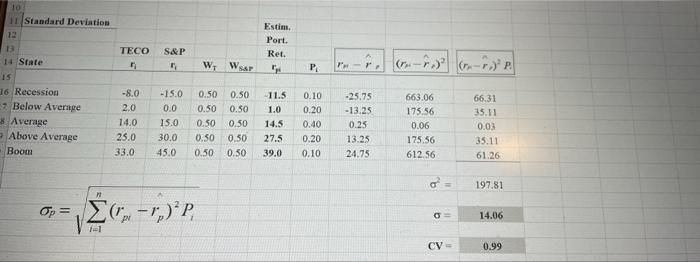

Risk and Return 2 PEACHTREE SECURITIES, INC. (A) Peachtree Securitics is a regional brokerage house based in Atlanta. Although the firm is only 20 years old, it has prospered by following a simple goal-providing quality personal brokerage ser- vices to small investors. Jake Taylor, the firm's founder and president, is well-satisfied with Peachtree's progress. However, he is apprehensive about the future, as more and more of the firm's customers are buying mutual funds rather than individual stocks and bonds. Thus, even though the number of customers per office has been increasing because of population growth, the number of transactions per customer has been decreasing, and hence sales growth has slackened. Taylor believes this trend will continue, so he has been actively expanding his product line in an effort to increase sales volume. As a first step, Peachtree began offering trust and portfolio man- agement services five years ago. Many of the trust clients are retirees who are interested primarily in current income rather than capital gains. Thus, an average portfolio consists mostly of bonds and high yield stocks. The stock component is heavily weighted with electric utilities, an industry that has traditionally paid high dividends. For example, the average electric company's dividend yield was about 6.3 percent in 1992, versus an average stock's yield of 3.1 percent. Until 1993. Peachtree had no in-house security analystsall stock and bond selections were based on research provided by subscription services. However, these services had become very costly, and the volume of portfolio management had reached the point where hiring an in-house ana- lyst was now cost-effective. Because most of its portfolios were heavily weighted with electric utilities, Peachtree created its first analyst position to track this industry. Taylor hired Laura Don- ahue, a recent graduate of the University of Georgia, to fill the job. Donahue reported to work in early January, 1993, jubilant at having the opportunity to use the skills she had worked so hard to learn. Taylor then informed her that her first task would be to conduct a seminar for a group of Peachtree customers on stock investments, including the effects of different securities on portfolio performance. Donahue was asked to pick an electric utility, assess its riskiness, develop an estimate of its required rate of return on equity, and then present her find- ings to a group of Peachtree's customers. Donahue's first step-choosing the company-was simple. She had been born and raised in Tampa, Florida, so she picked TECO Energy, Inc., the holding company for Tampa Electric. Next, she searched for information on the company. Donahue remembered using the Value Line Investment Survey during her student days, so she turned to this source first. (See Figure 1 on the last page of this case.) Then, she spent a few days reviewing industry trends to gain an historical perspective. Case: 02 Risk and Retur Electric utilities are granted monopolies to provide electric service in a given geographical area. In exchange for the franchise, the company is subjected to regulation over both the prices it may charge and the quality of its service. In theory, regulation acts to prevent the company from abusing its monopoly position, and its prices are set to mimic those that would occur if the firm were operating under perfect competition. Under such competition, the firm would earn its cost of capi- tal, no more and no less. In the 1950s and much of the 1960s, electric utilities were in an ideal position. Their costs were declining because of technological advances and economies of scale in generation and distribution. This made everyone happy-managers, regulators, stockholders, and customers. However, the sit- uation changed dramatically during the 1970s, when inflation, along with high gas and oil prices, pushed construction and operating costs to levels which were unimaginable just a few years earlier. The result was a massive change in the economics of the industry and in how investors viewed clectric utilities. Today, the industry is facing many challenges including cogeneration, diversification, dereg- ulation, and nuclear generation. Cogeneration is the combined production of electricity and ther- mal power, usually steam. Most electric companies use coal or naclear energy to generate electricity In the 1980s, though, oil and gas prices dropped sharply, making it cheaper to generate with gas or oil. However, one cannot bum asoroll in a coal or muclear plant. The changed fuel cost situation, combined with a need for steam, made it profitable for many industrial customers to switch to cogen- eration. This, in turn, has made it very difficult for utilities to forecast industrial demand. Also, since utilities must buy any surplus power generated by their former customers, companies with cogen- cration plants are, in effect, competing with the electric companies. Diversification, or expansion into nonregulated industries, is being evaluated by many utility companies. Due to large depreciation flows following completion of major plant construction pro- grams in the early 1980's, many companies now have cash flows that exceed immediate needs. Industry officials believe that usage of these cash flows to diversify into nonregulated industries would smooth out the financial risks of the regulated business, while providing companies an oppor- tunity to earn returns above those allowed by regulation. To facilitate diversification, many electric utilities, including TECO, have formed bolding companies under which the parent company holds both regulated and nonregulated subsidiaries. Diversification does have some potential downside for both utility customers (ratepayers) and stockholders. Ratepayers are supposed to pay the costs associated with producing and deliver ing power, plus enough to cover the utility's cost of capital. However, a diversified utility could, the- oretically, allocate some corporate costs that should be assigned to the unregulated (diversified) subsidiaries to the regulated utility. This would case reported profits to be abnormally high for the nooregulated business. In effet, rutepayers would be obsidizing the nonregulated businesses. The total corporation's overall rate of return would be excessive, because it would be coming the regu lated cost of capital on utility operations and more than a competitive retum on nonregulated oper- ations. Of course, regulators are aware of all this, so their auditors are always on the alert to detect and prevent improper cost allocations. There are two significant risks to stockholders from utility diversification programs. First, there is the chance that utility executives, who generally have limited exposure to intense competi- tion, will fail in the competitive, nonregulated, markets they cater. In that case, money that could have been paid out as dividends will have been lost in business ventures that tumed out to be unprof- itable. Second, if the diversified activities are highly profitable, causing the overall corporation to earn a high rate of return, then regulators might reduce the returns allowed on the utility opera- tions. There is always a question as to what a company's cost of capital really is bence the rate of return the utility commission should allow it to eats-und it is easier for a commission to set the allowed rate of return at the low end of any reasonable range if the company is highly profitable because of successful nonregulated businesses. Thus, it has been argued that diversified utilities 2 Case: 02 Risk and Retur might be getting into a "can't-win" situation. As one analyst put it, a diversified utility's stockhold- ers are in a "heads you win, tails I lose" situation. There is also much discussion at present about the deregulation of the electricity markets per se, and there is much controversy over the forced use of "wheeling," whereby a customer (usually a large industrial customer) buys power from some other party but gets delivery over the transmis- sion lines of the utility in whose service area it operates. This situation has occurred to a large extent in the gas industry, where large customers have contracted directly with producers and then forced (through legal actions) pipeline companies to deliver the gas. Another problem facing many, but not all, electric companies relates to nuclear plants. A few decades ago, nuclear power was thought by many to be the wave of the future in electric genera- tion. It was widely believed that nuclear was cleaner and cheaper than coal, oil, and gas generation. However, the 1979 accident at Three Mile Island almost instantly reversed the future of nuclear power. Many plants that were under construction at that time were canceled, while the costs of completing the remaining plants skyrocketed. Many partially completed plants had to be retrofitted with new safety devices. As a result, the cost of power from new nuclear plants rose dramatically. Further, several states have held referendums to close nuclear plants. With this industry overview in mind, Laura Donahue developed the data in Table 1 on retums expected in the coming year. TECO is the stock of primary interest, Gold Hill is a domestic gold mining company, and the S&P 500 Fund is a mutual fund that invests in the stocks which make up the S&P 500 index. Donahue's final preparatory step was to outline some questions that she believed to be relevant to the task at hand. Sce if you can answer the questions she developed. TABLE 1 Estimated Total Returns Estimated Total Returns State of the Economy Recession Below average Average Above Average Boom Probability 0.10 0.20 0.40 0.20 0.10 1-Year T-Bond 8.0 % 8.0 8.0 8.0 8.0 TECO -8.0% 2.0 14.0 25.0 33.0 Gold Hill 18.0 % 23.0 7.0 -3.0 2.0 S&P 500 Fund -15.0 % 0.0 15.0 30.0 45.0 1 Question 5 2 3 Portfolio 4 TECO/S&P 5 TECO E() S&P E(1) 6 W W S&P 1 7 8 Portfolio E(k) 13.50 15.00 0.5 0.5 14.25 Estim. Port. Ret. TECO S&P WWSAP 12 P P. PHP (nr.2 (2 P. 10 11 Standard Deviation 12 B 14 State 15 16 Recession * Below Average Average Above Average Boom -8.0 2.0 14.0 25.0 33.0 -15.0 0.0 15.0 0.50 0.50 0.50 0.30 0.50 0.50 0.50 0.50 0.50 0.50 -11.5 1.0 14.5 27.5 39.0 0.10 0.20 0.40 0.20 0.10 -25.75 -13.25 0.25 13.25 24.75 663.06 175 56 0.06 175.56 612.56 66.31 35.11 0.03 35.11 61.26 30.0 45.0 o = 197.81 Op = , - r,)'P (- O 14.06 1=1 CV = 0.99