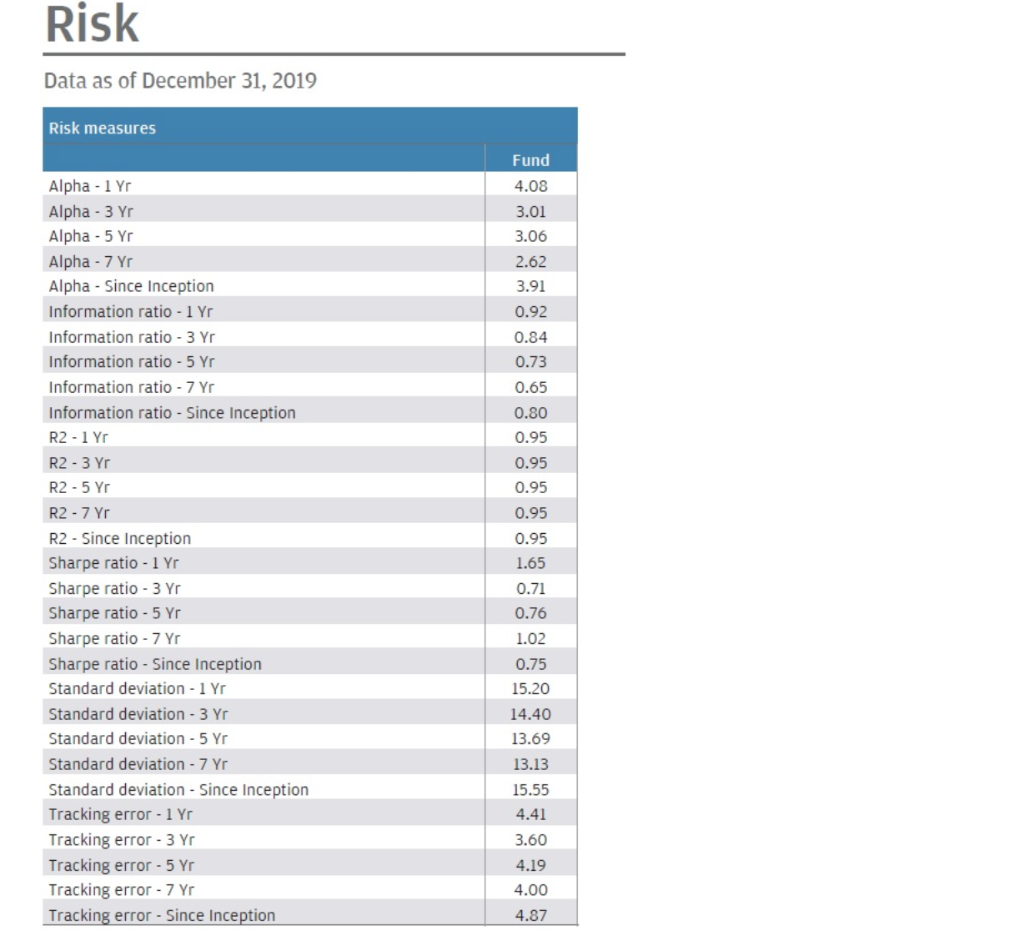

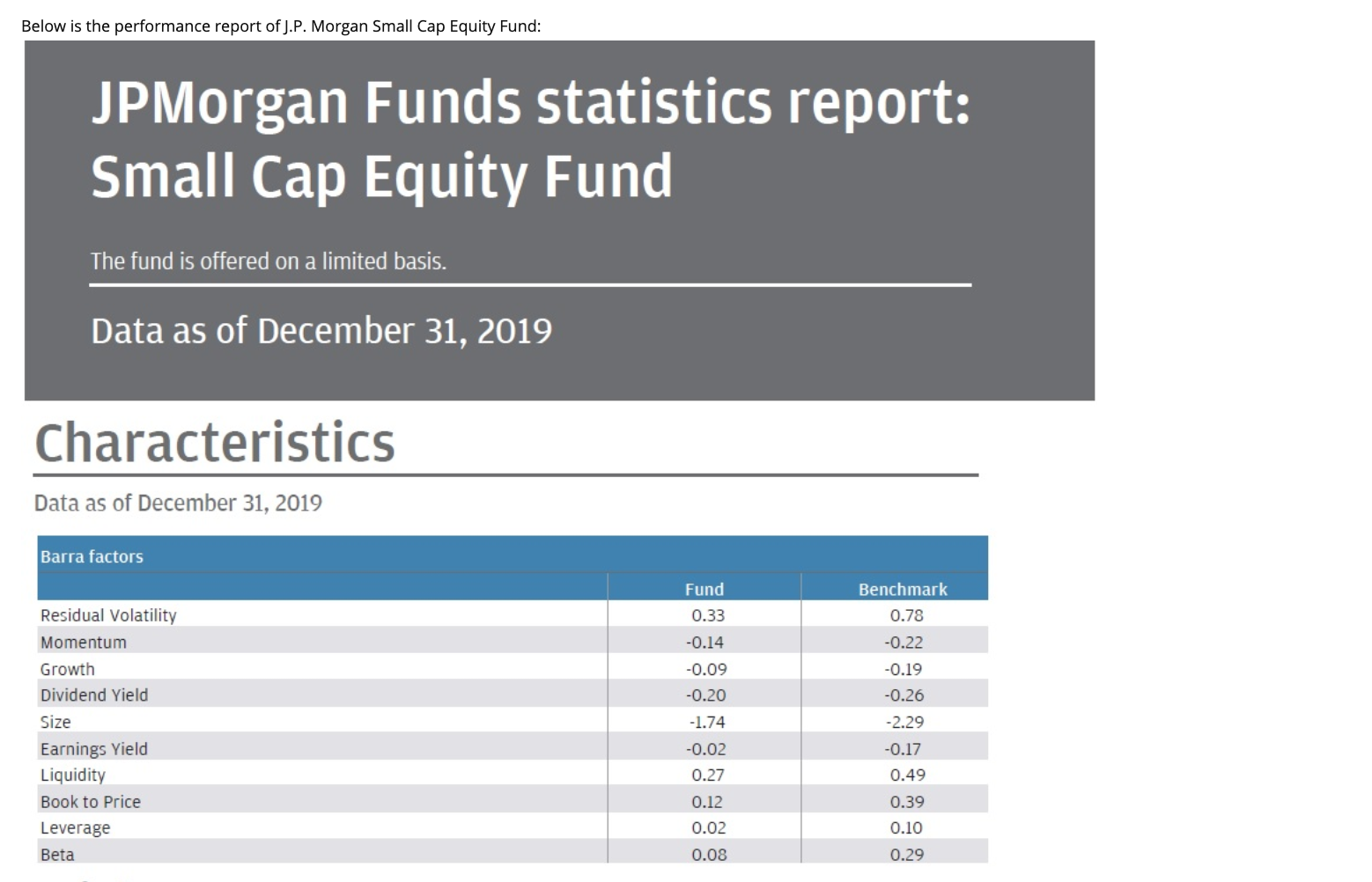

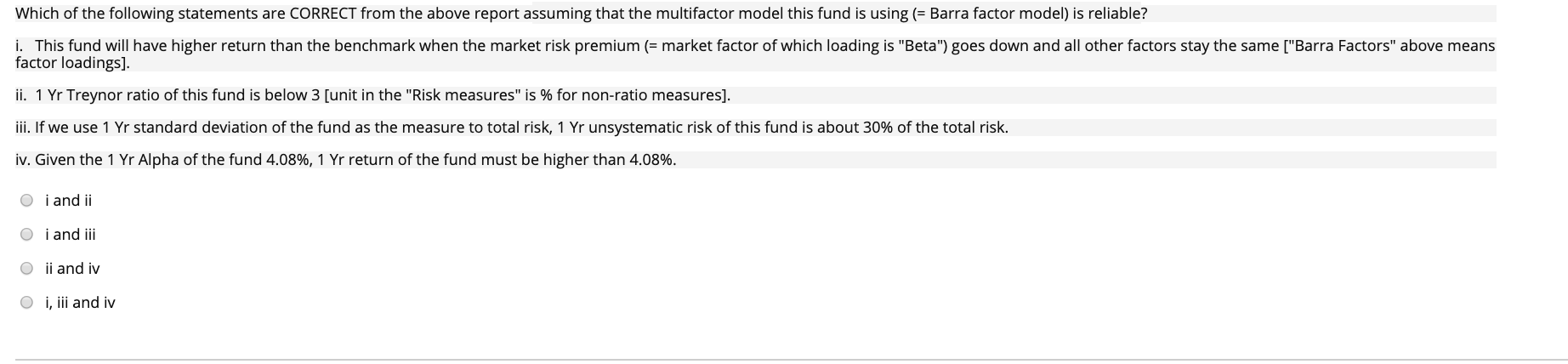

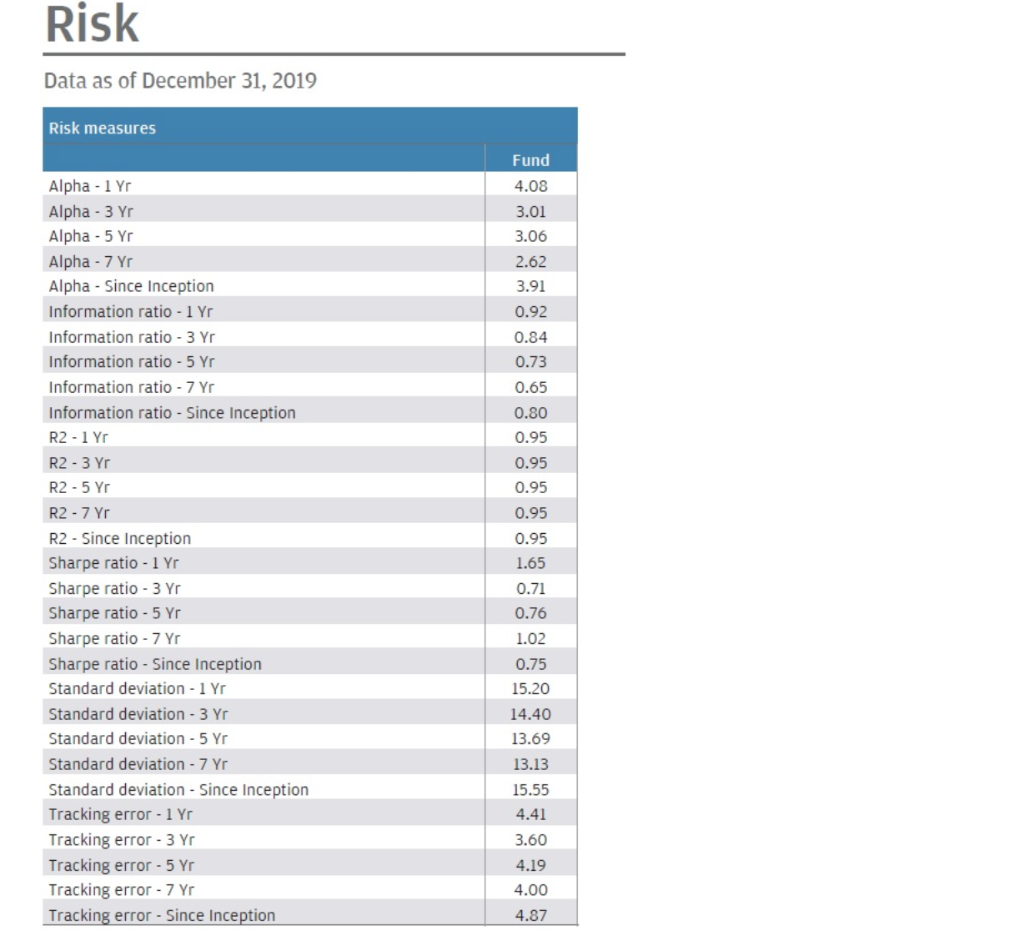

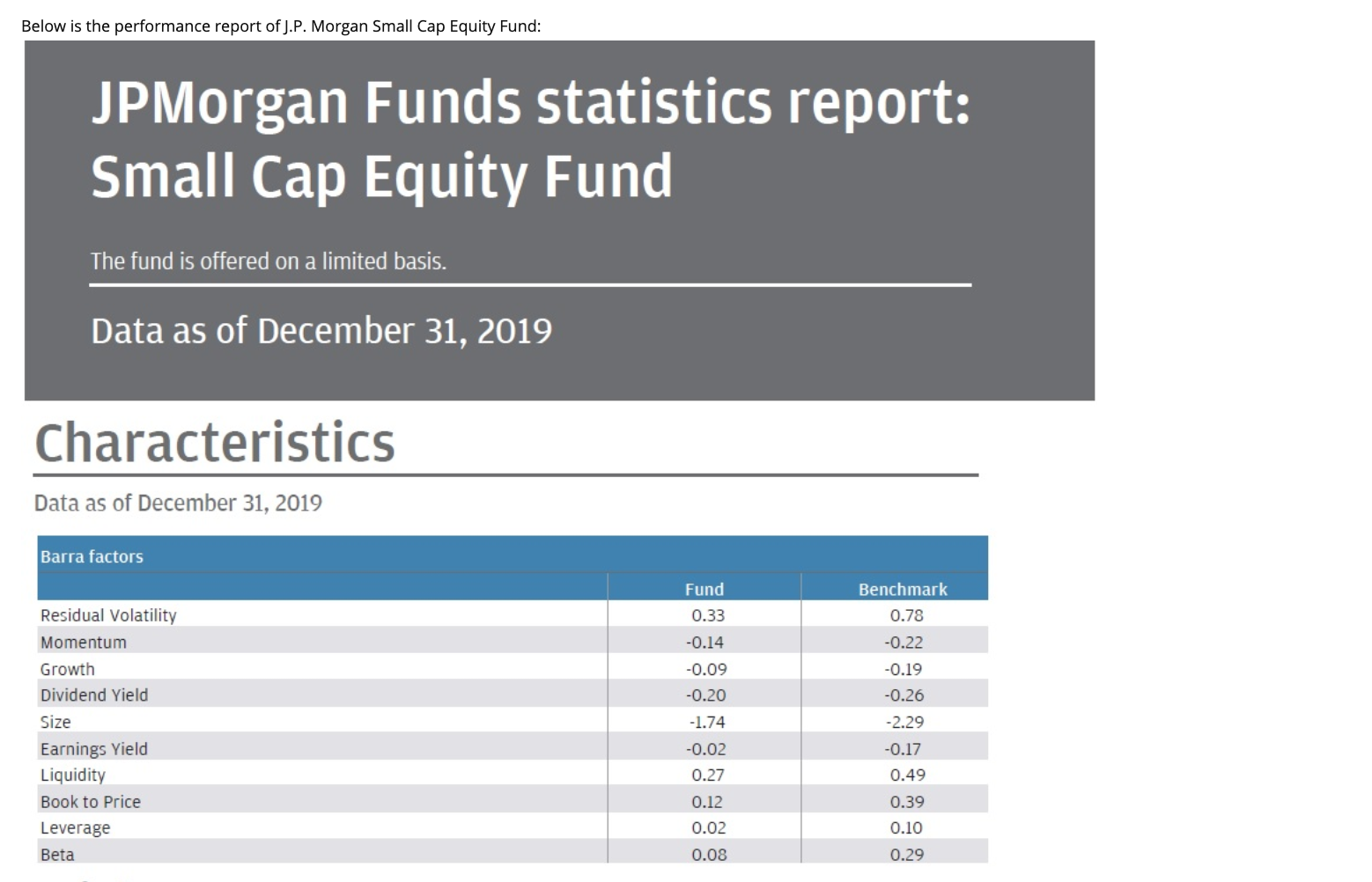

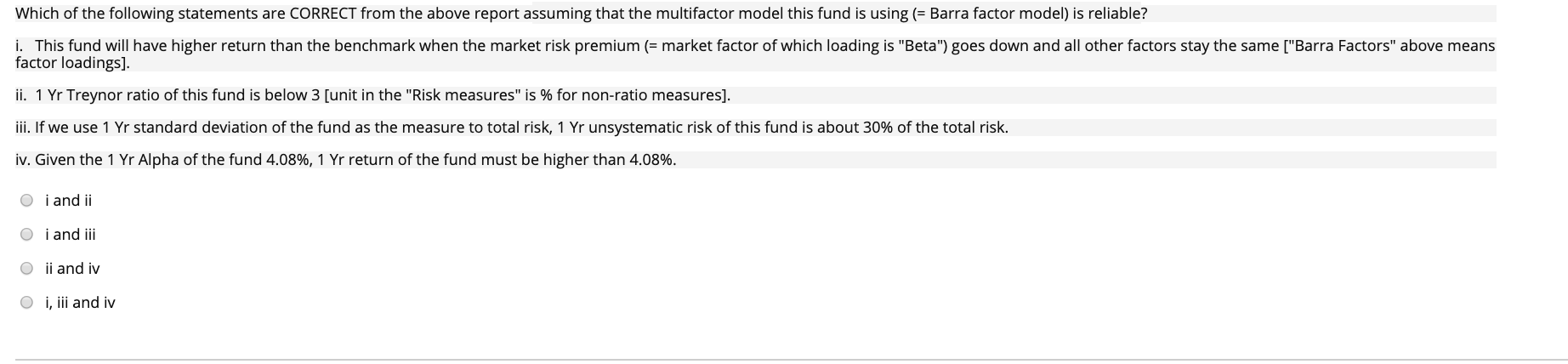

Risk Data as of December 31, 2019 Risk measures Alpha - 1 Yr Alpha - 3 Yr Alpha - 5 Yr Alpha - 7 Yr Alpha - Since Inception Information ratio - 1 Yr Information ratio - 3 Yr Information ratio - 5 Yr Information ratio - 7 Yr Information ratio - Since inception R2 - 1 Yr R2 - 3 Yr R2-5 Yr R2 - 7 Yr R2 - Since Inception Sharpe ratio - 1 Yr Sharpe ratio - 3 Yr Sharpe ratio - 5 Yr Sharpe ratio - 7 Yr Sharpe ratio - Since inception Standard deviation - 1 Yr Standard deviation - 3 Yr Standard deviation - 5 Yr Standard deviation - 7 Yr Standard deviation - Since inception Tracking error - 1 Yr Tracking error - 3 Yr Tracking error - 5 Yr Tracking error - 7 Yr Tracking error - Since Inception Fund 4.08 3.01 3.06 2.62 3.91 0.92 0.84 0.73 0.65 0.80 0.95 0.95 0.95 0.95 0.95 1.65 0.71 0.76 1.02 0.75 15.20 14.40 13.69 13.13 15.55 4.41 3.60 4.19 4.00 4.87 Below is the performance report of J.P. Morgan Small Cap Equity Fund: JPMorgan Funds statistics report: Small Cap Equity Fund The fund is offered on a limited basis. Data as of December 31, 2019 Characteristics Data as of December 31, 2019 Barra factors Residual Volatility Momentum Growth Dividend Yield Size Earnings Yield Liquidity Book to Price Leverage Fund 0.33 -0.14 -0.09 -0.20 -1.74 -0.02 0.27 0.12 0.02 0.08 Benchmark 0.78 -0.22 -0.19 -0.26 -2.29 -0.17 0.49 0.39 0.10 0.29 Beta Which of the following statements are CORRECT from the above report assuming that the multifactor model this fund is using (= Barra factor model) is reliable? . This fund will have higher return than the benchmark when the market risk premium (= market factor of which loading is "Beta") goes down and all other factors stay the same ["Barra Factors" above means factor loadings]. ii. 1 Yr Treynor ratio of this fund is below 3 [unit in the "Risk measures" is % for non-ratio measures]. iii. If we use 1 Yr standard deviation of the fund as the measure to total risk, 1 Yr unsystematic risk of this fund is about 30% of the total risk. iv. Given the 1 Yr Alpha of the fund 4.08%, 1 Yr return of the fund must be higher than 4.08%. O i and ii O i and iii Oli and iv O i, iii and iv Risk Data as of December 31, 2019 Risk measures Alpha - 1 Yr Alpha - 3 Yr Alpha - 5 Yr Alpha - 7 Yr Alpha - Since Inception Information ratio - 1 Yr Information ratio - 3 Yr Information ratio - 5 Yr Information ratio - 7 Yr Information ratio - Since inception R2 - 1 Yr R2 - 3 Yr R2-5 Yr R2 - 7 Yr R2 - Since Inception Sharpe ratio - 1 Yr Sharpe ratio - 3 Yr Sharpe ratio - 5 Yr Sharpe ratio - 7 Yr Sharpe ratio - Since inception Standard deviation - 1 Yr Standard deviation - 3 Yr Standard deviation - 5 Yr Standard deviation - 7 Yr Standard deviation - Since inception Tracking error - 1 Yr Tracking error - 3 Yr Tracking error - 5 Yr Tracking error - 7 Yr Tracking error - Since Inception Fund 4.08 3.01 3.06 2.62 3.91 0.92 0.84 0.73 0.65 0.80 0.95 0.95 0.95 0.95 0.95 1.65 0.71 0.76 1.02 0.75 15.20 14.40 13.69 13.13 15.55 4.41 3.60 4.19 4.00 4.87 Below is the performance report of J.P. Morgan Small Cap Equity Fund: JPMorgan Funds statistics report: Small Cap Equity Fund The fund is offered on a limited basis. Data as of December 31, 2019 Characteristics Data as of December 31, 2019 Barra factors Residual Volatility Momentum Growth Dividend Yield Size Earnings Yield Liquidity Book to Price Leverage Fund 0.33 -0.14 -0.09 -0.20 -1.74 -0.02 0.27 0.12 0.02 0.08 Benchmark 0.78 -0.22 -0.19 -0.26 -2.29 -0.17 0.49 0.39 0.10 0.29 Beta Which of the following statements are CORRECT from the above report assuming that the multifactor model this fund is using (= Barra factor model) is reliable? . This fund will have higher return than the benchmark when the market risk premium (= market factor of which loading is "Beta") goes down and all other factors stay the same ["Barra Factors" above means factor loadings]. ii. 1 Yr Treynor ratio of this fund is below 3 [unit in the "Risk measures" is % for non-ratio measures]. iii. If we use 1 Yr standard deviation of the fund as the measure to total risk, 1 Yr unsystematic risk of this fund is about 30% of the total risk. iv. Given the 1 Yr Alpha of the fund 4.08%, 1 Yr return of the fund must be higher than 4.08%. O i and ii O i and iii Oli and iv O i, iii and iv