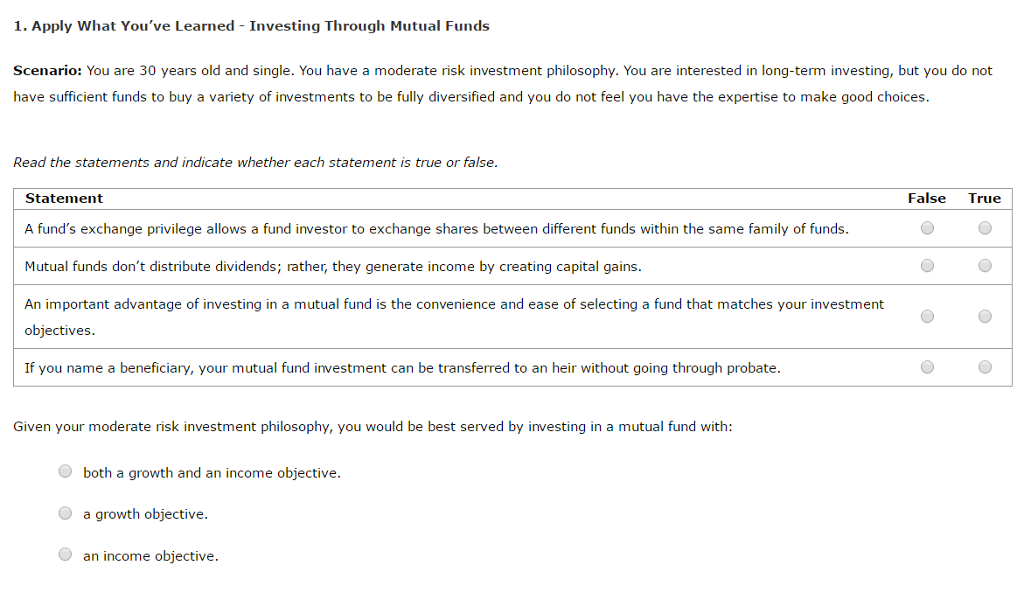

Question

Risk Level Options for quesiton below are as follow: 1,2, or 3 A $3,000 investment in a mutual fund with a 3% front-end load will

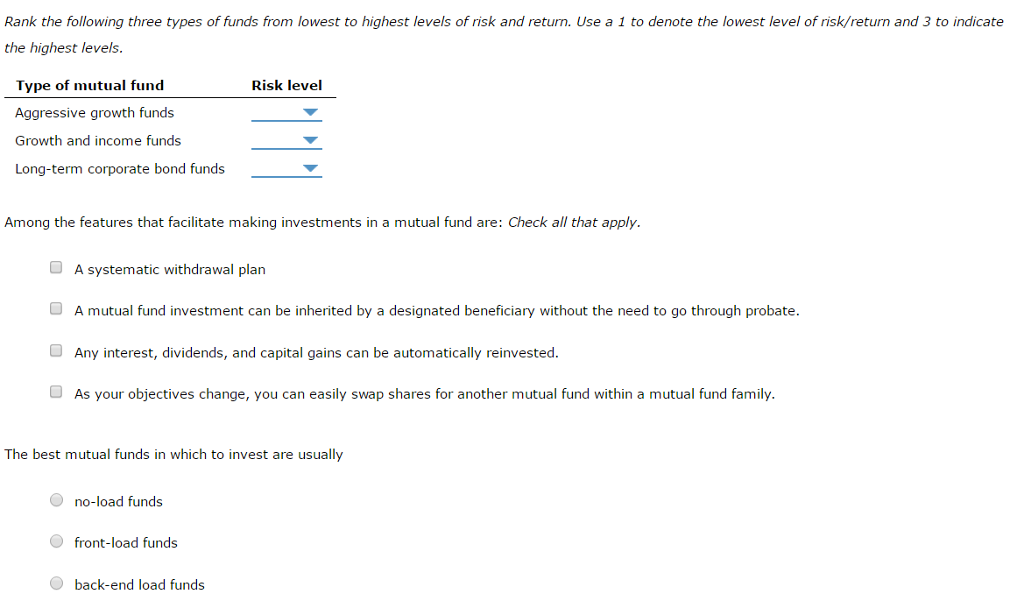

Risk Level Options for quesiton below are as follow:

1,2, or 3

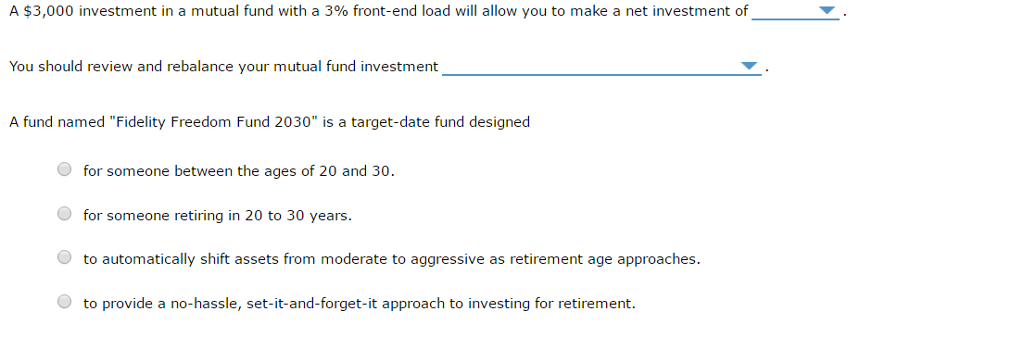

A $3,000 investment in a mutual fund with a 3% front-end load will allow you to make a net ivestment of: $2,820 or $2,910 or $3,090

You Shoul review and ralance your mutual fund investment: Quarterly, Annually, Monthly, or Never; the fund is rebalanced for you.

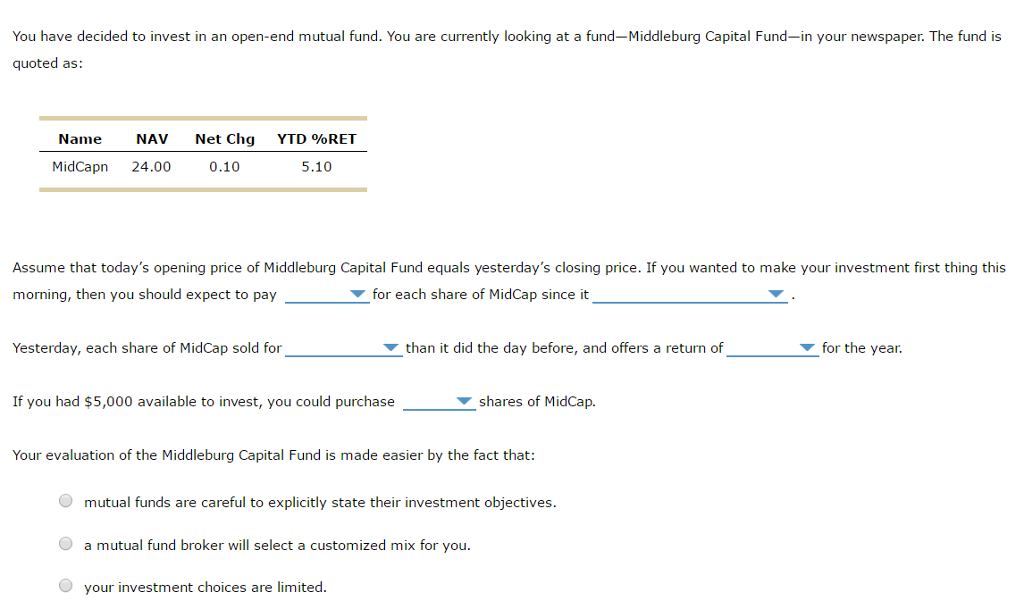

Assume that todays opening price of Middleburg Capital Fund equals yesterday's closing price. If you wanted to make your investment first thing this morning, then you should expect to pay: $23.80, or $24.00,or $28.80, or $22.80 for each share of MidCap since it: charges a 5.10% fee, or assess a 0.10% fee, or is a no load fund.

Yesterday, each share of MidCap sold for: $0.10 more, $5.10 more, $0.10 less, $5.10 less than it did the day before, and offers a return of: 24.00%, 0.10%, 5.10% for the year.

If you had $5,000 availble to invest, you could purchase: 208, 278, 347, 260 shares of MidCap.

What is in bold and italics are the fill in the blank choices to those statements.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started