Question

River Ltd enters into a non-cancellable lease agreement with Machinery Ltd on 1 January 2017. River Ltds financial year ends on 31 December. The lease

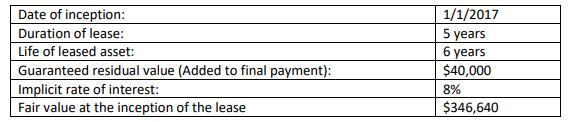

River Ltd enters into a non-cancellable lease agreement with Machinery Ltd on 1 January 2017. River Ltd’s financial year ends on 31 December. The lease consists of the following:

There are to be 5 annual payments of $90,000, the first being made on 31 December 2017. Included within the $90,000 lease payment is an amount of $10,000 representing payment to the Lessor Machinery Ltd for the insurance and maintenance of the equipment. The equipment is to be depreciated on a straight-line basis.

a) Verify the implicit rate of interest is correct against Fair Value.

b) Develop a table that shows the payment schedule to determine the interest expense for each year.

c) Prepare the journal entries for River Ltd. using the Net Method at the following date.

• 1/1/2017

• 31/12/2017

• 31/12/2018

Date of inception: 1/1/2017 5 years 6 years Duration of lease: Life of leased asset: $40,000 Guaranteed residual value (Added to final payment): Implicit rate of interest: Fair value at the inception of the lease 8% $346,640

Step by Step Solution

3.51 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a No Of Years Cash Inflow Discount Factor 8 Present Value Cash Inflow Discount Factor 1 80000 092592...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

6048a4c352c04_742554.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started