Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Riverbed Corp.s balance sheet at December 31, 2016, included the following. Note receivable $700,000 Interest receivable 36,000 Accounts receivable 1,420,000 Less: Allowance for doubtful accounts

Riverbed Corp.s balance sheet at December 31, 2016, included the following.

| Note receivable | $700,000 | |||

|---|---|---|---|---|

| Interest receivable | 36,000 | |||

| Accounts receivable | 1,420,000 | |||

| Less: Allowance for doubtful accounts receivable | 89,000 | 1,331,000 | ||

| $2,067,000 |

The following occurred in 2017.

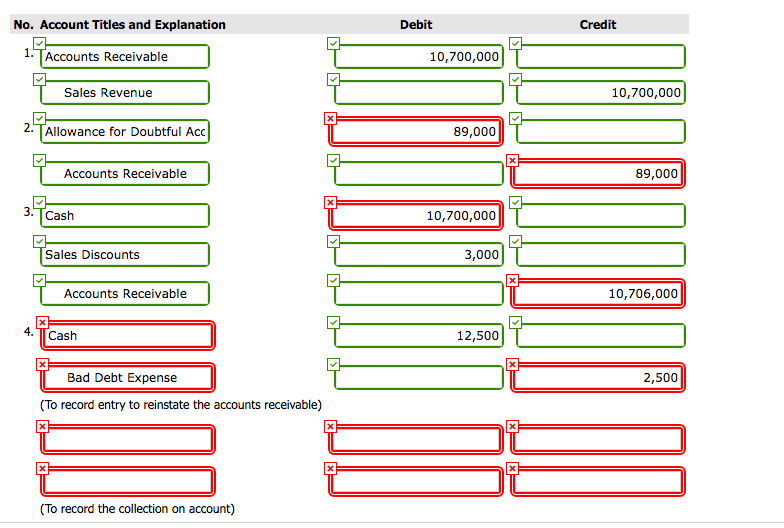

| 1. | Riverbed made sales of $10,700,000. All sales were credit sales. Riverbed allows some discounts for early payment of receivables and uses the gross method to record sales. | ||

| 2. | Customer accounts of $82,000 were written off during the year. | ||

| 3. | Accounts receivable of $10,800,000 were collected. Collections for the year included $300,000 of accounts on which 1% sales discounts were allowed. | ||

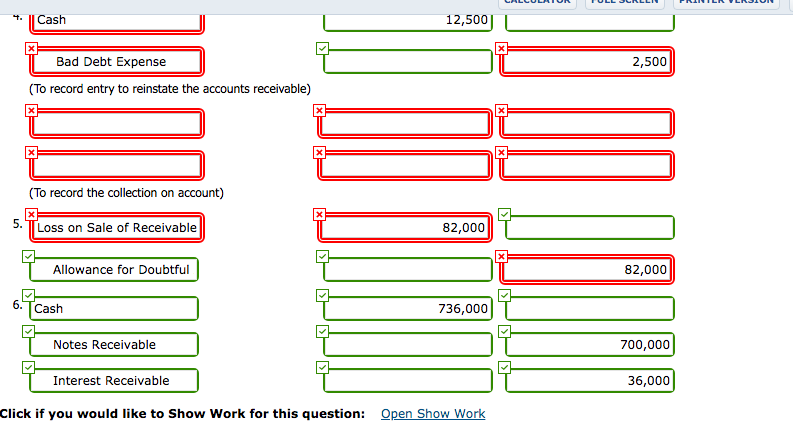

| 4. | $12,500 was received in payment of an account which was written off the books as worthless in 2016. | ||

| 5. | At year-end (December 31, 2017), Riverbed estimated that its Allowance for Doubtful Accounts needed a balance of $75,000. This estimate is based on an analysis of aged accounts receivable. | ||

| 6. | The note receivable and related interest were due January 1, 2017. Young collected both, in full, on that date.

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started