Answered step by step

Verified Expert Solution

Question

1 Approved Answer

rmation or Transmission is Strictly Prohibited! Harnoor Kaur Limited, follows IFRS, is in the process of preparing its financial statements for its second year

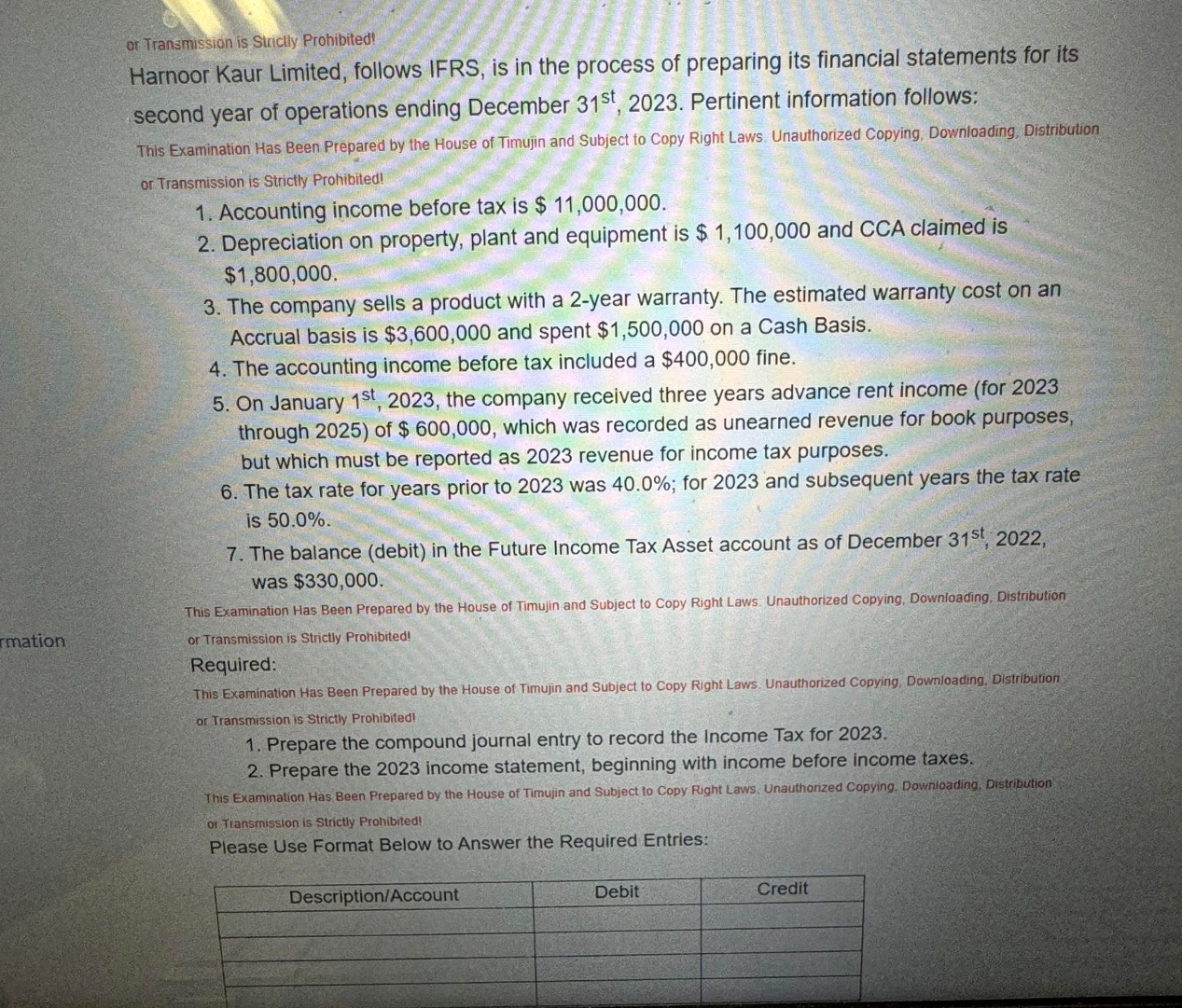

rmation or Transmission is Strictly Prohibited! Harnoor Kaur Limited, follows IFRS, is in the process of preparing its financial statements for its second year of operations ending December 31st, 2023. Pertinent information follows: This Examination Has Been Prepared by the House of Timujin and Subject to Copy Right Laws. Unauthorized Copying, Downloading, Distribution or Transmission is Strictly Prohibited! 1. Accounting income before tax is $ 11,000,000. 2. Depreciation on property, plant and equipment is $ 1,100,000 and CCA claimed is $1,800,000. 3. The company sells a product with a 2-year warranty. The estimated warranty cost on an Accrual basis is $3,600,000 and spent $1,500,000 on a Cash Basis. 4. The accounting income before tax included a $400,000 fine. 5. On January 1st, 2023, the company received three years advance rent income (for 2023 through 2025) of $ 600,000, which was recorded as unearned revenue for book purposes, but which must be reported as 2023 revenue for income tax purposes. 6. The tax rate for years prior to 2023 was 40.0%; for 2023 and subsequent years the tax rate is 50.0%. 7. The balance (debit) in the Future Income Tax Asset account as of December 31st, 2022, was $330,000. This Examination Has Been Prepared by the House of Timujin and Subject to Copy Right Laws. Unauthorized Copying, Downloading, Distribution or Transmission is Strictly Prohibited! Required: This Examination Has Been Prepared by the House of Timujin and Subject to Copy Right Laws. Unauthorized Copying, Downloading, Distribution or Transmission is Strictly Prohibited! 1. Prepare the compound journal entry to record the Income Tax for 2023. 2. Prepare the 2023 income statement, beginning with income before income taxes. This Examination Has Been Prepared by the House of Timujin and Subject to Copy Right Laws. Unauthorized Copying, Downloading, Distribution or Transmission is Strictly Prohibited! Please Use Format Below to Answer the Required Entries: Description/Account Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Harnoor Kaur Limited Income Tax Journal Entry and Income Statement 1 Income Tax Journal Entry Descri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started