Answered step by step

Verified Expert Solution

Question

1 Approved Answer

RO, kevidual Inceme keimer Steel Company. To manage the two seperate businesses, the operations af Keimer are reported separaely as an investment Raddington monitors its

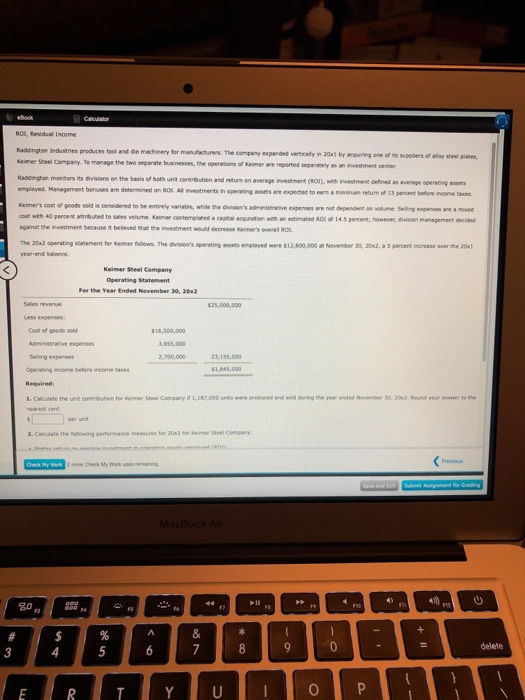

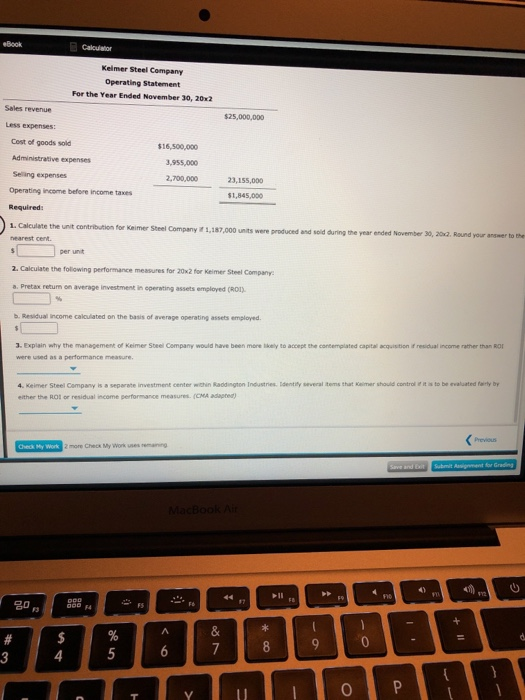

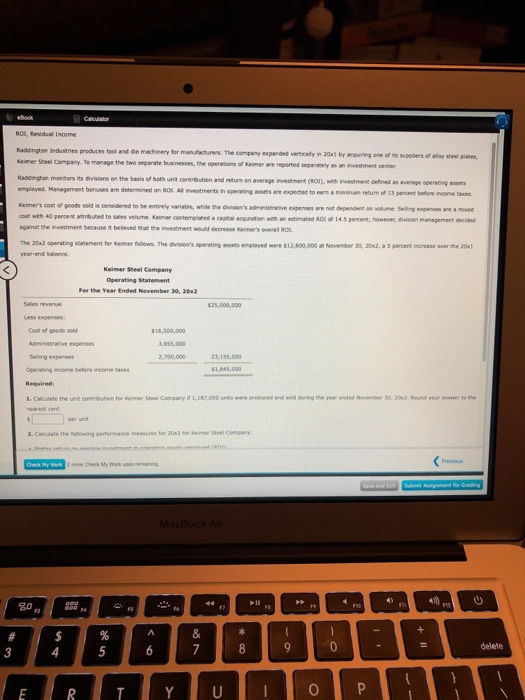

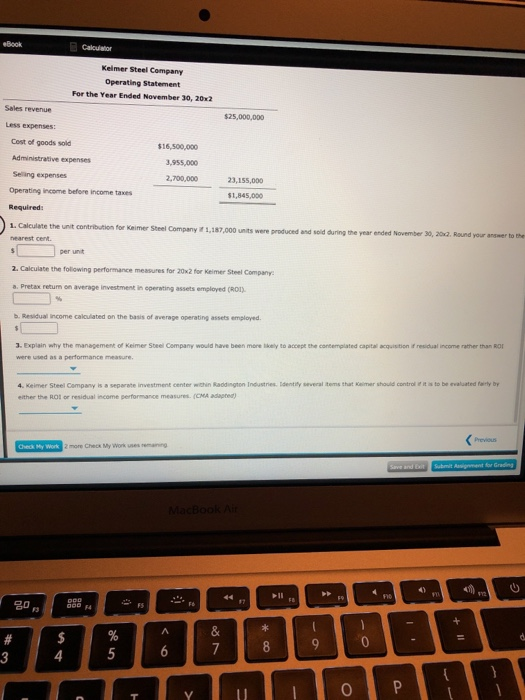

RO, kevidual Inceme keimer Steel Company. To manage the two seperate businesses, the operations af Keimer are reported separaely as an investment Raddington monitors its divisians on the banis of both unit centrbutien and neturm on emplayed. Management bonases are determined an RDl Al investments in average mestment r), with westment defned a..verege operating nets operaning assets are expected to eam a minimum refurn of 13 percent before income ta cost with 40 pencent antributed to sales velume. Kelmer coetemplated a caital soquisition with an extimated ROI of 14.5 pencent, however, divisien management decide t beleved that agsnst the investment because it beteved that the nvestment "old decrease Keme, oesa 0L The 20x2 aperating statement for Keimer foilows. The division's operating asets employed were $12,600,000at Navember 30, 20x2, a 5 percent increase over the 30x year-end baliance Keimer Steel Campany Operating Statement the Year Ended Less expenses Cost of geeds sole $16,500,000 ,955,000 2,700,000 Selling expenses Operaing income befone income tases 1.Criculate tte unt corerotors for Krmer Steel Company if 1,157,000snts-ere pretuted and said ang the year ended November 30, 20.2 Rond pe answer to me 2. Calculate the following performance measures for 20x2 for Keimer Steel Company Kelmer Steel Company Operating Statement For the Year Ended November 30, 20x2 Sales revenue Less expenses: Cost of goods sold Administrative expenses Seling expenses Operating income before income taxes Required: 1. Calculate the unit nearest cent $16,500,000 3,955,000 2.700,000 $1,845,000 contribution for Kaimer Steel Company 1,187,000 units were produced and soid duning the year ended November 30, 20x2. Round your answer to the per unit 2.Calculate the folowing performance measures for 20x2 for Keimer Steel Company Pretax retum on average investment in cperating assets employed (ROI) b. Residual income calculated on the basis of average operating assets employed 3. Explain why the management of Keimer Sbeel Company would have been more likely to accept the contemplated capital acquisition if residual income rather than RO were used as a performance measure 4. Keimer Steel Company is a separate investment center witin Raddington Industries. Edentily several items that Keimer should control e it a to be rvaluated ferly by either the ROt or residual income performance measures. (CMA dapted) 2 more Check My Work uses remaning 4

RO, kevidual Inceme keimer Steel Company. To manage the two seperate businesses, the operations af Keimer are reported separaely as an investment Raddington monitors its divisians on the banis of both unit centrbutien and neturm on emplayed. Management bonases are determined an RDl Al investments in average mestment r), with westment defned a..verege operating nets operaning assets are expected to eam a minimum refurn of 13 percent before income ta cost with 40 pencent antributed to sales velume. Kelmer coetemplated a caital soquisition with an extimated ROI of 14.5 pencent, however, divisien management decide t beleved that agsnst the investment because it beteved that the nvestment "old decrease Keme, oesa 0L The 20x2 aperating statement for Keimer foilows. The division's operating asets employed were $12,600,000at Navember 30, 20x2, a 5 percent increase over the 30x year-end baliance Keimer Steel Campany Operating Statement the Year Ended Less expenses Cost of geeds sole $16,500,000 ,955,000 2,700,000 Selling expenses Operaing income befone income tases 1.Criculate tte unt corerotors for Krmer Steel Company if 1,157,000snts-ere pretuted and said ang the year ended November 30, 20.2 Rond pe answer to me 2. Calculate the following performance measures for 20x2 for Keimer Steel Company Kelmer Steel Company Operating Statement For the Year Ended November 30, 20x2 Sales revenue Less expenses: Cost of goods sold Administrative expenses Seling expenses Operating income before income taxes Required: 1. Calculate the unit nearest cent $16,500,000 3,955,000 2.700,000 $1,845,000 contribution for Kaimer Steel Company 1,187,000 units were produced and soid duning the year ended November 30, 20x2. Round your answer to the per unit 2.Calculate the folowing performance measures for 20x2 for Keimer Steel Company Pretax retum on average investment in cperating assets employed (ROI) b. Residual income calculated on the basis of average operating assets employed 3. Explain why the management of Keimer Sbeel Company would have been more likely to accept the contemplated capital acquisition if residual income rather than RO were used as a performance measure 4. Keimer Steel Company is a separate investment center witin Raddington Industries. Edentily several items that Keimer should control e it a to be rvaluated ferly by either the ROt or residual income performance measures. (CMA dapted) 2 more Check My Work uses remaning 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started