Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Roam Group Co (The Roam Group) was formed in 2009 when the owners of Stuart Roam Road Transport decided to create a group structure

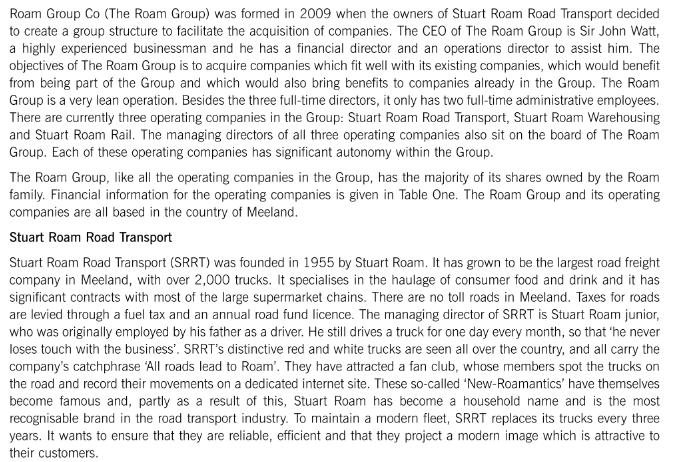

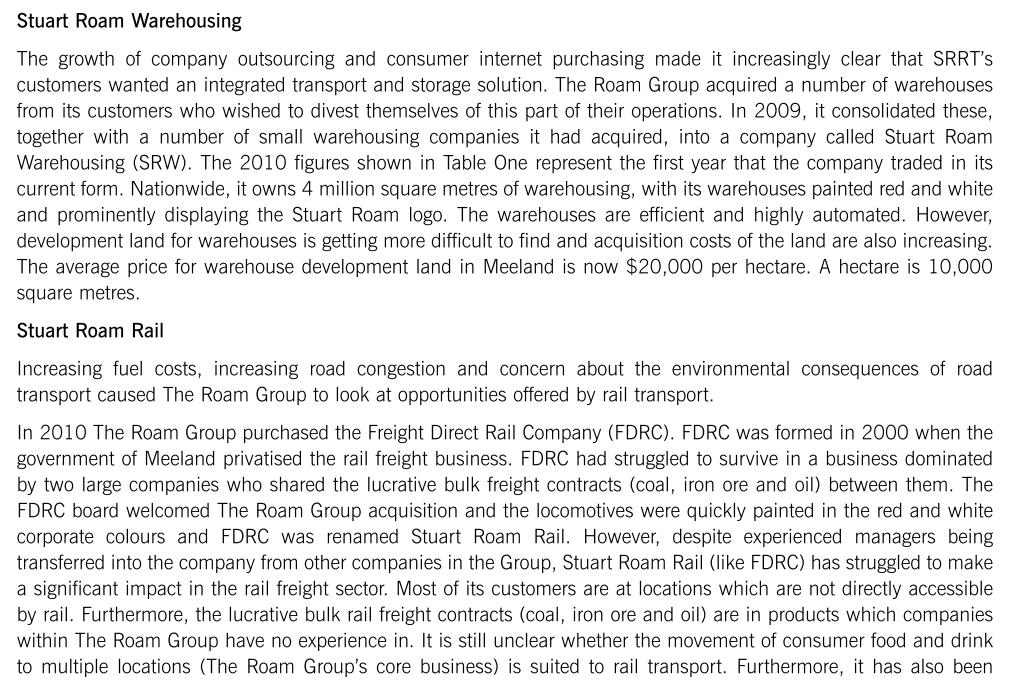

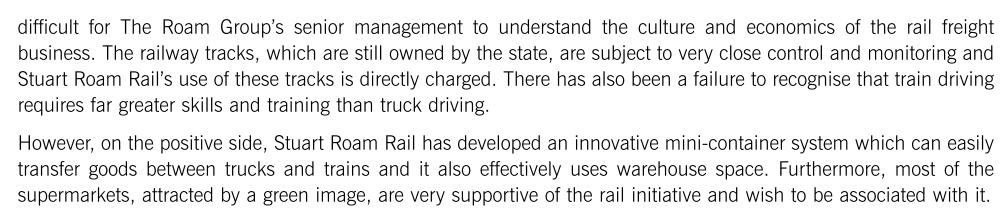

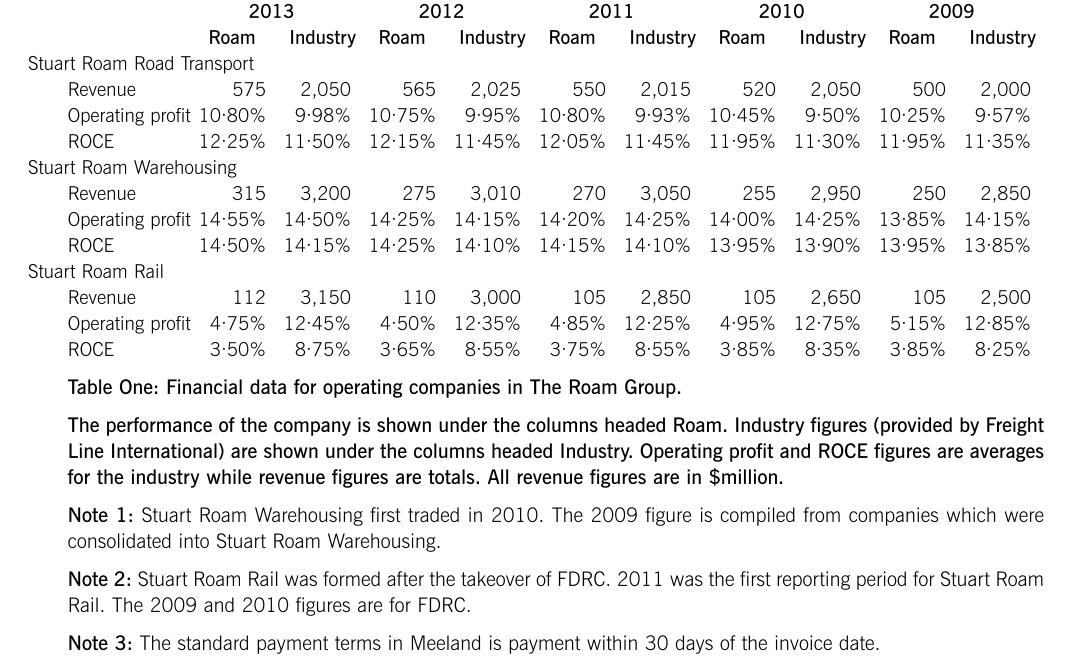

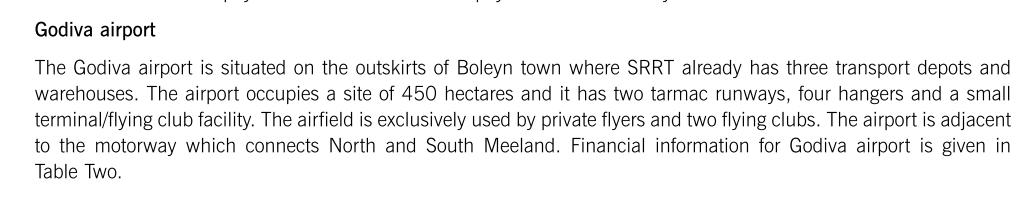

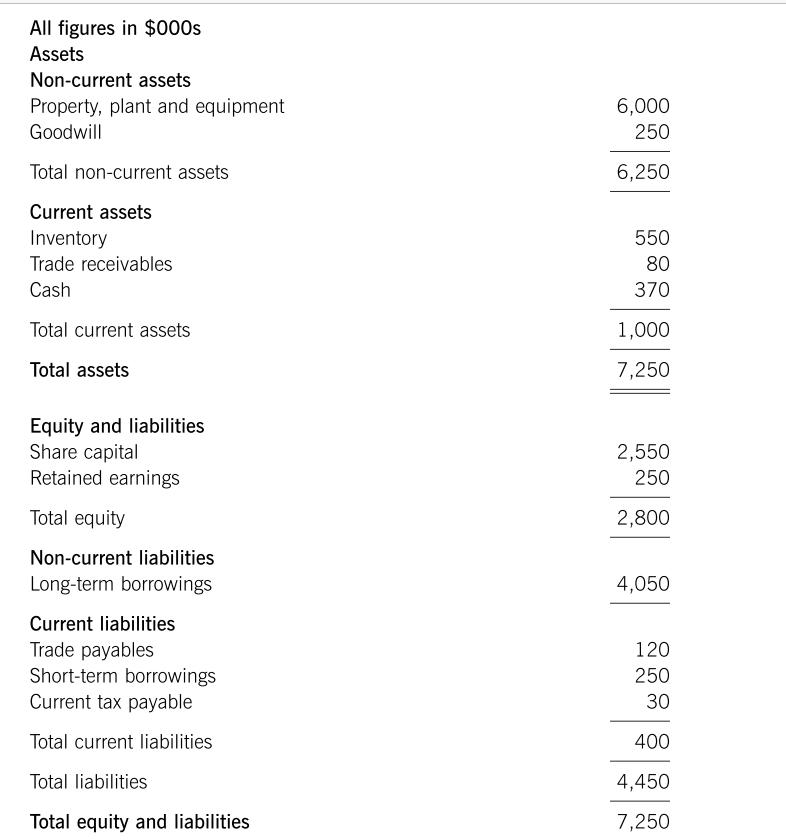

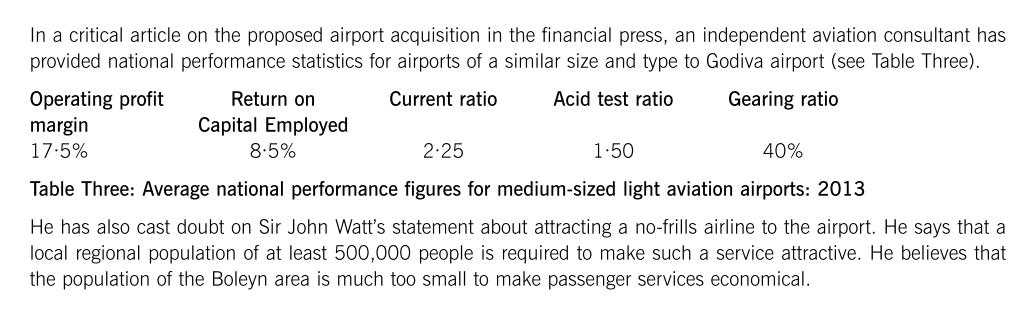

Roam Group Co (The Roam Group) was formed in 2009 when the owners of Stuart Roam Road Transport decided to create a group structure to facilitate the acquisition of companies. The CEO of The Roam Group is Sir John Watt, a highly experienced businessman and he has a financial director and an operations director to assist him. The objectives of The Roam Group is to acquire companies which fit well with its existing companies, which would benefit from being part of the Group and which would also bring benefits to companies already in the Group. The Roam Group is a very lean operation. Besides the three full-time directors, it only has two full-time administrative employees. There are currently three operating companies in the Group: Stuart Roam Road Transport, Stuart Roam Warehousing and Stuart Roam Rail. The managing directors of all three operating companies also sit on the board of The Roam Group. Each of these operating companies has significant autonomy within the Group. The Roam Group, like all the operating companies in the Group, has the majority of its shares owned by the Roam family. Financial information for the operating companies is given in Table One. The Roam Group and its operating companies are all based in the country of Meeland. Stuart Roam Road Transport Stuart Roam Road Transport (SRRT) was founded in 1955 by Stuart Roam. It has grown to be the largest road freight company in Meeland, with over 2,000 trucks. It specialises in the haulage of consumer food and drink and it has significant contracts with most of the large supermarket chains. There are no toll roads in Meeland. Taxes for roads are levied through a fuel tax and an annual road fund licence. The managing director of SRRT is Stuart Roam junior, who was originally employed by his father as a driver. He still drives a truck for one day every month, so that 'he never loses touch with the business'. SRRT's distinctive red and white trucks are seen all over the country, and all carry the company's catchphrase 'All roads lead to Roam'. They have attracted a fan club, whose members spot the trucks on the road and record their movements on a dedicated internet site. These so-called 'New-Roamantics' have themselves become famous and, partly as a result of this, Stuart Roam has become a household name and is the most recognisable brand in the road transport industry. To maintain a modern fleet, SRRT replaces its trucks every three years. It wants to ensure that they are reliable, efficient and that they project a modern image which is attractive to their customers. Stuart Roam Warehousing The growth of company outsourcing and consumer internet purchasing made it increasingly clear that SRRT's customers wanted an integrated transport and storage solution. The Roam Group acquired a number of warehouses from its customers who wished to divest themselves of this part of their operations. In 2009, it consolidated these, together with a number of small warehousing companies it had acquired, into a company called Stuart Roam Warehousing (SRW). The 2010 figures shown in Table One represent the first year that the company traded in its current form. Nationwide, it owns 4 million square metres of warehousing, with its warehouses painted red and white and prominently displaying the Stuart Roam logo. The warehouses are efficient and highly automated. However, development land for warehouses is getting more difficult to find and acquisition costs of the land are also increasing. The average price for warehouse development land in Meeland is now $20,000 per hectare. A hectare is 10,000 square metres. Stuart Roam Rail Increasing fuel costs, increasing road congestion and concern about the environmental consequences of road transport caused The Roam Group to look at opportunities offered by rail transport. In 2010 The Roam Group purchased the Freight Direct Rail Company (FDRC). FDRC was formed in 2000 when the government of Meeland privatised the rail freight business. FDRC had struggled to survive in a business dominated by two large companies who shared the lucrative bulk freight contracts (coal, iron ore and oil) between them. The FDRC board welcomed The Roam Group acquisition and the locomotives were quickly painted in the red and white corporate colours and FDRC was renamed Stuart Roam Rail. However, despite experienced managers being transferred into the company from other companies in the Group, Stuart Roam Rail (like FDRC) has struggled to make a significant impact in the rail freight sector. Most of its customers are at locations which are not directly accessible by rail. Furthermore, the lucrative bulk rail freight contracts (coal, iron ore and oil) are in products which companies within The Roam Group have no experience in. It is still unclear whether the movement of consumer food and drink to multiple locations (The Roam Group's core business) is suited to rail transport. Furthermore, it has also been difficult for The Roam Group's senior management to understand the culture and economics of the rail freight business. The railway tracks, which are still owned by the state, are subject to very close control and monitoring and Stuart Roam Rail's use of these tracks is directly charged. There has also been a failure to recognise that train driving requires far greater skills and training than truck driving. However, on the positive side, Stuart Roam Rail has developed an innovative mini-container system which can easily transfer goods between trucks and trains and it also effectively uses warehouse space. Furthermore, most of the supermarkets, attracted by a green image, are very supportive of the rail initiative and wish to be associated with it. 2013 Roam Stuart Roam Road Transport Revenue 575 Operating profit 10-80% ROCE 12.25% Stuart Roam Warehousing Revenue 315 Operating profit 14-55% 14.50% 2012 2011 2010 Industry Roam Industry Roam 2,050 565 2,025 550 2,015 520 9.98% 10.75% 9.95% 10-80% 9.93% 10.45% 11.50% 12-15% 11.45% 12-05% 11.45% 11-95% Industry Roam 2009 Industry Roam Industry 500 2,000 2,050 9.50% 10-25% 9.57% 11.30% 11.95% 11.35% 250 2,850 3,200 275 3,010 270 3,050 255 2,950 14.50% 14.25% 14-15% 14-20 % 14.25% 14.00% 14.25% 13.85% 14.15% 14-15% 14.25% 14.10% 14-15% 14.10% 13-95% 13.90% 13-95% 13.85% ROCE Stuart Roam Rail Revenue 3,150 110 105 2,850 105 2,650 112 3,000 105 2,500 Operating profit 4.75% 12.45% 4.50% 12.35% 4-85% 12.25% 4-95% 12.75% 5.15% 12.85% ROCE 3.50% 8.75% 3.65% 8.55% 3.75% 8.55% 3.85% 8.35% 3.85% 8.25% Table One: Financial data for operating companies in The Roam Group. The performance of the company is shown under the columns headed Roam. Industry figures (provided by Freight Line International) are shown under the columns headed Industry. Operating profit and ROCE figures are averages for the industry while revenue figures are totals. All revenue figures are in $million. Note 1: Stuart Roam Warehousing first traded in 2010. The 2009 figure is compiled from companies which were consolidated into Stuart Roam Warehousing. Note 2: Stuart Roam Rail was formed after the takeover of FDRC. 2011 was the first reporting period for Stuart Roam Rail. The 2009 and 2010 figures are for FDRC. Note 3: The standard payment terms in Meeland is payment within 30 days of the invoice date. Godiva airport The Godiva airport is situated on the outskirts of Boleyn town where SRRT already has three transport depots and warehouses. The airport occupies a site of 450 hectares and it has two tarmac runways, four hangers and a small terminal/flying club facility. The airfield is exclusively used by private flyers and two flying clubs. The airport is adjacent to the motorway which connects North and South Meeland. Financial information for Godiva airport is given in Table Two. All figures in $000s Assets Non-current assets Property, plant and equipment Goodwill Total non-current assets Current assets Inventory Trade receivables Cash Total current assets Total assets Equity and liabilities Share capital Retained earnings Total equity Non-current liabilities Long-term borrowings Current liabilities Trade payables Short-term borrowings Current tax payable Total current liabilities Total liabilities Total equity and liabilities 6,000 250 6,250 550 80 370 1,000 7,250 2,550 250 2,800 4,050 120 250 30 400 4,450 7,250 Statement of profit or loss Revenue Cost of sales Gross profit Administrative expenses Finance costs 975 (700) 275 (125) (100) Profit before tax Tax expense Profit for the period Table Two: Godiva airport - extracts from financial statements - 2013 50 (10) 40 The Roam Group has recently issued the following press release from Sir John Watt: The Roam Group is pleased to announce that it has signed an initial agreement to purchase Godiva airport from the Godiva Airport Company for the sum of $7m, funded from retained profits from within the Group. We see this as a natural extension of our transport capabilities. Road, rail and air have long been complementary forms of transport and we are pleased to be able to offer our customers all three, using our innovative mini-container system as an effective transhipment method between transport modes. We also hope to attract a no-frills airline to the airport, encouraged by low landing fees and a population of over 150,000 people living within 20 miles of the airport. Godiva Airport Company will become an operating company within The Roam Group, and renamed Stuart Roam Air. In a critical article on the proposed airport acquisition in the financial press, an independent aviation consultant has provided national performance statistics for airports of a similar size and type to Godiva airport (see Table Three). Current ratio Acid test ratio Gearing ratio Operating profit margin 17.5% Return on Capital Employed 8.5% 2.25 40% Table Three: Average national performance figures for medium-sized light aviation airports: 2013 He has also cast doubt on Sir John Watt's statement about attracting a no-frills airline to the airport. He says that a local regional population of at least 500,000 people is required to make such a service attractive. He believes that the population of the Boleyn area is much too small to make passenger services economical. 1.50 Write an independent report which: (i) Evaluates the current performance and contribution of each of the three current operating companies in The Roam Group portfolio and assesses their relative significance in its future strategy. (21 marks) (ii) Evaluates the proposed acquisition of Godiva airport. (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started