Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rob Corp is a lumber yard on Angel Island. Apr. 15 Sold lumber on an account to Hard Hat Construction, $500,000. The inventory subsidiary

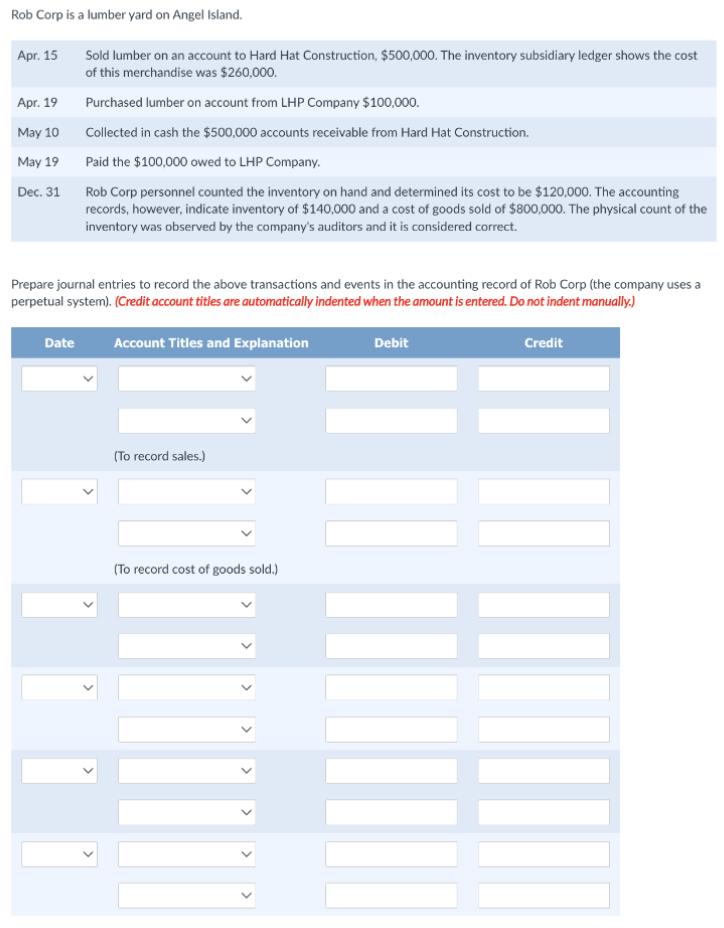

Rob Corp is a lumber yard on Angel Island. Apr. 15 Sold lumber on an account to Hard Hat Construction, $500,000. The inventory subsidiary ledger shows the cost of this merchandise was $260,000. Apr. 19 Purchased lumber on account from LHP Company $100,000. May 10 Collected in cash the $500,000 accounts receivable from Hard Hat Construction. May 19 Paid the $100,000 owed to LHP Company. Rob Corp personnel counted the inventory on hand and determined its cost to be $120,000. The accounting records, however, indicate inventory of $140,000 and a cost of goods sold of $800,000. The physical count of the inventory was observed by the company's auditors and it is considered correct. Dec. 31 Prepare journal entries to record the above transactions and events in the accounting record of Rob Corp (the company uses a perpetual system). (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit (To record sales.) (To record cost of goods sold.) > (e) Ratio Analysis The parts of this question must be completed in order. This part will be available when you complete the part above. (f) Prepare Bank Reconciliation The parts of this question must be completed in order. This part will be available when you complete the part above. (g) Prepare Journal Entries for Notes Receivable The parts of this question must be completed in order. This part will be available when you complete the part above. (h) Prepare Journal Entries for Allowance for Doubtful Accounts The parts of this question must be completed in order. This part will be available when you complete the part above. Rob Corp is a lumber yard on Angel Island. Apr. 15 Sold lumber on an account to Hard Hat Construction, $500,000. The inventory subsidiary ledger shows the cost of this merchandise was $260,000. Apr. 19 Purchased lumber on account from LHP Company $100,000. May 10 Collected in cash the $500,000 accounts receivable from Hard Hat Construction. May 19 Paid the $100,000 owed to LHP Company. Rob Corp personnel counted the inventory on hand and determined its cost to be $120,000. The accounting records, however, indicate inventory of $140,000 and a cost of goods sold of $800,000. The physical count of the inventory was observed by the company's auditors and it is considered correct. Dec. 31 Prepare journal entries to record the above transactions and events in the accounting record of Rob Corp (the company uses a perpetual system). (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit (To record sales.) (To record cost of goods sold.) > (e) Ratio Analysis The parts of this question must be completed in order. This part will be available when you complete the part above. (f) Prepare Bank Reconciliation The parts of this question must be completed in order. This part will be available when you complete the part above. (g) Prepare Journal Entries for Notes Receivable The parts of this question must be completed in order. This part will be available when you complete the part above. (h) Prepare Journal Entries for Allowance for Doubtful Accounts The parts of this question must be completed in order. This part will be available when you complete the part above. Rob Corp is a lumber yard on Angel Island. Apr. 15 Sold lumber on an account to Hard Hat Construction, $500,000. The inventory subsidiary ledger shows the cost of this merchandise was $260,000. Apr. 19 Purchased lumber on account from LHP Company $100,000. May 10 Collected in cash the $500,000 accounts receivable from Hard Hat Construction. May 19 Paid the $100,000 owed to LHP Company. Rob Corp personnel counted the inventory on hand and determined its cost to be $120,000. The accounting records, however, indicate inventory of $140,000 and a cost of goods sold of $800,000. The physical count of the inventory was observed by the company's auditors and it is considered correct. Dec. 31 Prepare journal entries to record the above transactions and events in the accounting record of Rob Corp (the company uses a perpetual system). (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit (To record sales.) (To record cost of goods sold.) > (e) Ratio Analysis The parts of this question must be completed in order. This part will be available when you complete the part above. (f) Prepare Bank Reconciliation The parts of this question must be completed in order. This part will be available when you complete the part above. (g) Prepare Journal Entries for Notes Receivable The parts of this question must be completed in order. This part will be available when you complete the part above. (h) Prepare Journal Entries for Allowance for Doubtful Accounts The parts of this question must be completed in order. This part will be available when you complete the part above. Rob Corp is a lumber yard on Angel Island. Apr. 15 Sold lumber on an account to Hard Hat Construction, $500,000. The inventory subsidiary ledger shows the cost of this merchandise was $260,000. Apr. 19 Purchased lumber on account from LHP Company $100,000. May 10 Collected in cash the $500,000 accounts receivable from Hard Hat Construction. May 19 Paid the $100,000 owed to LHP Company. Rob Corp personnel counted the inventory on hand and determined its cost to be $120,000. The accounting records, however, indicate inventory of $140,000 and a cost of goods sold of $800,000. The physical count of the inventory was observed by the company's auditors and it is considered correct. Dec. 31 Prepare journal entries to record the above transactions and events in the accounting record of Rob Corp (the company uses a perpetual system). (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit (To record sales.) (To record cost of goods sold.) > (e) Ratio Analysis The parts of this question must be completed in order. This part will be available when you complete the part above. (f) Prepare Bank Reconciliation The parts of this question must be completed in order. This part will be available when you complete the part above. (g) Prepare Journal Entries for Notes Receivable The parts of this question must be completed in order. This part will be available when you complete the part above. (h) Prepare Journal Entries for Allowance for Doubtful Accounts The parts of this question must be completed in order. This part will be available when you complete the part above.

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Image caption Date Boalutions shthe book06 Rob coxp Jowe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started