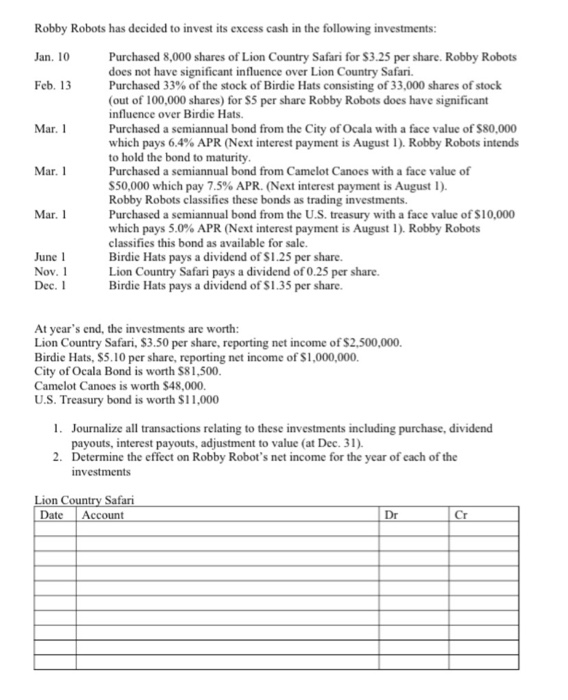

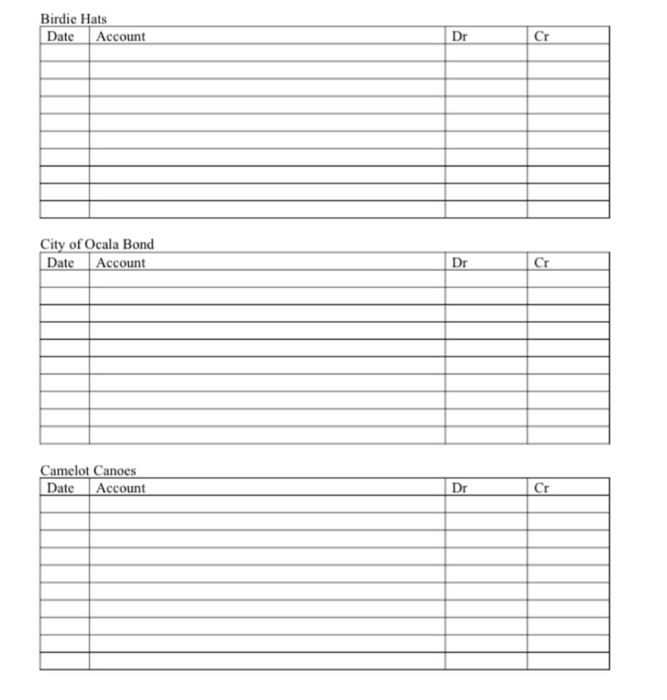

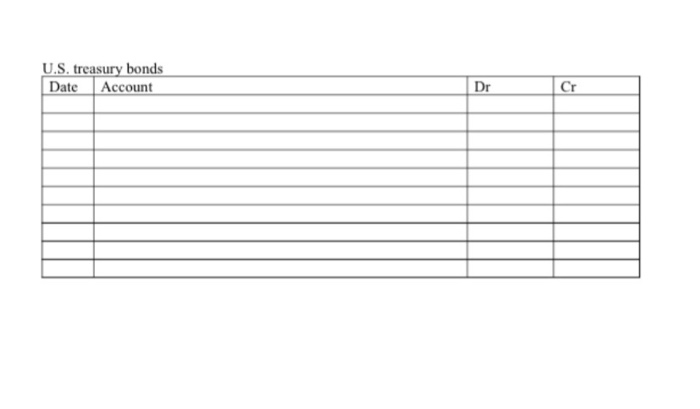

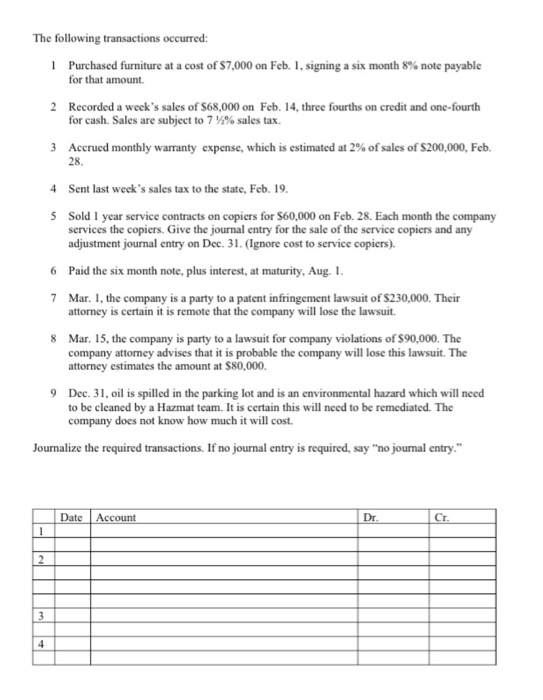

Robby Robots has decided to invest its excess cash in the following investments: Jan. 10 Feb. 13 Mar. 1 Mar. 1 Purchased 8,000 shares of Lion Country Safari for $3.25 per share. Robby Robots does not have significant influence over Lion Country Safari Purchased 33% of the stock of Birdie Hats consisting of 33,000 shares of stock (out of 100,000 shares) for $5 per share Robby Robots does have significant influence over Birdie Hats. Purchased a semiannual bond from the City of Ocala with a face value of $80,000 which pays 6.4% APR (Next interest payment is August 1). Robby Robots intends to hold the bond to maturity. Purchased a semiannual bond from Camelot Canoes with a face value of S50,000 which pay 7.5% APR. (Next interest payment is August 1). Robby Robots classifies these bonds as trading investments. Purchased a semiannual bond from the U.S. treasury with a face value of $10,000 which pays 5.0% APR (Next interest payment is August 1). Robby Robots classifies this bond as available for sale. Birdie Hats pays a dividend of S1.25 per share. Lion Country Safari pays a dividend of 0.25 per share. Birdie Hats pays a dividend of $1.35 per share. Mar. 1 June 1 Nov. 1 Dec. 1 At year's end, the investments are worth: Lion Country Safari, $3.50 per share, reporting net income of $2,500,000 Birdie Hats, $5.10 per share, reporting net income of $1,000,000. City of Ocala Bond is worth $81,500. Camelot Canoes is worth $48,000. U.S. Treasury bond is worth $11,000 1. Journalize all transactions relating to these investments including purchase, dividend payouts, interest payouts, adjustment to value (at Dec. 31). 2. Determine the effect on Robby Robot's net income for the year of each of the investments Lion Country Safari Date Account Birdie Hats Date Account City of Ocala Bond Date Account Dr1 Camelot Canoes Date Account Dr U.S. treasury bonds Date Account The following transactions occurred: | Purchased furniture at a cost of $7,000 on Feb. 1, signing a six month 8% note payable for that amount 2 Recorded a week's sales of $68,000 on Feb. 14, three fourths on credit and one-fourth for cash. Sales are subject to 7 % sales tax. 3 Accrued monthly warranty expense, which is estimated at 2% of sales of $200,000. Feb. 28. 4 Sent last week's sales tax to the state, Feb. 19. 5 Sold 1 year service contracts on copiers for $60,000 on Feb. 28. Each month the company services the copiers. Give the journal entry for the sale of the service copiers and any adjustment journal entry on Dec. 31. (Ignore cost to service copiers). 6 Paid the six month note, plus interest, at maturity, Aug. 1. 7 Mar. I, the company is a party to a patent infringement lawsuit of $230,000. Their attorney is certain it is remote that the company will lose the lawsuit. 8 Mar. 15, the company is party to a lawsuit for company violations of $90,000. The company attomey advises that it is probable the company will lose this lawsuit. The attorney estimates the amount at $80,000. 9 Dec 31, oil is spilled in the parking lot and is an environmental hazard which will need to be cleaned by a Hazmat team. It is certain this will need to be remediated. The company does not know how much it will cost. Journalize the required transactions. If no journal entry is required, say "no journal entry." Date Account Dr Mike Wallace is a general manager at the local Fox News channel. During 2018, Wallace worked for the company all year at $21,000 monthly salary. He also eamed a year-end bonus equal to 6% of his annual salary. Wallace's Federal income tax withheld during 2018 was 20%. State income tax withheld was 6%. FICA tax was withheld on the annual earnings (remember the Social Security limit of $118,400). Wallace authorized the following payroll deductions: Charity Fund of 2% of total earnings and life insurance of $25 per month. Fox News incurred payroll tax expense on Wallace for FICA taxes. Federal unemployment and State Unemployment taxes were $1,254 and $2,456, respectively. They also paid $7,200 in Health Insurance (payable) for Wallace. 1 Compute Wallace's gross pay, payroll deductions, and net pay for the full year 2018, Round all amounts to the nearest dollar. 2 Compute Fox News' total 2018 payroll tax expense for Wallace. 3 Make the journal entry to record Fox News' expense for Wallace's total earnings for the year, his payroll deductions, and net pay. Debit Salary Expense and Bonus Expense as appropriate. Credit liability accounts for the payroll deductions and Cash for net pay. 4 Make the journal entry to record the accrual of Fox News' payroll for Wallace's total earnings. 5 Make the journal entry for the payment of the payroll withholdings and taxes. Robby Robots has decided to invest its excess cash in the following investments: Jan. 10 Feb. 13 Mar. 1 Mar. 1 Purchased 8,000 shares of Lion Country Safari for $3.25 per share. Robby Robots does not have significant influence over Lion Country Safari Purchased 33% of the stock of Birdie Hats consisting of 33,000 shares of stock (out of 100,000 shares) for $5 per share Robby Robots does have significant influence over Birdie Hats. Purchased a semiannual bond from the City of Ocala with a face value of $80,000 which pays 6.4% APR (Next interest payment is August 1). Robby Robots intends to hold the bond to maturity. Purchased a semiannual bond from Camelot Canoes with a face value of S50,000 which pay 7.5% APR. (Next interest payment is August 1). Robby Robots classifies these bonds as trading investments. Purchased a semiannual bond from the U.S. treasury with a face value of $10,000 which pays 5.0% APR (Next interest payment is August 1). Robby Robots classifies this bond as available for sale. Birdie Hats pays a dividend of S1.25 per share. Lion Country Safari pays a dividend of 0.25 per share. Birdie Hats pays a dividend of $1.35 per share. Mar. 1 June 1 Nov. 1 Dec. 1 At year's end, the investments are worth: Lion Country Safari, $3.50 per share, reporting net income of $2,500,000 Birdie Hats, $5.10 per share, reporting net income of $1,000,000. City of Ocala Bond is worth $81,500. Camelot Canoes is worth $48,000. U.S. Treasury bond is worth $11,000 1. Journalize all transactions relating to these investments including purchase, dividend payouts, interest payouts, adjustment to value (at Dec. 31). 2. Determine the effect on Robby Robot's net income for the year of each of the investments Lion Country Safari Date Account Birdie Hats Date Account City of Ocala Bond Date Account Dr1 Camelot Canoes Date Account Dr U.S. treasury bonds Date Account The following transactions occurred: | Purchased furniture at a cost of $7,000 on Feb. 1, signing a six month 8% note payable for that amount 2 Recorded a week's sales of $68,000 on Feb. 14, three fourths on credit and one-fourth for cash. Sales are subject to 7 % sales tax. 3 Accrued monthly warranty expense, which is estimated at 2% of sales of $200,000. Feb. 28. 4 Sent last week's sales tax to the state, Feb. 19. 5 Sold 1 year service contracts on copiers for $60,000 on Feb. 28. Each month the company services the copiers. Give the journal entry for the sale of the service copiers and any adjustment journal entry on Dec. 31. (Ignore cost to service copiers). 6 Paid the six month note, plus interest, at maturity, Aug. 1. 7 Mar. I, the company is a party to a patent infringement lawsuit of $230,000. Their attorney is certain it is remote that the company will lose the lawsuit. 8 Mar. 15, the company is party to a lawsuit for company violations of $90,000. The company attomey advises that it is probable the company will lose this lawsuit. The attorney estimates the amount at $80,000. 9 Dec 31, oil is spilled in the parking lot and is an environmental hazard which will need to be cleaned by a Hazmat team. It is certain this will need to be remediated. The company does not know how much it will cost. Journalize the required transactions. If no journal entry is required, say "no journal entry." Date Account Dr Mike Wallace is a general manager at the local Fox News channel. During 2018, Wallace worked for the company all year at $21,000 monthly salary. He also eamed a year-end bonus equal to 6% of his annual salary. Wallace's Federal income tax withheld during 2018 was 20%. State income tax withheld was 6%. FICA tax was withheld on the annual earnings (remember the Social Security limit of $118,400). Wallace authorized the following payroll deductions: Charity Fund of 2% of total earnings and life insurance of $25 per month. Fox News incurred payroll tax expense on Wallace for FICA taxes. Federal unemployment and State Unemployment taxes were $1,254 and $2,456, respectively. They also paid $7,200 in Health Insurance (payable) for Wallace. 1 Compute Wallace's gross pay, payroll deductions, and net pay for the full year 2018, Round all amounts to the nearest dollar. 2 Compute Fox News' total 2018 payroll tax expense for Wallace. 3 Make the journal entry to record Fox News' expense for Wallace's total earnings for the year, his payroll deductions, and net pay. Debit Salary Expense and Bonus Expense as appropriate. Credit liability accounts for the payroll deductions and Cash for net pay. 4 Make the journal entry to record the accrual of Fox News' payroll for Wallace's total earnings. 5 Make the journal entry for the payment of the payroll withholdings and taxes