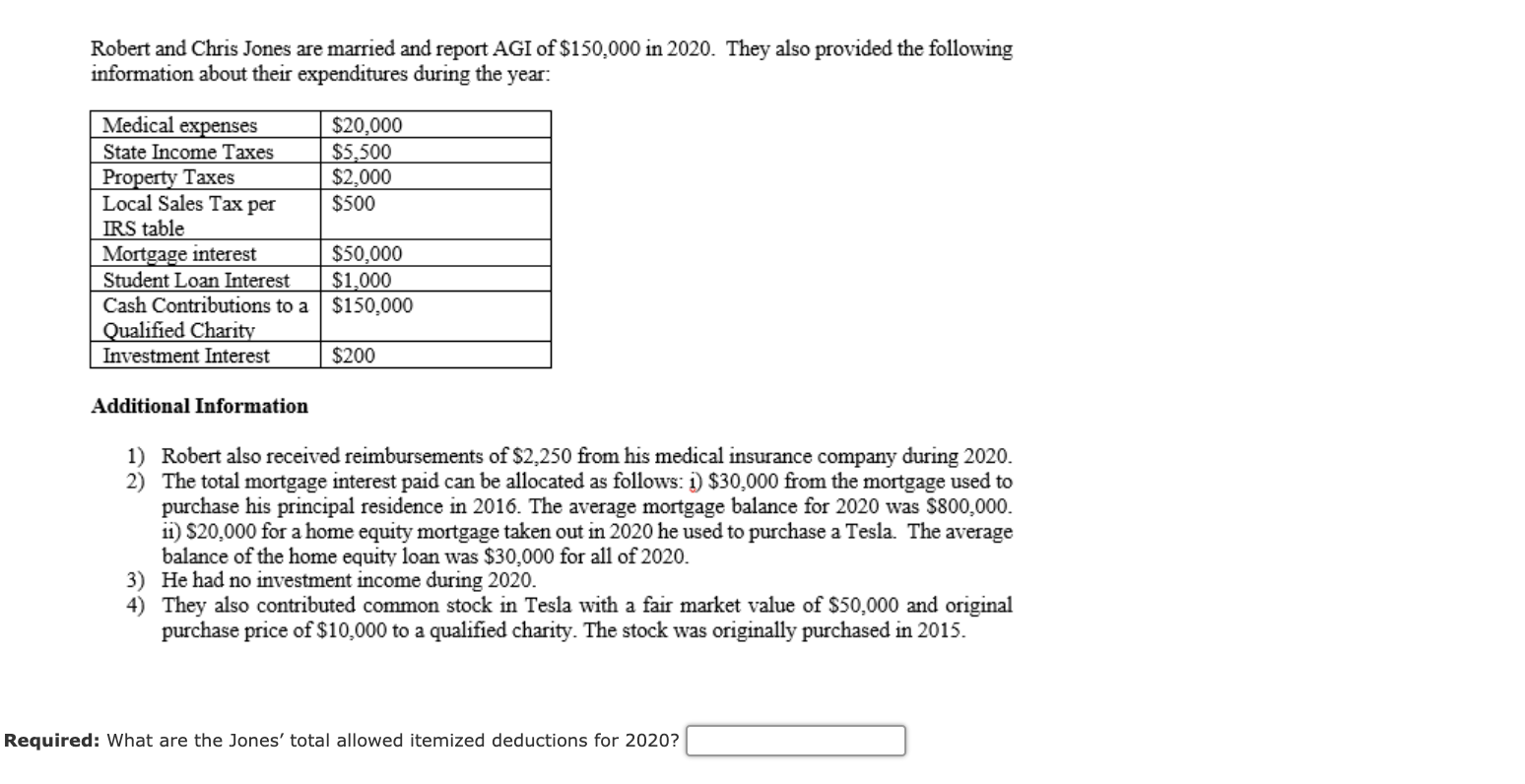

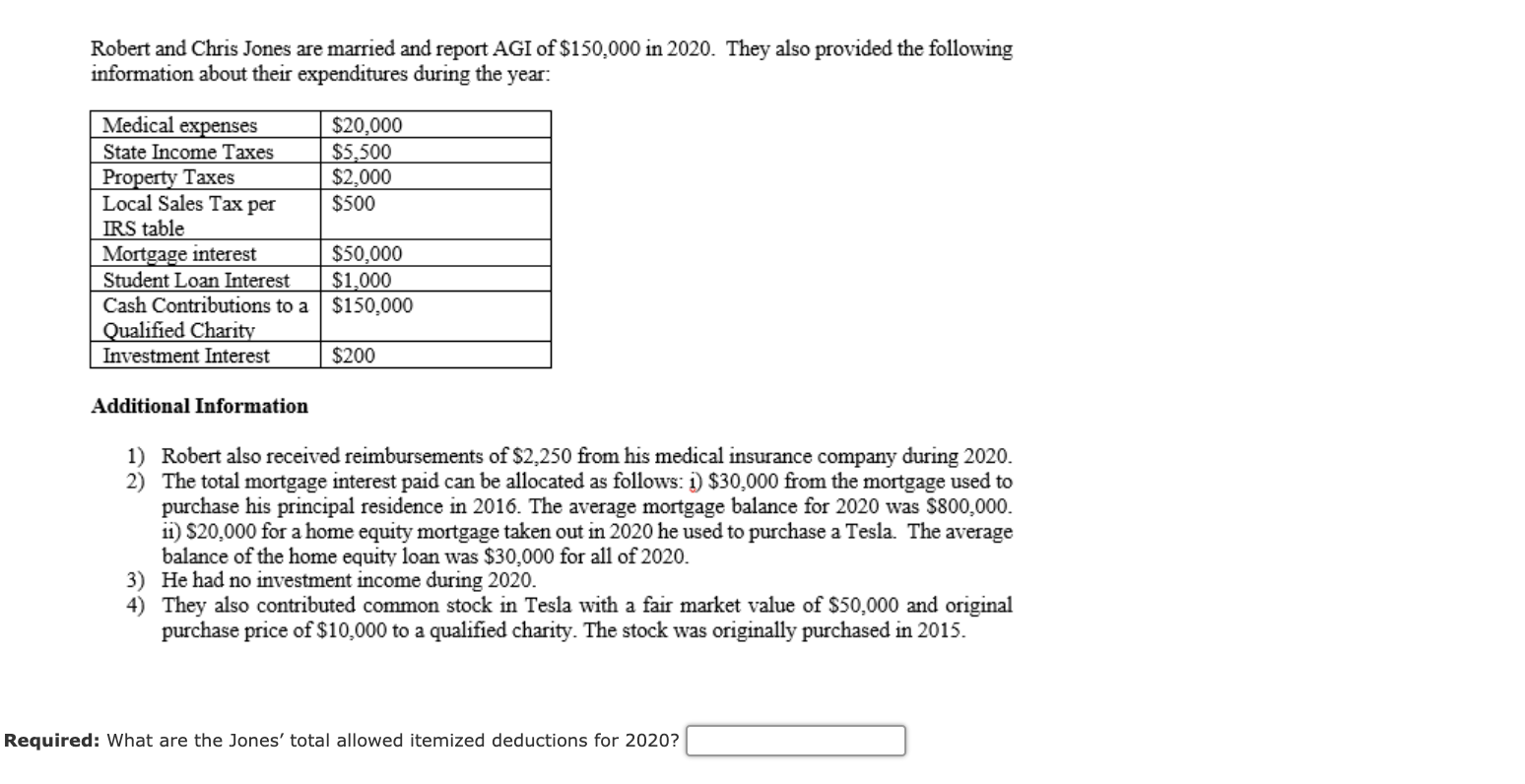

Robert and Chris Jones are married and report AGI of $150,000 in 2020. They also provided the following information about their expenditures during the year: Medical expenses $20,000 State Income Taxes $5,500 Property Taxes $2,000 Local Sales Tax per $500 IRS table Mortgage interest $50,000 Student Loan Interest $1,000 Cash Contributions to a $150,000 Qualified Charity Investment Interest $200 Additional Information 1) Robert received reimbursements of $2,250 from his medical insurance company during 2020. 2) The total mortgage interest paid can be allocated as follows: 1) $30,000 from the mortgage used to purchase his principal residence in 2016. The average mortgage balance for 2020 was $800,000. 11) $20,000 for a home equity mortgage taken out in 2020 he used to purchase a Tesla. The average balance of the home equity loan was $30,000 for all of 2020. 3) He had no investment income during 2020. 4) They also contributed common stock in Tesla with a fair market value of $50,000 and original purchase price of $10,000 to a qualified charity. The stock was originally purchased in 2015. Required: What are the Jones' total allowed itemized deductions for 2020? Robert and Chris Jones are married and report AGI of $150,000 in 2020. They also provided the following information about their expenditures during the year: Medical expenses $20,000 State Income Taxes $5,500 Property Taxes $2,000 Local Sales Tax per $500 IRS table Mortgage interest $50,000 Student Loan Interest $1,000 Cash Contributions to a $150,000 Qualified Charity Investment Interest $200 Additional Information 1) Robert received reimbursements of $2,250 from his medical insurance company during 2020. 2) The total mortgage interest paid can be allocated as follows: 1) $30,000 from the mortgage used to purchase his principal residence in 2016. The average mortgage balance for 2020 was $800,000. 11) $20,000 for a home equity mortgage taken out in 2020 he used to purchase a Tesla. The average balance of the home equity loan was $30,000 for all of 2020. 3) He had no investment income during 2020. 4) They also contributed common stock in Tesla with a fair market value of $50,000 and original purchase price of $10,000 to a qualified charity. The stock was originally purchased in 2015. Required: What are the Jones' total allowed itemized deductions for 2020