Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Robert & Becky are married and file a joint return. They have a vacation home that they rent out for 196 days and use

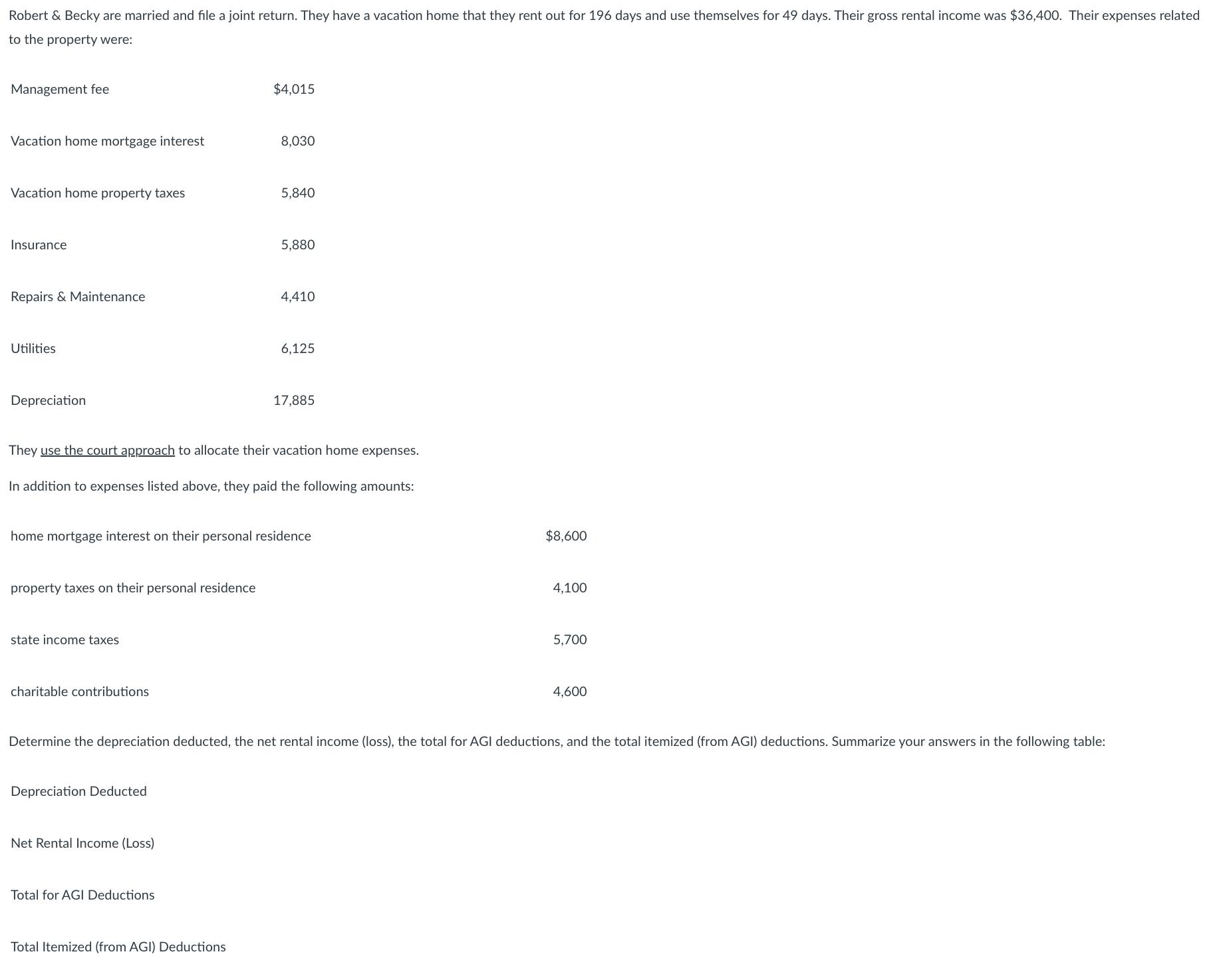

Robert & Becky are married and file a joint return. They have a vacation home that they rent out for 196 days and use themselves for 49 days. Their gross rental income was $36,400. Their expenses related to the property were: Management fee Vacation home mortgage interest Vacation home property taxes Insurance Repairs & Maintenance Utilities Depreciation property taxes on their personal residence state income taxes charitable contributions $4,015 They use the court approach to allocate their vacation home expenses. Depreciation Deducted 8,030 In addition to expenses listed above, they paid the following amounts: Net Rental Income (Loss) 5,840 home mortgage interest on their personal residence Total for AGI Deductions 5,880 Total Itemized (from AGI) Deductions 4,410 6,125 17,885 $8,600 Determine the depreciation deducted, the net rental income (loss), the total for AGI deductions, and the total itemized (from AGI) deductions. Summarize your answers in the following table: 4,100 5,700 4,600

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Sure heres a summary based on the information provided Category Amount Depreciation Deducted 17885 N...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started