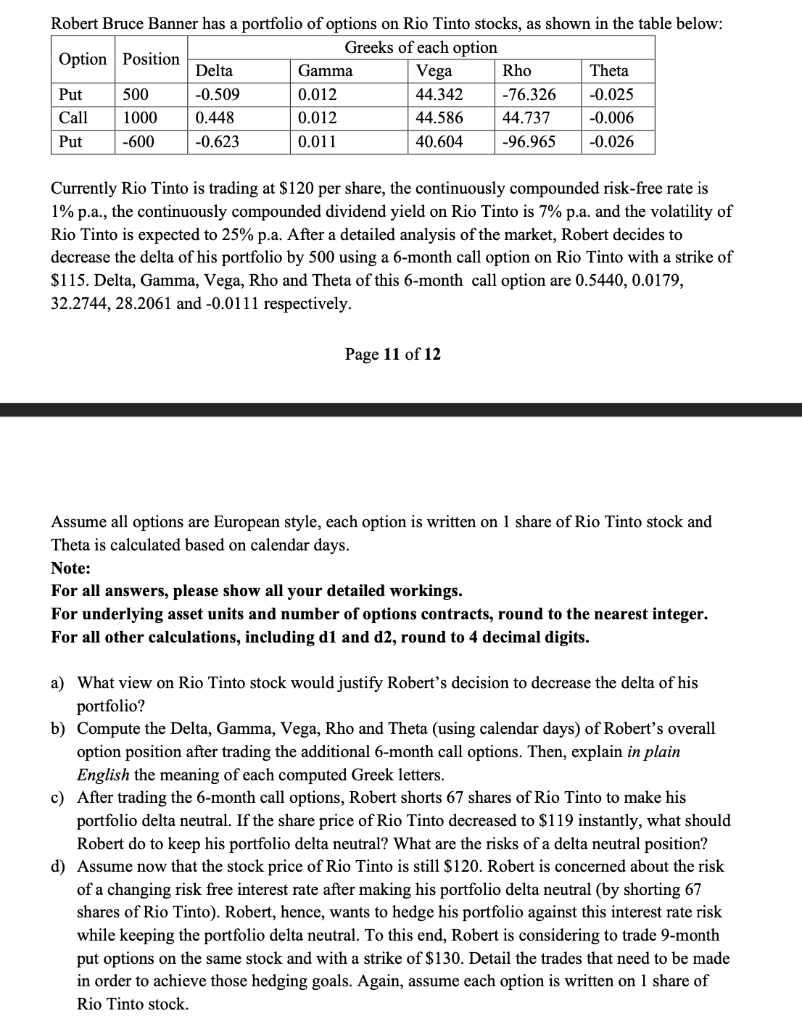

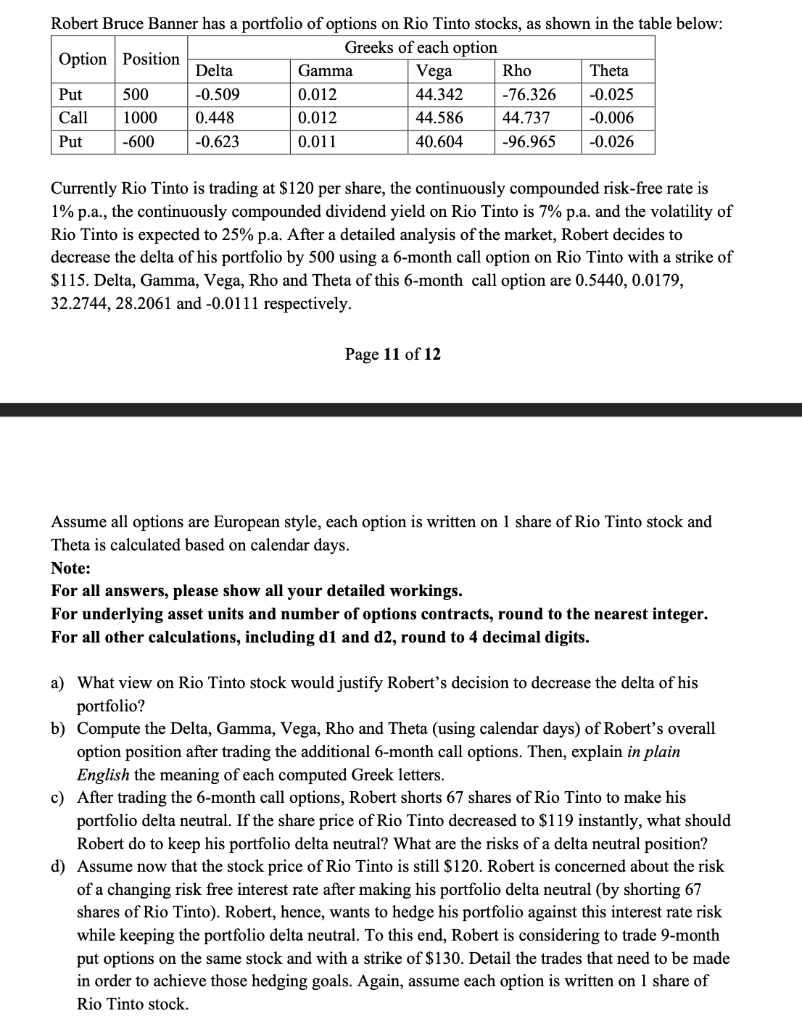

Robert Bruce Banner has a portfolio of options on Rio Tinto stocks, as shown in the table below: Greeks of each option Option Position Delta Gamma Vega Rho Theta Put 500 -0.509 0.012 44.342 -76.326 -0.025 Call 1000 0.448 0.012 44.586 44.737 -0.006 Put -600 -0.623 0.011 40.604 -96.965 -0.026 Currently Rio Tinto is trading at $120 per share, the continuously compounded risk-free rate is 1% p.a., the continuously compounded dividend yield on Rio Tinto is 7% p.a. and the volatility of Rio Tinto is expected to 25% p.a. After a detailed analysis of the market, Robert decides to decrease the delta of his portfolio by 500 using a 6-month call option on Rio Tinto with a strike of $115. Delta, Gamma, Vega, Rho and Theta of this 6-month call option are 0.5440, 0.0179, 32.2744, 28.2061 and -0.0111 respectively. Page 11 of 12 Assume all options are European style, each option is written on 1 share of Rio Tinto stock and Theta is calculated based on calendar days. Note: For all answers, please show all your detailed workings. For underlying asset units and number of options contracts, round to the nearest integer. For all other calculations, including d1 and d2, round to 4 decimal digits. a) What view on Rio Tinto stock would justify Robert's decision to decrease the delta of his portfolio? b) Compute the Delta, Gamma, Vega, Rho and Theta (using calendar days) of Robert's overall option position after trading the additional 6-month call options. Then, explain in plain English the meaning of each computed Greek letters. c) After trading the 6-month call options, Robert shorts 67 shares of Rio Tinto to make his portfolio delta neutral. If the share price of Rio Tinto decreased to $119 instantly, what should Robert do to keep his portfolio delta neutral? What are the risks of a delta neutral position? d) Assume now that the stock price of Rio Tinto is still $120. Robert is concerned about the risk of a changing risk free interest rate after making his portfolio delta neutral (by shorting 67 shares of Rio Tinto). Robert, hence, wants to hedge his portfolio against this interest rate risk while keeping the portfolio delta neutral. To this end, Robert is considering to trade 9-month put options on the same stock and with a strike of $130. Detail the trades that need to be made in order to achieve those hedging goals. Again, assume each option is written on 1 share of Rio Tinto stock. Robert Bruce Banner has a portfolio of options on Rio Tinto stocks, as shown in the table below: Greeks of each option Option Position Delta Gamma Vega Rho Theta Put 500 -0.509 0.012 44.342 -76.326 -0.025 Call 1000 0.448 0.012 44.586 44.737 -0.006 Put -600 -0.623 0.011 40.604 -96.965 -0.026 Currently Rio Tinto is trading at $120 per share, the continuously compounded risk-free rate is 1% p.a., the continuously compounded dividend yield on Rio Tinto is 7% p.a. and the volatility of Rio Tinto is expected to 25% p.a. After a detailed analysis of the market, Robert decides to decrease the delta of his portfolio by 500 using a 6-month call option on Rio Tinto with a strike of $115. Delta, Gamma, Vega, Rho and Theta of this 6-month call option are 0.5440, 0.0179, 32.2744, 28.2061 and -0.0111 respectively. Page 11 of 12 Assume all options are European style, each option is written on 1 share of Rio Tinto stock and Theta is calculated based on calendar days. Note: For all answers, please show all your detailed workings. For underlying asset units and number of options contracts, round to the nearest integer. For all other calculations, including d1 and d2, round to 4 decimal digits. a) What view on Rio Tinto stock would justify Robert's decision to decrease the delta of his portfolio? b) Compute the Delta, Gamma, Vega, Rho and Theta (using calendar days) of Robert's overall option position after trading the additional 6-month call options. Then, explain in plain English the meaning of each computed Greek letters. c) After trading the 6-month call options, Robert shorts 67 shares of Rio Tinto to make his portfolio delta neutral. If the share price of Rio Tinto decreased to $119 instantly, what should Robert do to keep his portfolio delta neutral? What are the risks of a delta neutral position? d) Assume now that the stock price of Rio Tinto is still $120. Robert is concerned about the risk of a changing risk free interest rate after making his portfolio delta neutral (by shorting 67 shares of Rio Tinto). Robert, hence, wants to hedge his portfolio against this interest rate risk while keeping the portfolio delta neutral. To this end, Robert is considering to trade 9-month put options on the same stock and with a strike of $130. Detail the trades that need to be made in order to achieve those hedging goals. Again, assume each option is written on 1 share of Rio Tinto stock