Answered step by step

Verified Expert Solution

Question

1 Approved Answer

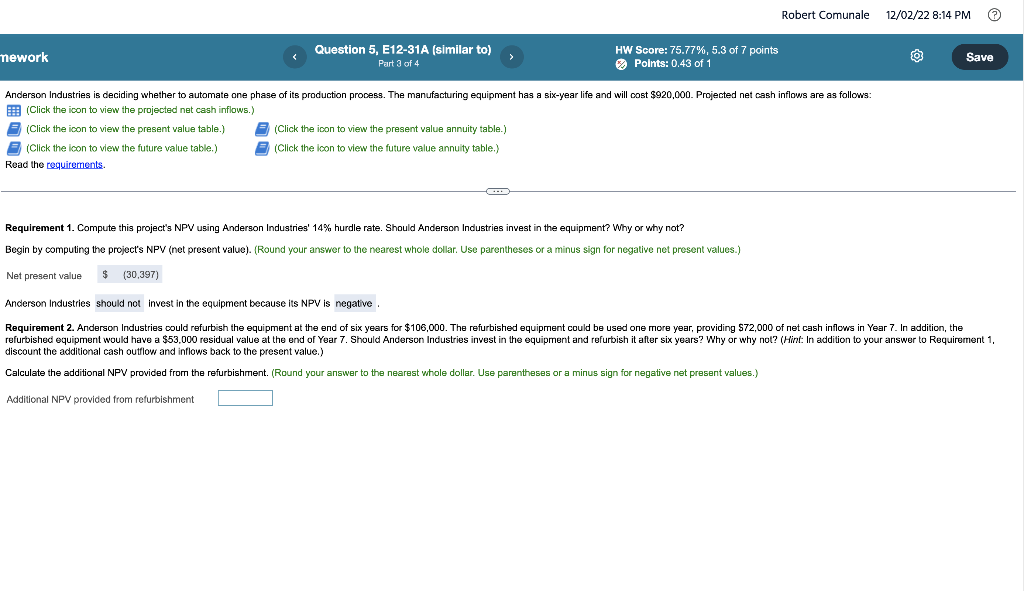

Robert Comunale 12/02/22 8:14 PM mework Question 5, E12-31A (similar to) Part 3 of 4 HW Score: 75.77%, 5.3 of 7 points Points: 0.43

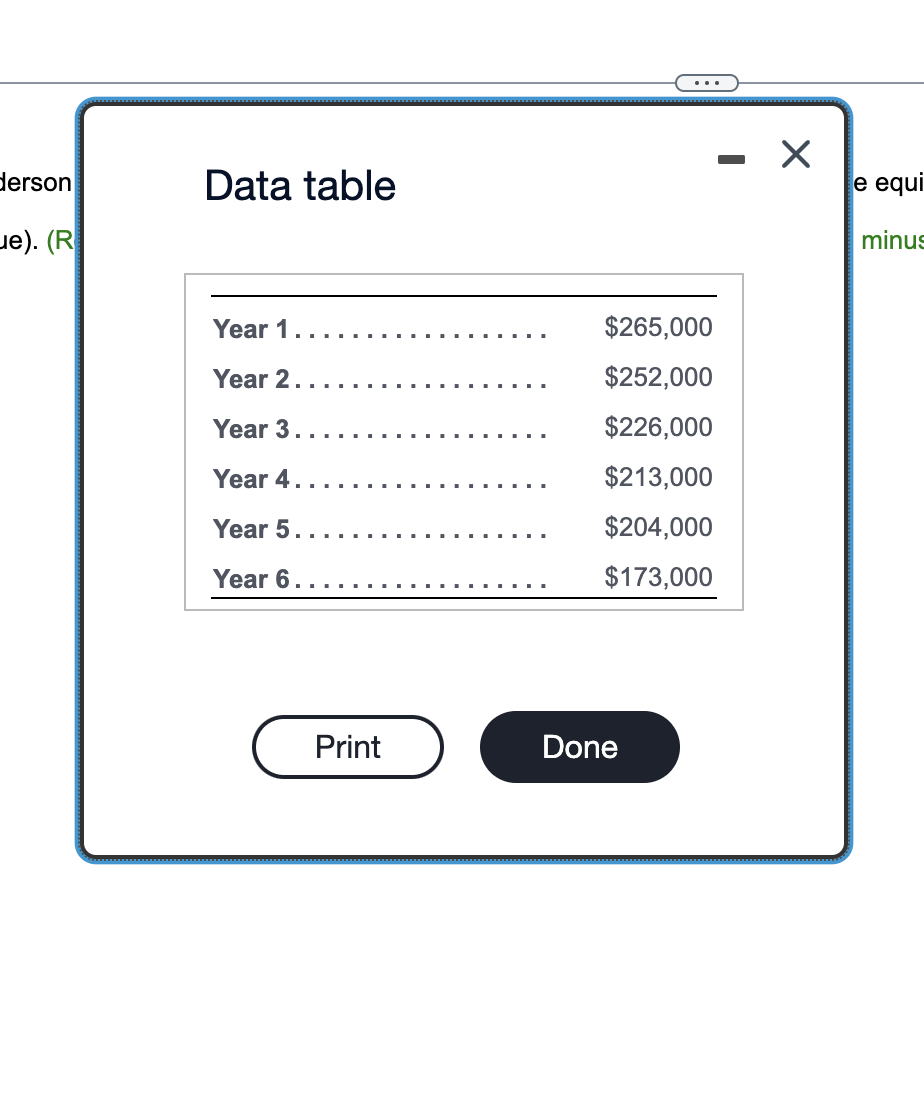

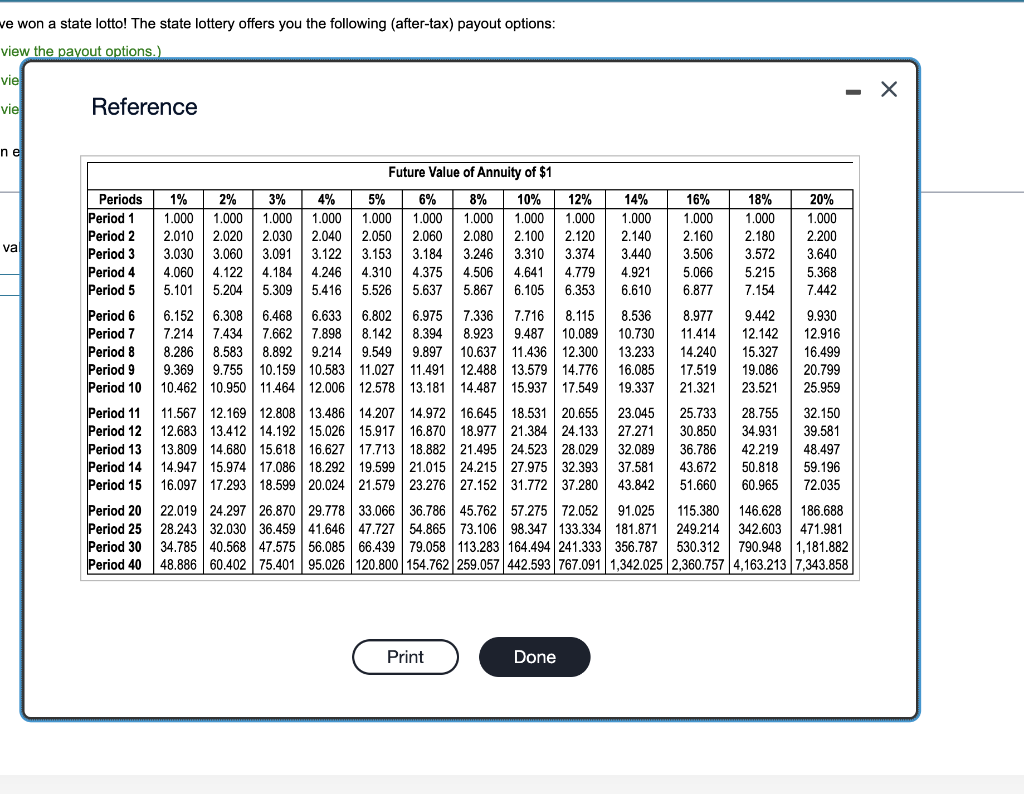

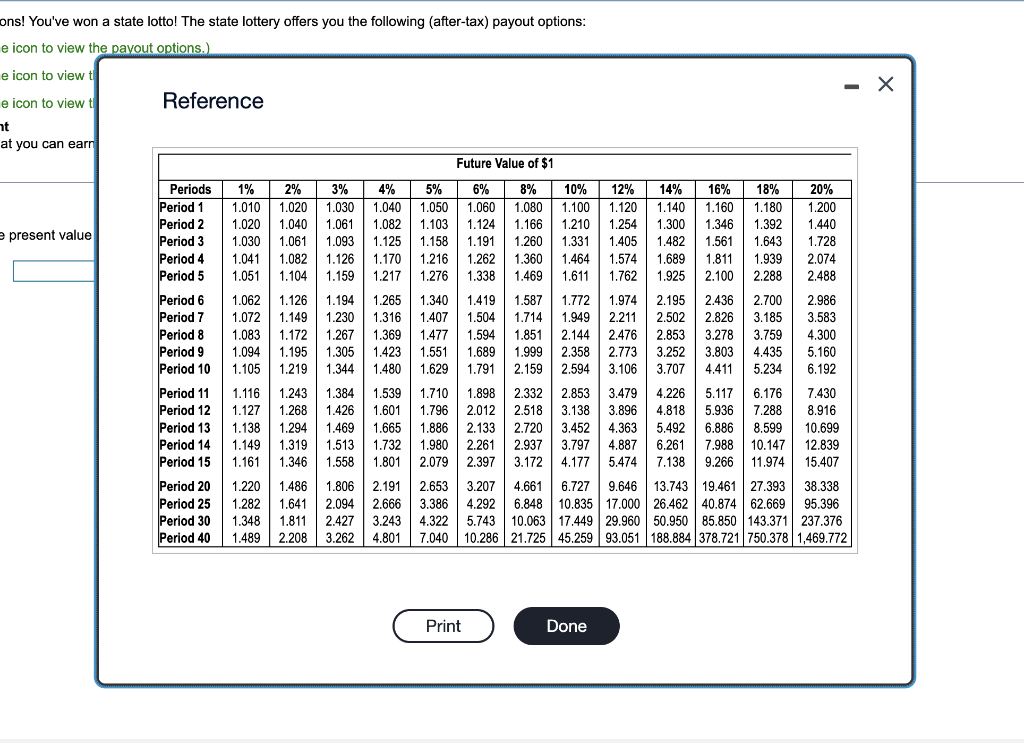

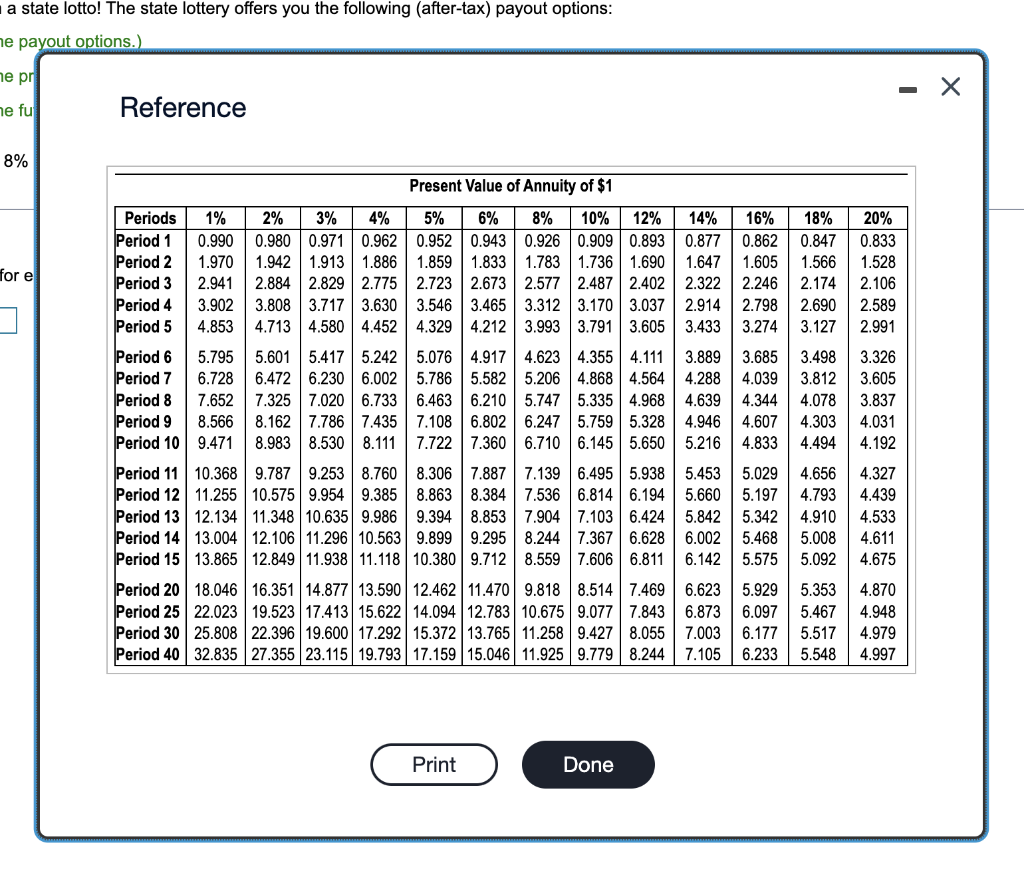

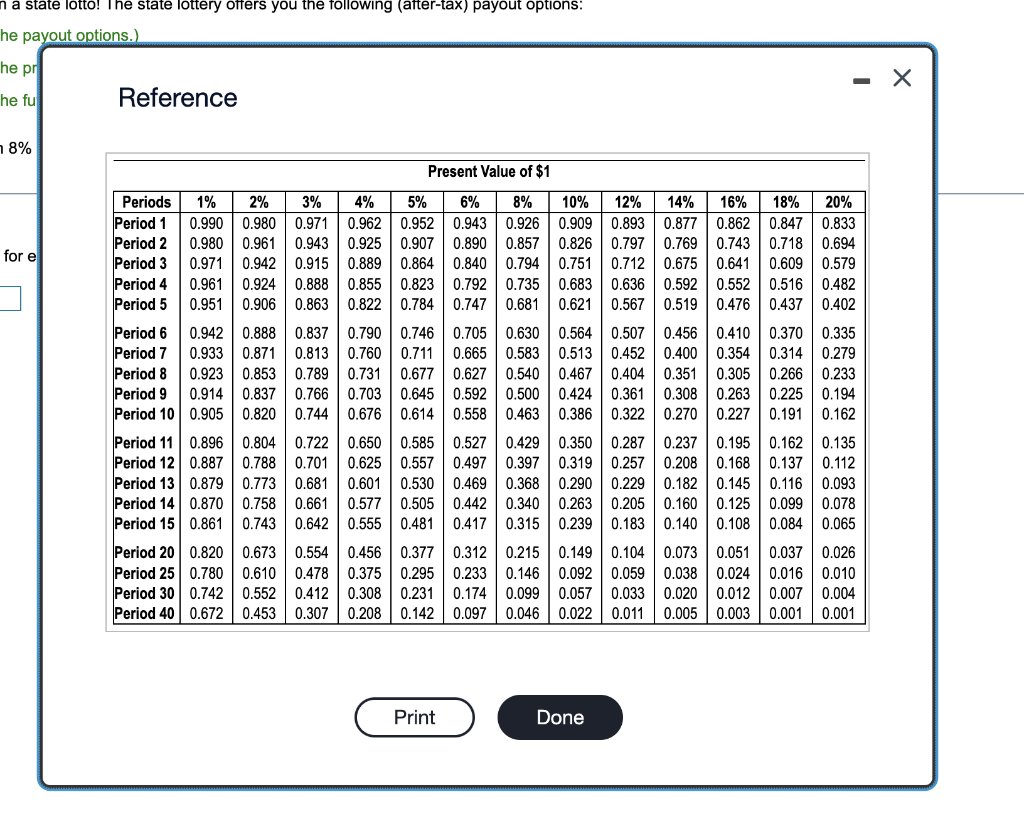

Robert Comunale 12/02/22 8:14 PM mework Question 5, E12-31A (similar to) Part 3 of 4 HW Score: 75.77%, 5.3 of 7 points Points: 0.43 of 1 Anderson Industries is deciding whether to automate one phase of its production process. The manufacturing equipment has a six-year life and will cost $920,000. Projected net cash inflows are as follows: (Click the icon to view the projected net cash inflows.) (Click the icon to view the present value table.) (Click the icon to view the future value table.) Read the requirements. (Click the icon to view the present value annuity table.) (Click the icon to view the future value annuity table.) Save Requirement 1. Compute this project's NPV using Anderson Industries' 14% hurdle rate. Should Anderson Industries invest in the equipment? Why or why not? Begin by computing the project's NPV (net present value). (Round your answer to the nearest whole dollar. Use parentheses or a minus sign for negative net present values.) Net present value $ (30,397) Anderson Industries should not invest in the equipment because its NPV is negative. Requirement 2. Anderson Industries could refurbish the equipment at the end of six years for $106,000. The refurbished equipment could be used one more year, providing $72,000 of net cash inflows in Year 7. In addition, the refurbished equipment would have a $53,000 residual value at the end of Year 7. Should Anderson Industries invest in the equipment and refurbish it after six years? Why or why not? (Hint: In addition to your answer to Requirement 1, discount the additional cash outflow and inflows back to the present value.) Calculate the additional NPV provided from the refurbishment. (Round your answer to the nearest whole dollar. Use parentheses or a minus sign for negative net present values.) Additional NPV provided from refurbishment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started