Question

Robert Falkner, President of Falkner Investments Inc., was faced with a major decision. One of the firms that his company had invested in, Spandex Corporation,

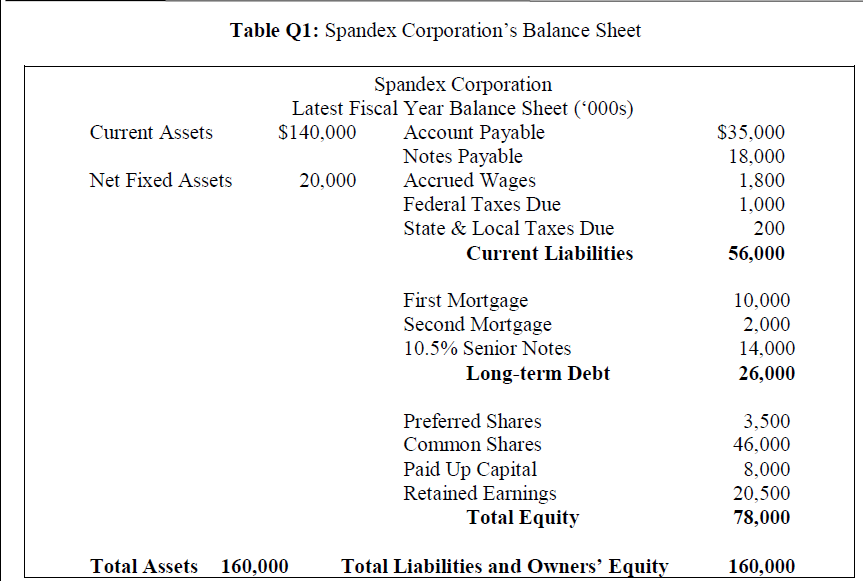

Robert Falkner, President of Falkner Investments Inc., was faced with a major decision. One of the firms that his company had invested in, Spandex Corporation, was under severe financial distress. It had therefore, sent out a proposal for reorganization. If this proposal for reorganization is approved by a majority of creditors would lead to a prepack, in the hope that the company could restructure itself and be salvaged. Being rather unfamiliar with the various regulations nuances associated with corporate bankruptcy, Falkner has summoned his Chief Financial Officer, Matt Roger, to look at the proposal and make a recommendation whether Falkner Investments Inc. should vote for or against the reorganization plan. The Spandex Corporation, incorporated in 1985, designed, manufactured, imported and marketed various menswear, childrens sleepwear and underware, and other apparel products. Spandex Corporation sold its products to department and specialty stores, national chains and retailers throughout the United States. About 9 years earlier when sales were booming, the company undertook a major business expansion involving doubling its manufacturing capacity. The expansion was primarily financed by the issuance of senior notes and preferred shares. However, due to significantly lower profit margins and declining demand caused by increasing competition and weak economic conditions, the company faced negative earnings and poor liquidity conditions during the past three years. Initial attempts to cut costs did alleviate the problems a bit, however with the debt servicing costs being fairly high, the companys cash flows declined sharply. With the senior notes coming up for redemption within a year, the companys management was concerned that they would not be able to refinance the debt nor have the liquidity to pay off the creditors in time. They had therefore embarked upon a voluntary reorganization plan by which the debt would be exchanged for common shares, if agreed upon by the majority of creditors. Table 2 shows the latest balance sheet of the company. Falkner had purchased $5 million worth of Spandex Corporations senior notes, about nine years ago. The industry outlook was good and the 10.5% yield on the 10-year notes certainly looked enticing. The company had demonstrated a good record of complying with its interest and dividend obligations and analysts were bullish on the performance of Spandexs common shares. In their letter to the creditors, Spandex Corporations management had explained that the current situation was in their opinion, temporary. In their opinion if given a chance to reorganize and restructure, they would do their best to steer the company back on track. It was their intention to arrive at an agreement with the majority of creditors and then go for a prepackaged bankruptcy. The reorganization plan called for the exchange of 90.5805 shares of new common shares for each $1000 face value of the senior notes. The management pointed out that if the firm was forced to liquidate, its current assets could probably be sold for about 40% of the book value and its fixed assets would bring in about $9 million. However, about 20% of the gross proceeds would have to be paid towards administrative fees and other charges. After reading the letter and going over the financial statements of Spandex, Falkner was undecided. On the one hand, it seemed as if the management team was serious and confident about being able to weather this storm and make the company profitable once again. However, on the other hand, Falkner was concerned that the problems could get worse and he may end up with nothing. He was hoping that Matt Rogers would be able to shed some light on this matter and help him decide.

(a) Based on the above case, discuss the following options that Spandex Corporation has to survive a financial crisis. (i) Restructure of loan versus Extension of loan. (ii) Insolvency versus Bankruptcy (iii) Bankruptcy reorganization versus bankruptcy liquidation

(b) Explain: (i) The main problem at Spandex Corporation. (ii) The various ways in which firms can be financially distressed. (iii) The reason why the Spandex Corporations management attempted to get a pre-packaged bankruptcy.

(c) Evaluate whether should Falkner vote in favour of or against the voluntary reorganization using the necessary measurements.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started