Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Robert Lorca is the only shareholder of Rolorc Ltd., a CCPC with a taxation year that ends on December 31. His only source of

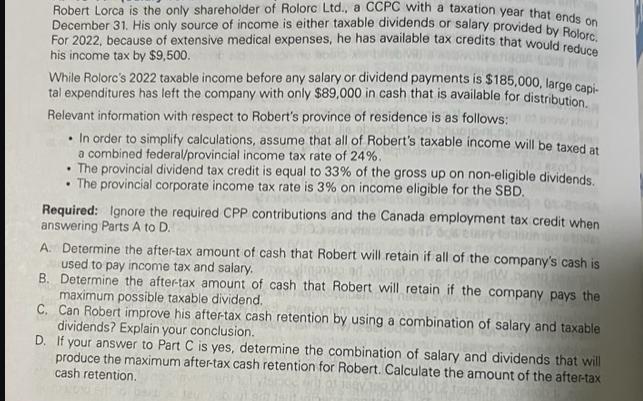

Robert Lorca is the only shareholder of Rolorc Ltd., a CCPC with a taxation year that ends on December 31. His only source of income is either taxable dvailable or salary provided by Rolore, For 2022, because of extensive medical expenses, he has available tax credits that would reduce his income tax by $9,500. While Rolorc's 2022 taxable income before any salary or dividend payments is $185,000, large capi- tal expenditures has left the company with only $89,000 in cash that is available for distribution. Relevant information with respect to Robert's province of residence is as follows: In order to simplify calculations, assume that all of Robert's taxable income will be taxed at a combined federal/provincial income tax rate of 24%. The provincial dividend tax credit is equal to 33% of the gross up on non-eligible dividends. The provincial corporate income tax rate is 3% on income eligible for the SBD. Required: Ignore the required CPP contributions and the Canada employment tax credit when answering Parts A to D. A. Determine the after-tax amount of cash that Robert will retain if all of the company's cash is used to pay income tax and salary. Hinw B. Determine the after-tax amount of cash that Robert will retain if the company pays the maximum possible taxable dividend. C. Can Robert improve his after-tax cash retention by using a combination of salary and taxable dividends? Explain your conclusion. D. If your answer to Part C is yes, determine the combination of salary and dividends that will produce the maximum after-tax cash retention for Robert. Calculate the amount of the after-tax cash retention.

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Part A All salary If Rolorc pays out all 89000 as salary to Robert Roberts salary income 89000 Feder...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started