Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Robertson, Surrey, and Thames are partners who share in profits and losses 30:40:30, respectively. Robertson is personally insolvent, Surrey has only $10,000 in personal

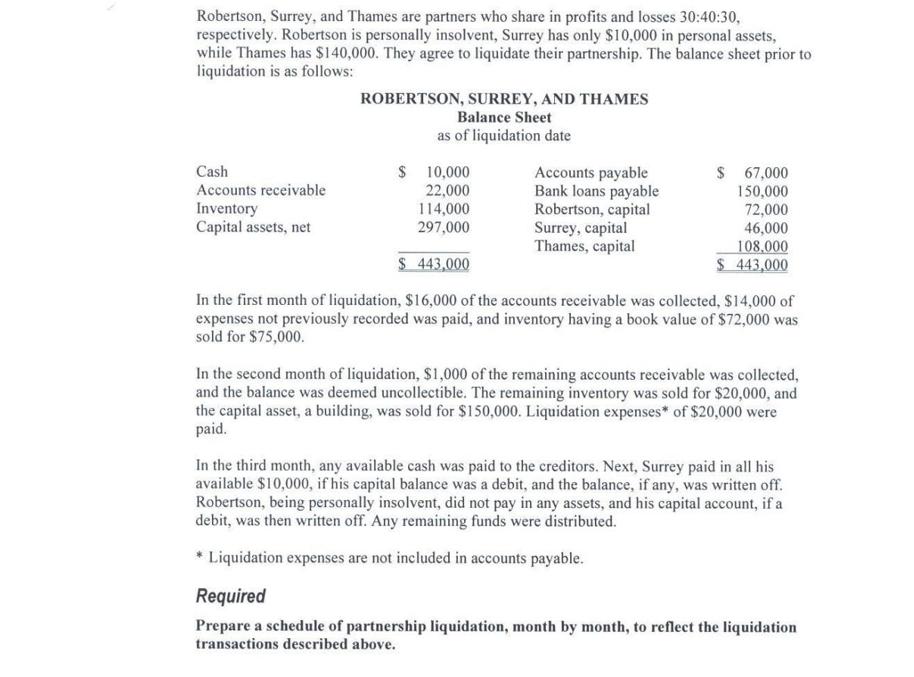

Robertson, Surrey, and Thames are partners who share in profits and losses 30:40:30, respectively. Robertson is personally insolvent, Surrey has only $10,000 in personal assets, while Thames has $140,000. They agree to liquidate their partnership. The balance sheet prior to liquidation is as follows: Cash Accounts receivable Inventory Capital assets, net ROBERTSON, SURREY, AND THAMES Balance Sheet as of liquidation date $ 10,000 22,000 114,000 297,000 $ 443,000 In the first month of liquidation, $16,000 of the accounts receivable was collected, $14,000 of expenses not previously recorded was paid, and inventory having a book value of $72,000 was sold for $75,000. Accounts payable Bank loans payable Robertson, capital Surrey, capital Thames, capital $ 67,000 150,000 72,000 46,000 108,000 $ 443,000 In the second month of liquidation, $1,000 of the remaining accounts receivable was collected, and the balance was deemed uncollectible. The remaining inventory was sold for $20,000, and the capital asset, a building, was sold for $150,000. Liquidation expenses* of $20,000 were paid. In the third month, any available cash was paid to the creditors. Next, Surrey paid in all his available $10,000, if his capital balance was a debit, and the balance, if any, was written off. Robertson, being personally insolvent, did not pay in any assets, and his capital account, if a debit, was then written off. Any remaining funds were distributed. Liquidation expenses are not included in accounts payable. Required Prepare a schedule of partnership liquidation, month by month, to reflect the liquidation transactions described above.

Step by Step Solution

★★★★★

3.55 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Here is the schedule of partnership liquidation month by month to reflect the liquidation transactions described above Month 1 Cash collected from acc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started