Question

Robinson & Company Ltd. (RCL) has the following capital structure: 25% Debt and 75% common equity. The after-tax cost of debt is 15% and

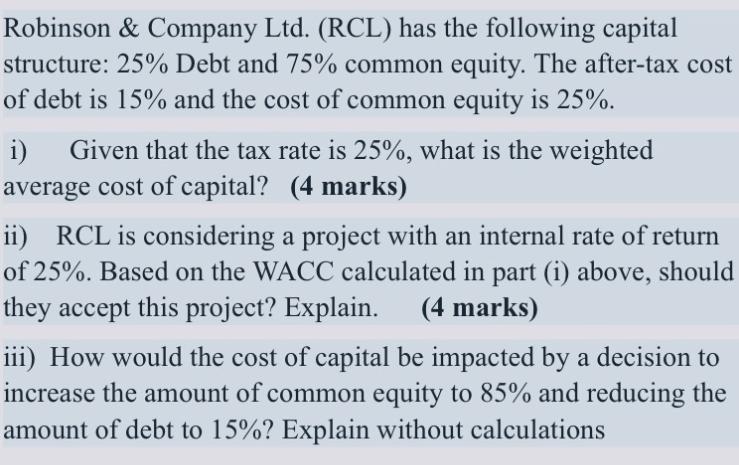

Robinson & Company Ltd. (RCL) has the following capital structure: 25% Debt and 75% common equity. The after-tax cost of debt is 15% and the cost of common equity is 25%. i) Given that the tax rate is 25%, what is the weighted average cost of capital? (4 marks) ii) RCL is considering a project with an internal rate of return of 25%. Based on the WACC calculated in part (i) above, should they accept this project? Explain. (4 marks) iii) How would the cost of capital be impacted by a decision to increase the amount of common equity to 85% and reducing the amount of debt to 15%? Explain without calculations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

i The weighted average cost of capital WACC is the weighted average of the cost of each component of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Practical financial management

Authors: William r. Lasher

5th Edition

0324422636, 978-0324422634

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App