Question

Robinson Company purchased Franklin Company at a price of $3,860,000. The fair market value of the net assets purchased equals $2,870,000. 1. What is

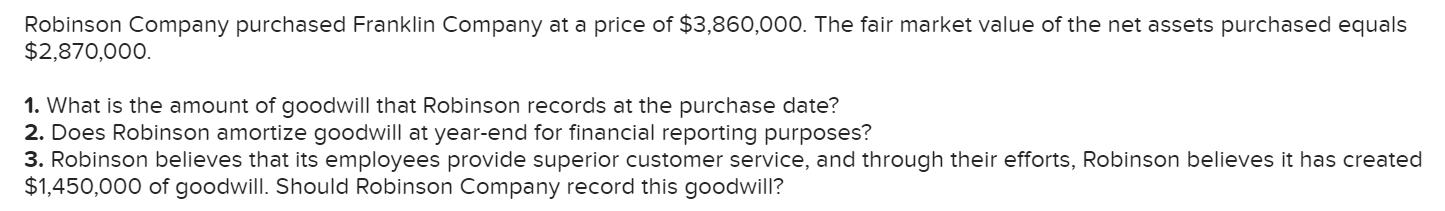

Robinson Company purchased Franklin Company at a price of $3,860,000. The fair market value of the net assets purchased equals $2,870,000. 1. What is the amount of goodwill that Robinson records at the purchase date? 2. Does Robinson amortize goodwill at year-end for financial reporting purposes? 3. Robinson believes that its employees provide superior customer service, and through their efforts, Robinson believes it has created $1,450,000 of goodwill. Should Robinson Company record this goodwill?

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Answer Solution Requirement 1 Goodwill purchase price fair market value of net assets 386000028...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental accounting principle

Authors: John J. Wild, Ken W. Shaw, Barbara Chiappetta

21st edition

1259119831, 9781259311703, 978-1259119835, 1259311708, 978-0078025587

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App