Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 5-3A (Part Level Submission) The Cheyenne Corp. is located in midtown Madison. During the past several years, net income has been declining because

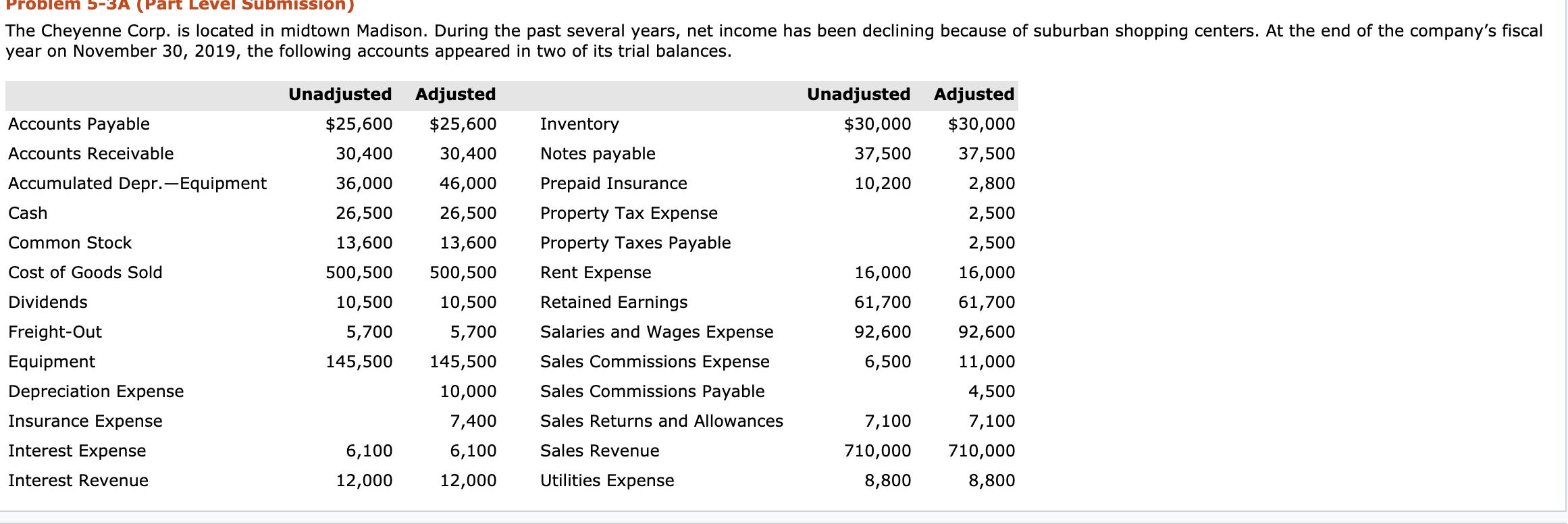

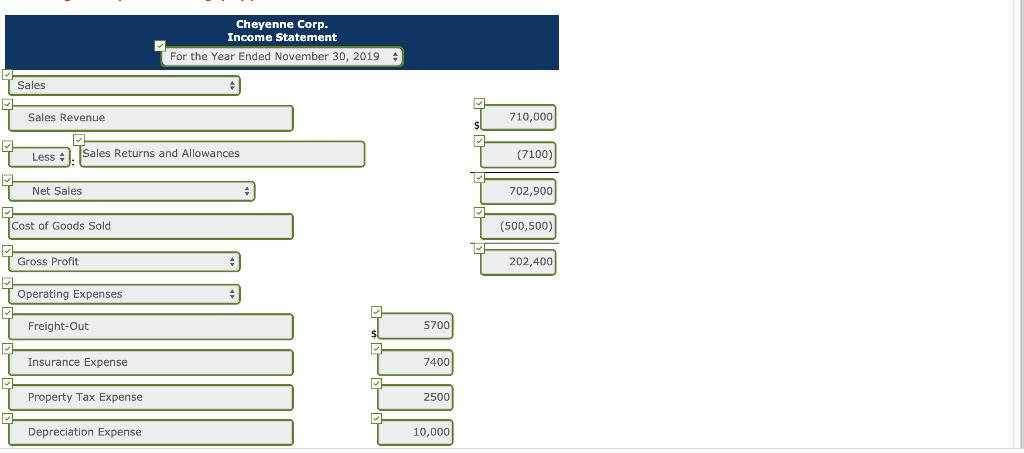

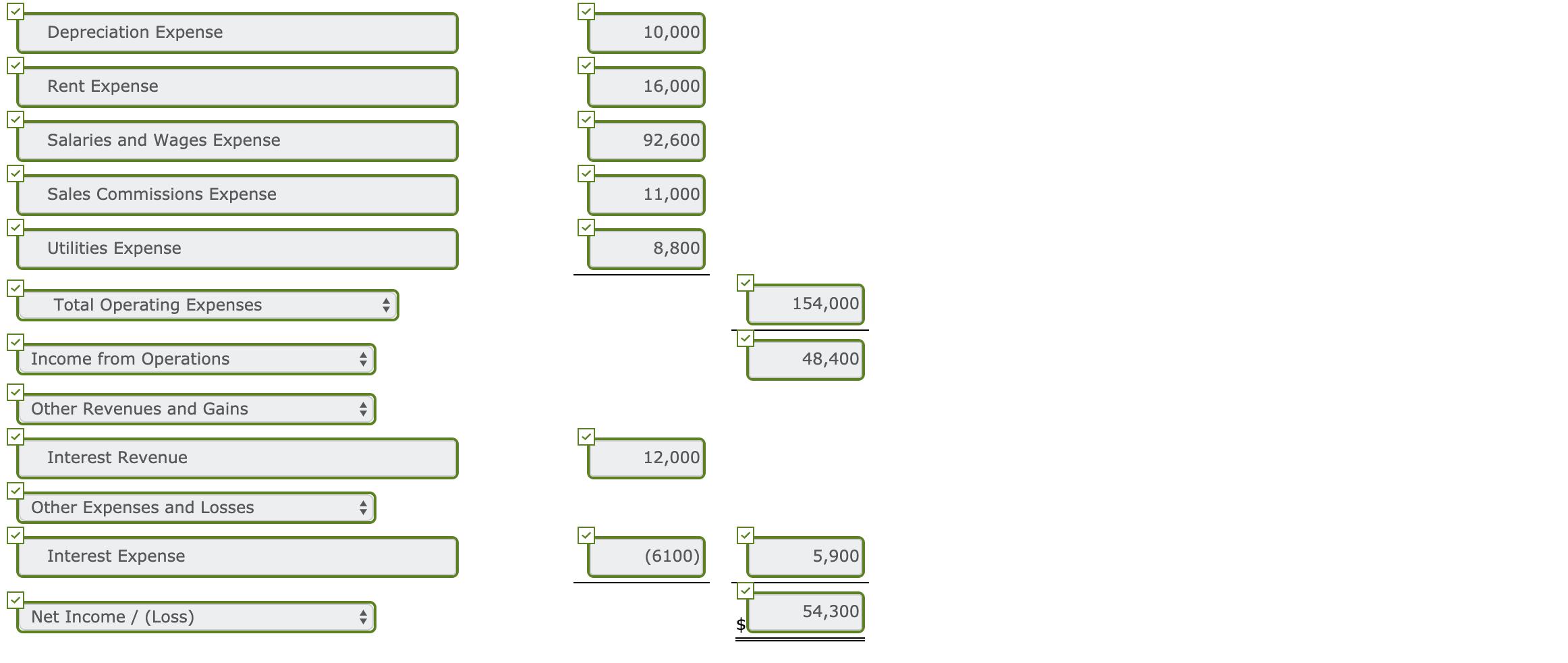

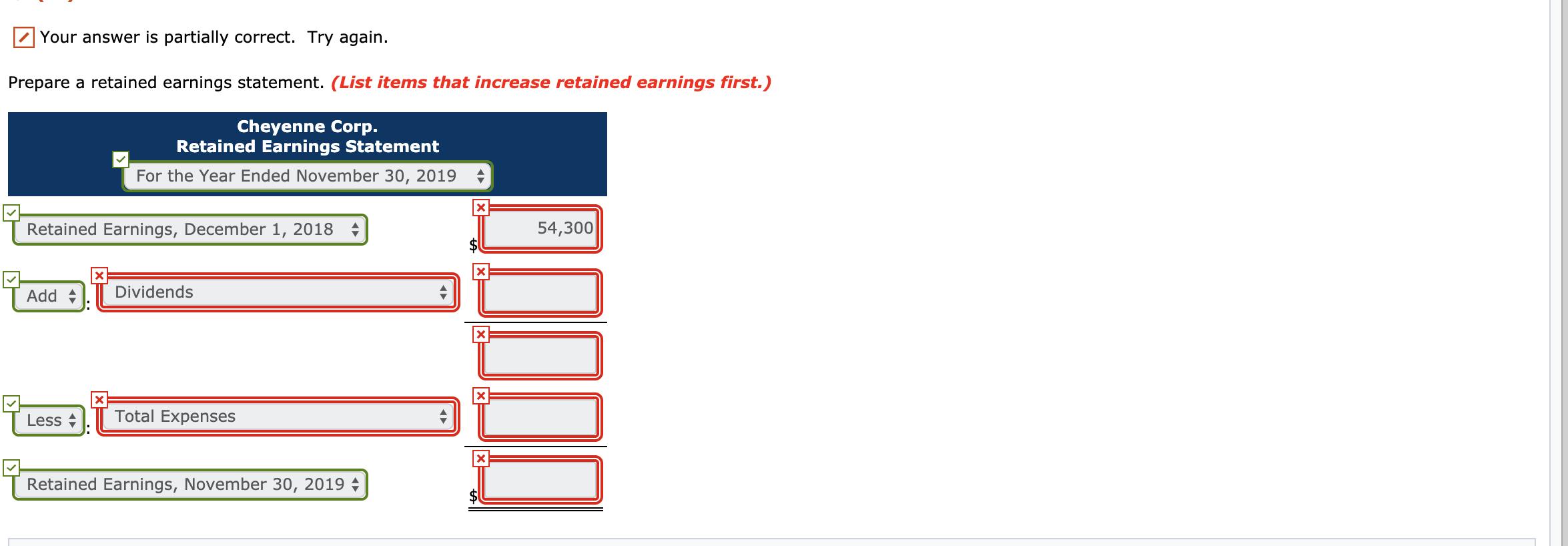

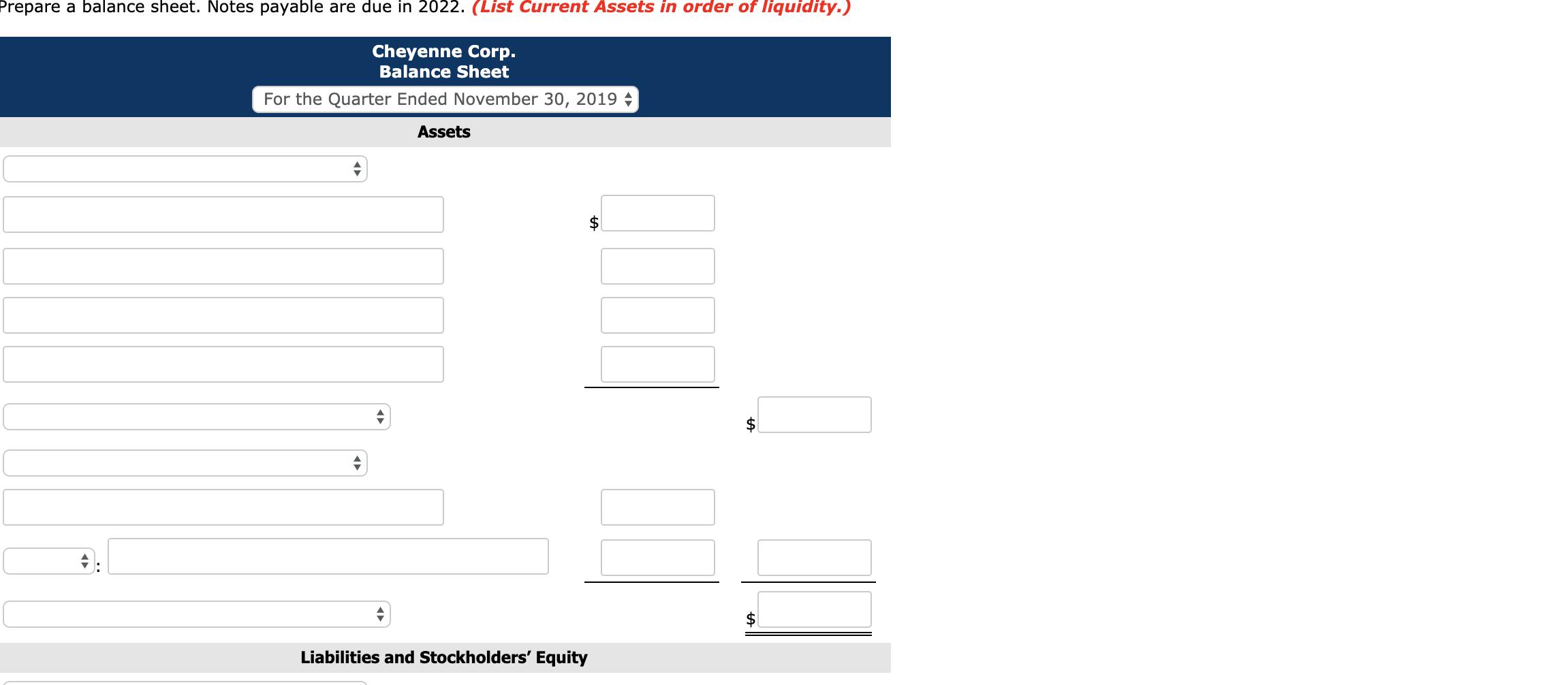

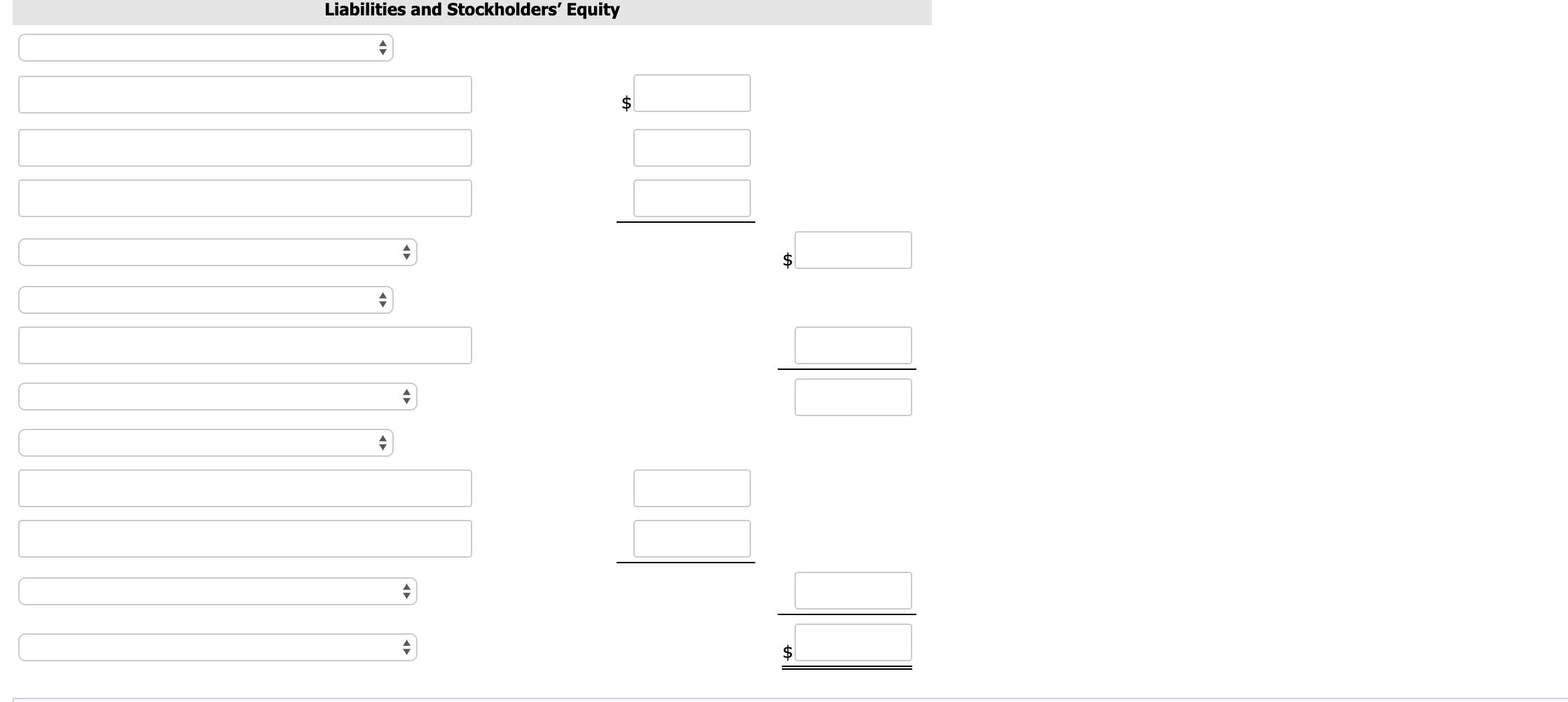

Problem 5-3A (Part Level Submission) The Cheyenne Corp. is located in midtown Madison. During the past several years, net income has been declining because of suburban shopping centers. At the end of the company's fiscal year on November 30, 2019, the following accounts appeared in two of its trial balances. Accounts Payable Accounts Receivable Accumulated Depr.-Equipment Cash Common Stock Cost of Goods Sold Dividends Freight-Out Equipment Depreciation Expense Insurance Expense Interest Expense Interest Revenue Unadjusted Adjusted $25,600 $25,600 30,400 30,400 36,000 46,000 26,500 26,500 13,600 13,600 500,500 500,500 10,500 10,500 5,700 5,700 145,500 145,500 10,000 7,400 6,100 12,000 6,100 12,000 Inventory Notes payable Prepaid Insurance Property Tax Expense Property Taxes Payable Rent Expense Retained Earnings Salaries and Wages Expense Sales Commissions Expense Sales Commissions Payable Sales Returns and Allowances Sales Revenue Utilities Expense Unadjusted Adjusted $30,000 $30,000 37,500 2,800 2,500 2,500 16,000 61,700 92,600 11,000 4,500 7,100 710,000 8,800 37,500 10,200 16,000 61,700 92,600 6,500 7,100 710,000 8,800 M F Sales Sales Revenue Less Sales Returns and Allowances Net Sales Cost of Goods Sold Gross Profit Operating Expenses Freight-Out Insurance Expense Property Tax Expense Cheyenne Corp. Income Statement For the Year Ended November 30, 2019 Depreciation Expense 0000 5700 7400 2500 10,000 0.0000 710,000 (7100) 702,900 (500,500) 202,400 Depreciation Expense Rent Expense Salaries and Wages Expense Sales Commissions Expense Utilities Expense Total Operating Expenses Income from Operations Other Revenues and Gains Interest Revenue Other Expenses and Losses Interest Expense Net Income / (Loss) < 10,000 16,000 92,600 11,000 8,800 12,000 (6100) 154,000 48,400 5,900 54,300 Your answer is partially correct. Try again. Prepare a retained earnings statement. (List items that increase retained earnings first.) Cheyenne Corp. Retained Earnings Statement For the Year Ended November 30, 2019 + Retained Earnings, December 1, 2018 Add Less X Dividends Total Expenses Retained Earnings, November 30, 2019 00.00.0 54,300 Prepare a balance sheet. Notes payable are due in 2022. (List Current Assets in order of liquidity.) Cheyenne Corp. Balance Sheet For the Quarter Ended November 30, 2019 + Assets Liabilities and Stockholders' Equity Liabilities and Stockholders' Equity + LA $ $

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Solutions Revenues Sales Revenue Less Sales Retwin and allowance...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635e39ca67a2d_182519.pdf

180 KBs PDF File

635e39ca67a2d_182519.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started