Question

RoboLand is a U.S. company that exports robotic toys to Mexico. The company expects to receive 5,000,000 Mexican pesos (MXN) in one year from

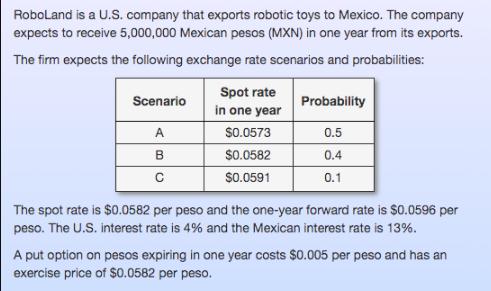

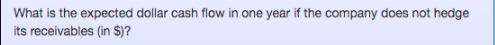

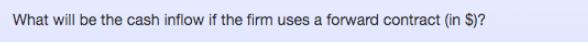

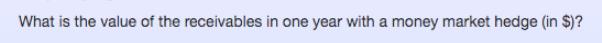

RoboLand is a U.S. company that exports robotic toys to Mexico. The company expects to receive 5,000,000 Mexican pesos (MXN) in one year from its exports. The firm expects the following exchange rate scenarios and probabilities: Scenario A B C Spot rate in one year $0.0573 $0.0582 $0.0591 Probability 0.5 0.4 0.1 The spot rate is $0.0582 per peso and the one-year forward rate is $0.0596 per peso. The U.S. interest rate is 4% and the Mexican interest rate is 13%. A put option on pesos expiring in one year costs $0.005 per peso and has an exercise price of $0.0582 per peso.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets break down the calculations step by step 1 Expected dollar cash flow in one year without hedgin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International financial management

Authors: Jeff Madura

9th Edition

978-0324593495, 324568207, 324568193, 032459349X, 9780324568202, 9780324568196, 978-0324593471

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App