Question

Robots Gone Wild The gyrations transpired in the currency markets witching hour (Links to an external site.), between the Wednesday close in New York and

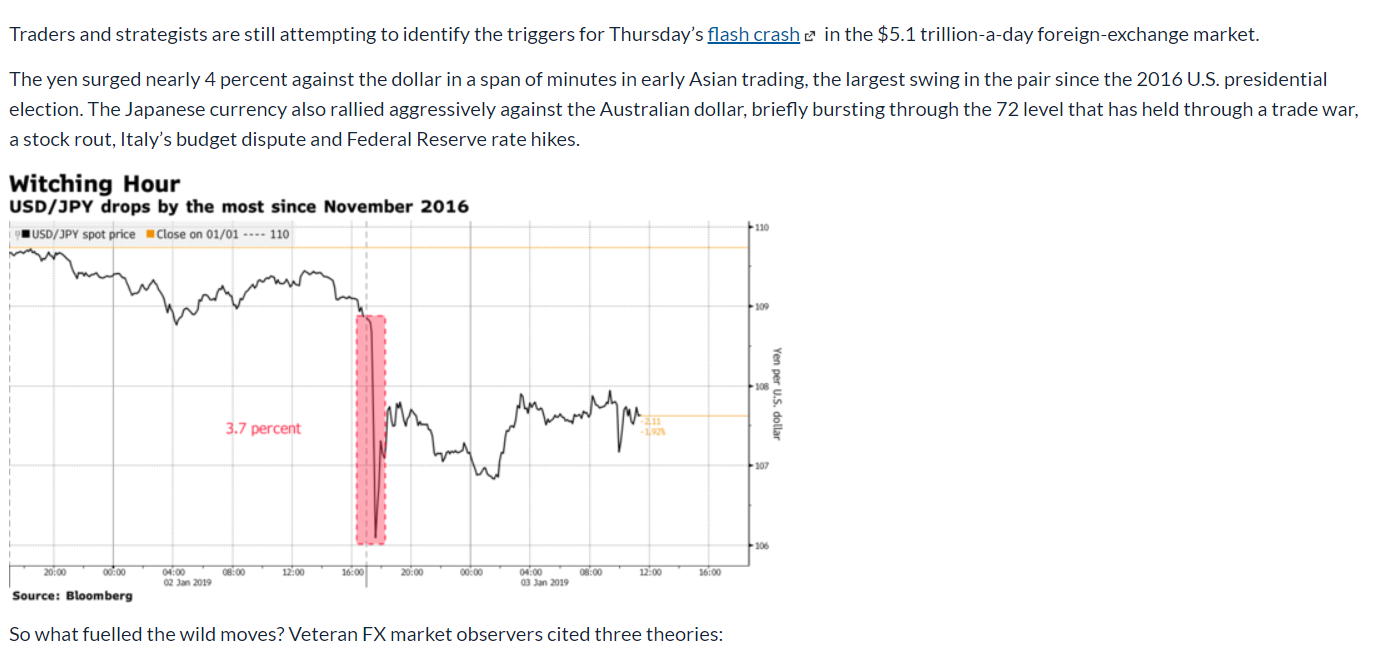

Robots Gone Wild

The gyrations transpired in the currency markets witching hour (Links to an external site.), between the Wednesday close in New York and the Thursday open in Tokyo. While the episode was likely exacerbated by a market holiday in Japan, flash crashes are becoming more common in that time frame, according to Andrew Maack, Vanguard Group Inc.s global head of foreign-exchange trading. He called it a black hole of liquidity where algorithmic trading programs dominate.

Its a time when you dont have many human traders interacting with the market, he said. If youre trying to source liquidity with an algorithm that doesnt have the proper constraints and controls, then you can see a situation where the market can move very quickly.

Compounding the turmoil was the fact that the yens rapid rally probably triggered stop-loss levels, Maack said. That would create a snowball effect given that the market had to digest those orders at the same time that algorithms were pushing prices in the same direction.

As a result, turnover in the yen soared. On the FX trading platform of CBOE Global Markets, spot volume in dollar-yen tallied roughly $5.5 billion from 5 p.m. New York time Wednesday to 9 a.m. Thursday. The typical amount during the past month for that period was about $2.7 billion.

Apple-Inspired Woes

News that Apple Inc. (Links to an external site.) cut its fiscal first-quarter revenue forecast (Links to an external site.) is also being blamed for the turbulence. The announcement came roughly an hour before the yen rally, further straining risk sentiment at a time when investors were still coming to grips with disappointing Chinese manufacturing data.

The yens abrupt advance is further proof that the global growth outlook is darkening, according to Jane Foley, head of currency strategy at Rabobank. The yen was the only Group-of-10 currency to gain against the dollar in 2018, buoyed by flight-to-quality flows amid a fraught geopolitical backdrop.

The yen is reinforcing itself as a more traditional safe haven beyond the dollar, she said. The Apple news was a trigger because it reinforces fears about slower Chinese growth, but what we saw was just an enhanced version of a trend thats been in place over the past few weeks.

Vanguards Maack agrees.

The move higher in yen was likely real people wanting to get long yen, Maack said. Theres real flow behind that.

Short Squeeze

Also potentially adding to the fray was an unwind of the substantial short position against the yen. Hedge funds and other large speculators net bearish stance on the yen versus the greenback was close to its most extreme levels of 2018, according to the latest U.S. Commodity Futures Trading Commission data.

However, the partial U.S. government shutdown is complicating (Links to an external site.) that picture, given that the CFTC hasnt been able to release fresh figures since Dec. 21. Traders use the data to track speculators market biases, with a focus on whether their positions are extreme and ripe for a reversal.

Since the last update, longs have almost certainly been cut substantially, wrote Adam Cole, chief currency strategist at RBC Europe, in a note to clients. The size of the overnight USD/JPY move was more likely a function of unusually shallow markets, particularly with local Japanese investors still on holiday (until tomorrow).

- Identify three potential causes of the jump in the USD/JPY exchange rate, according to the above article. (3 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started