Answered step by step

Verified Expert Solution

Question

1 Approved Answer

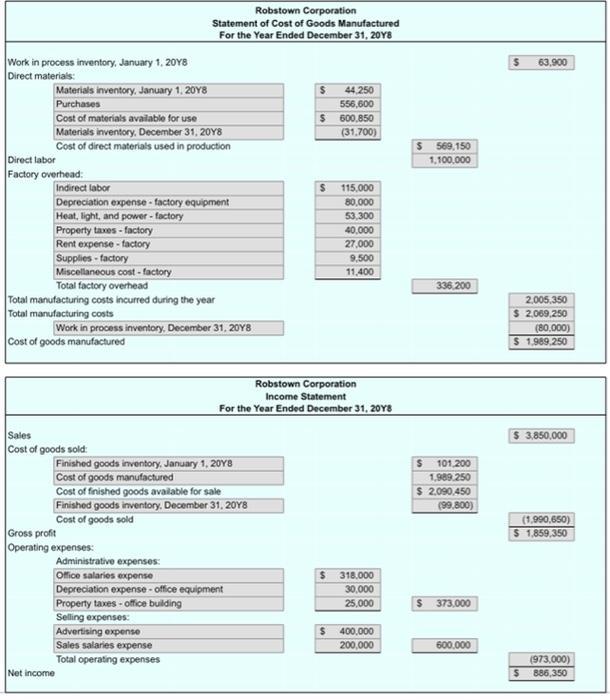

Robstown Corp. has an option to buy items for reselling at $1,500,000 (or manufacturing it in-house). Should Robstown buy (outsource) or make (continue manufacturing)? Discuss

- Robstown Corp. has an option to buy items for reselling at $1,500,000 (or manufacturing it in-house). Should Robstown buy (outsource) or make (continue manufacturing)? Discuss both qualitative and quantitative aspects of your decision-making.

- Analyze the income statement. Comment on Robstown Corp's financial health given this limited information. Consider calculating gross margin. Analyze the relationship between the cost of goods sold and operating expenses. (Perhaps, consider using the 'vertical analysis' that you learned from your financial accounting class). What information can you discern from this analysis?

Robstown Corporation Statement of Cost of Goods Manufactured For the Year Ended December 31, 20Y8 Work in process inventory, January 1. 20Y8 Direct materials: 63,900 Materials inventory, January 1, 20Y8 44,250 Purchases 556,600 Cost of materials available for use Materials inventory, December 31, 20Y8 Cost of direct materials used in production $ 600,850 (31,700) $ 569,150 Direct labor 1,100,000 Factory overhead: Indirect labor 115,000 Depreciation expense - factory equipment Heat, light, and power - factory Property taxes - factory Rent expense - factory 80,000 53,300 40,000 Supplies - factory Miscellaneous cost - factory 27,000 9,500 11,400 Total factory overhead 336,200 Total manufacturing costs incurred during the year Total manufacturing costs 2,005,350 $ 2.069,250 Work in process inventory. December 31, 20Y8 (80,000) Cost of goods manufactured $ 1.989,250 Robstown Corporation Income Statement For the Year Ended December 31, 20Y8 $ 3,850,000 Sales Cost of goods sold: 101.200 Finished goods inventory. January 1, 20Y8 Cost of goods manufactured Cost of finished goods available for sale Finishod goods inventory. December 31, 20Y8 Cost of goods sold 1,989.250 $ 2.090,450 (99,800) (1,990,650) Gross profit $ 1,859,350 Operating expenses: Administrative expenses: Ofice salaries expense 318,000 Depreciation expense - office equipment Property taxes - office building Selling expenses: Advertising expense Sales salaries expense Total operating expenses 30,000 25,000 $ 373,000 $ 400,000 200,000 600.000 (973,000) Net income 886,350

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

1 Outsourcing is a business practice in which services or job functions are farmed out to a third party The business case for outsourcing varies by situation but the benefits of outsourcing often incl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started