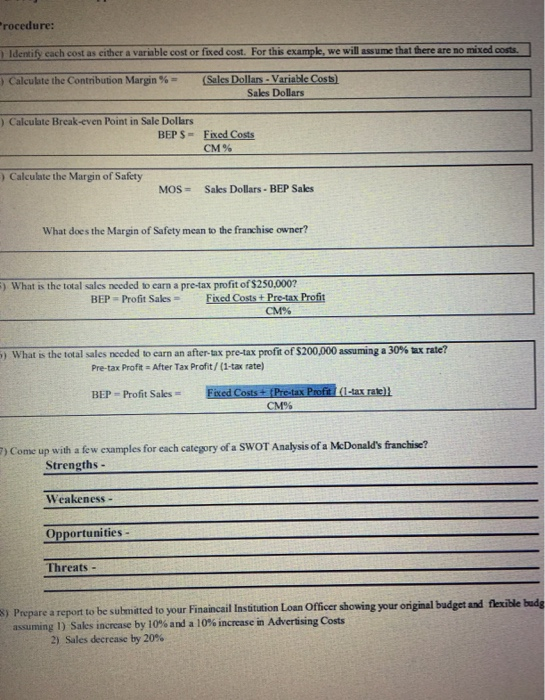

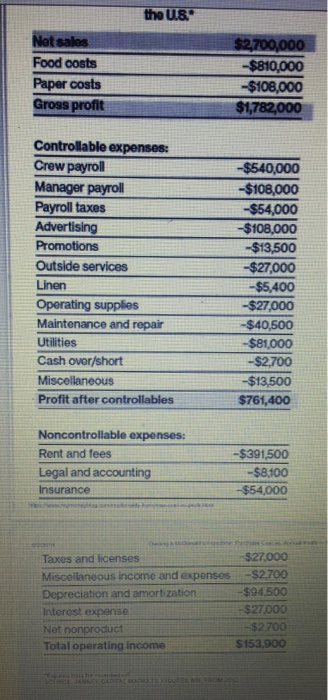

rocedure: Identify each cost as either a variable cost or fixed cost. For this example, we will assume that there are no mixed costs. Calculate the Contribution Margin %= (Sales Dollars - Variable Costs) Sales Dollars ) Calculate Break-even Point in Sale Dollars BEPS Fixed Costs CM% > Calculate the Margin of Safety MOS Sales Dollars - BEP Sales What does the Margin of Safety mean to the franchise owner? 5) What is the total sales needed to earn a pre-tax profit of $250,000? BEP-Profit Sales Fixed Costs + Pre-tax Profit CM% 5) What is the total sales needed to earn an after-tax pre-tax profit of $200,000 assuming a 30% tax rate? Pre-tax Profit - After Tax Profit/(1-tax rate) BEP-Profit Sales Fixed Costs + Pre-tax Profit (1-tax rate) CMS 7) Come up with a few examples for each category of a SWOT Analysis of a McDonald's franchise? Strengths - Weakeness - Opportunities - Threats - 3) Prepare a report to be submitted to your Finaincail Institution Loan Officer showing your original budget and flexible budg assuming 1) Sales increase by 10% and a 10% increase in Advertising Costs 2) Sales decrease by 20% the US. Net sales Food costs Paper costs Gross profit $2,700,000 -$810,000 -$108,000 $1,782,000 Controllable expenses: Crew payroll Manager payroll Payroll taxes Advertising Promotions Outside services Linen Operating supplies Maintenance and repair Utilities Cash over/short Miscellaneous Profit after controllables -$540,000 -$108,000 -$54,000 -$108,000 -$13,500 -$27,000 -$5,400 -$27,000 -$40,500 -$81,000 -$2,700 -$13,500 $761,400 Noncontrollable expenses: Rent and fees Legal and accounting Insurance -$391,500 -$8,100 $54,000 Taxes and licenses $27,000 Miscellaneous Income and expenses -$2.700 Depreciation and amortization -$94.500 Interest expense $27.000 Net nonproduct -$2.700 Total operating income $153.900 rocedure: Identify each cost as either a variable cost or fixed cost. For this example, we will assume that there are no mixed costs. Calculate the Contribution Margin %= (Sales Dollars - Variable Costs) Sales Dollars ) Calculate Break-even Point in Sale Dollars BEPS Fixed Costs CM% > Calculate the Margin of Safety MOS Sales Dollars - BEP Sales What does the Margin of Safety mean to the franchise owner? 5) What is the total sales needed to earn a pre-tax profit of $250,000? BEP-Profit Sales Fixed Costs + Pre-tax Profit CM% 5) What is the total sales needed to earn an after-tax pre-tax profit of $200,000 assuming a 30% tax rate? Pre-tax Profit - After Tax Profit/(1-tax rate) BEP-Profit Sales Fixed Costs + Pre-tax Profit (1-tax rate) CMS 7) Come up with a few examples for each category of a SWOT Analysis of a McDonald's franchise? Strengths - Weakeness - Opportunities - Threats - 3) Prepare a report to be submitted to your Finaincail Institution Loan Officer showing your original budget and flexible budg assuming 1) Sales increase by 10% and a 10% increase in Advertising Costs 2) Sales decrease by 20% the US. Net sales Food costs Paper costs Gross profit $2,700,000 -$810,000 -$108,000 $1,782,000 Controllable expenses: Crew payroll Manager payroll Payroll taxes Advertising Promotions Outside services Linen Operating supplies Maintenance and repair Utilities Cash over/short Miscellaneous Profit after controllables -$540,000 -$108,000 -$54,000 -$108,000 -$13,500 -$27,000 -$5,400 -$27,000 -$40,500 -$81,000 -$2,700 -$13,500 $761,400 Noncontrollable expenses: Rent and fees Legal and accounting Insurance -$391,500 -$8,100 $54,000 Taxes and licenses $27,000 Miscellaneous Income and expenses -$2.700 Depreciation and amortization -$94.500 Interest expense $27.000 Net nonproduct -$2.700 Total operating income $153.900