Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rock Canyon Enterprises has a five-year loan with a large bank. This loan includes a covenant requiring Rock Canyon Enterprises to have tangible net

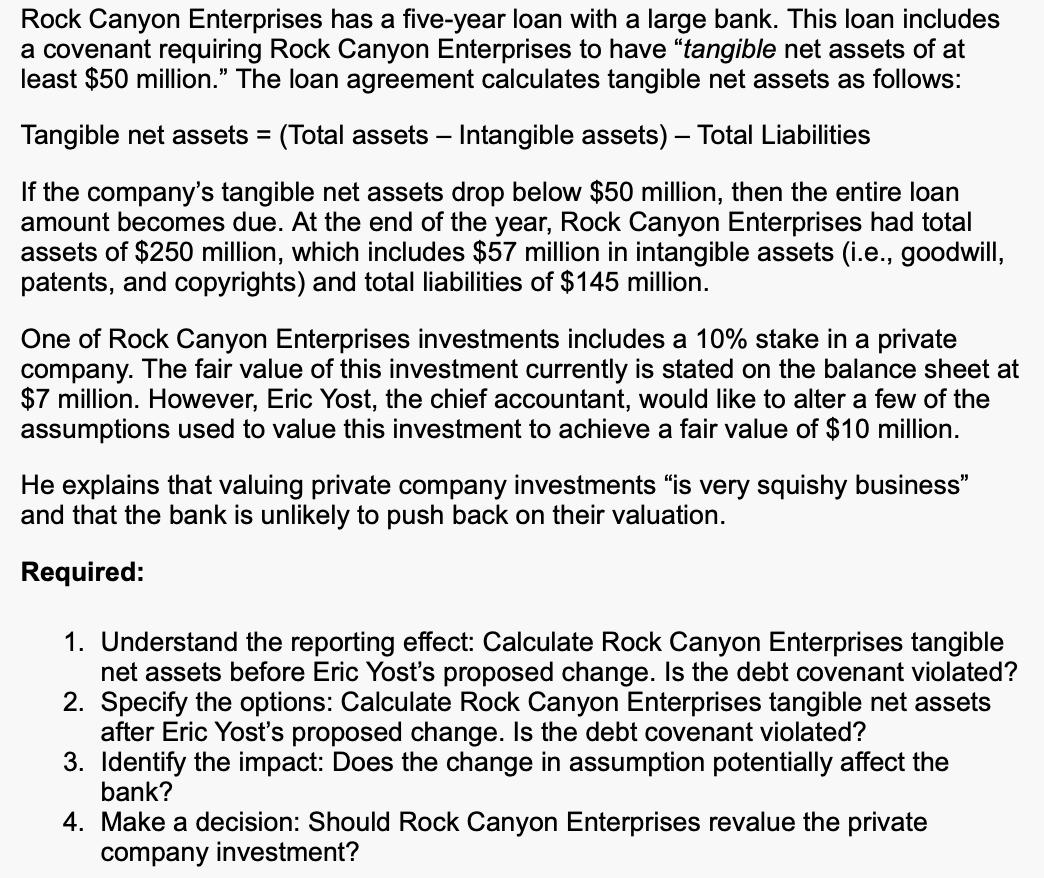

Rock Canyon Enterprises has a five-year loan with a large bank. This loan includes a covenant requiring Rock Canyon Enterprises to have "tangible net assets of at least $50 million." The loan agreement calculates tangible net assets as follows: Tangible net assets = (Total assets - Intangible assets) - Total Liabilities If the company's tangible net assets drop below $50 million, then the entire loan amount becomes due. At the end of the year, Rock Canyon Enterprises had total assets of $250 million, which includes $57 million in intangible assets (i.e., goodwill, patents, and copyrights) and total liabilities of $145 million. One of Rock Canyon Enterprises investments includes a 10% stake in a private company. The fair value of this investment currently is stated on the balance sheet at $7 million. However, Eric Yost, the chief accountant, would like to alter a few of the assumptions used to value this investment to achieve a fair value of $10 million. He explains that valuing private company investments "is very squishy business" and that the bank is unlikely to push back on their valuation. Required: 1. Understand the reporting effect: Calculate Rock Canyon Enterprises tangible net assets before Eric Yost's proposed change. Is the debt covenant violated? 2. Specify the options: Calculate Rock Canyon Enterprises tangible net assets after Eric Yost's proposed change. Is the debt covenant violated? 3. Identify the impact: Does the change in assumption potentially affect the bank? 4. Make a decision: Should Rock Canyon Enterprises revalue the private company investment?

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The question asks us to consider the financial implications of a change in valuation for an investment held by Rock Canyon Enterprises To address the required points well perform several calculations ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started