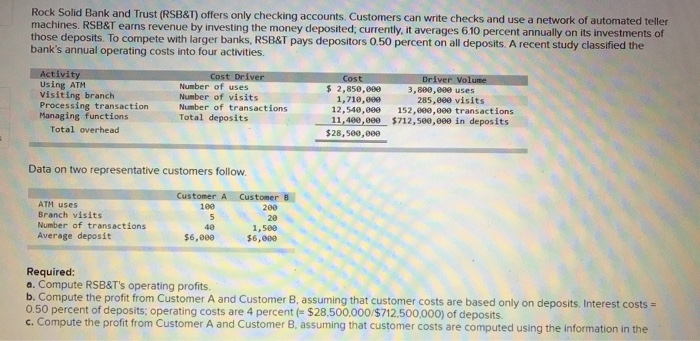

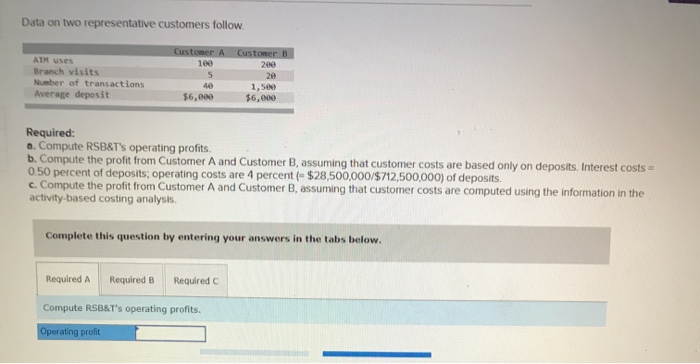

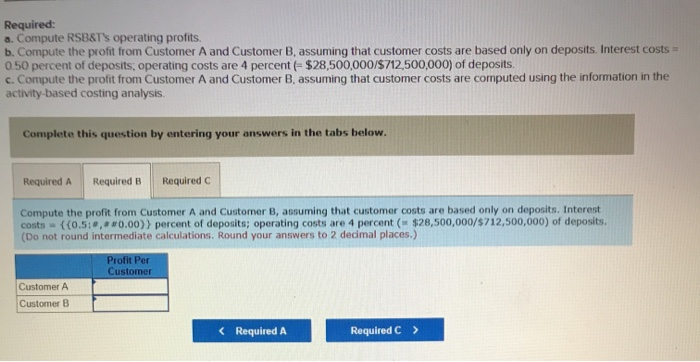

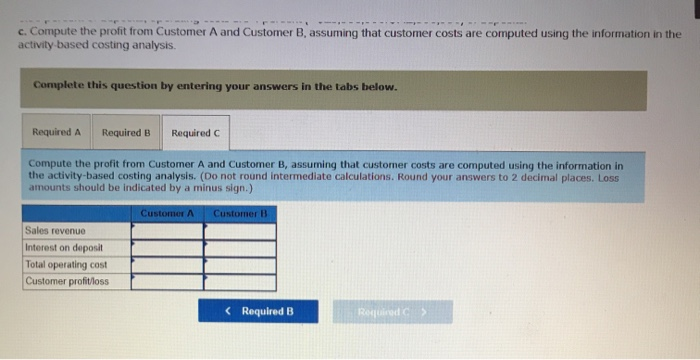

Rock Solid Bank and Trust (RSB&T) offers only checking accounts. Customers can write checks and use a network of automated teller machines. RSB&T earns revenue by investing the money deposited; currently, it averages 610 percent annually on its investments of those deposits. To compete with larger banks, RSB&T pays depositors 0.50 percent on all deposits. A recent study classified the bank's annual operating costs into four activities. Activity Using ATM Visiting branch Processing transaction Managing functions Total overhead Cost Driver Number of uses Number of visits Number of transactions Total deposits Cost Driver Volume $ 2,850,000 3,800,000 uses 1,710,000 285,000 visits 12,540,000 152,000,000 transactions 11,400,000 $712,500,000 in deposits $28,500,000 Data on two representative customers follow. ATM uses Branch visits Number of transactions Average deposit Customer A 180 5 40 $6,000 Customer B 200 20 1,500 $6,000 Required: a. Compute RSB&T's operating profits. b. Compute the profit from Customer A and Customer B, assuming that customer costs are based only on deposits. Interest costs = 0.50 percent of deposits; operating costs are 4 percent (= $28,500,000/$712,500,000) of deposits c. Compute the profit from Customer A and Customer B, assuming that customer costs are computed using the information in the Data on two representative customers follow ATM uses Branch visits Number of transactions Average deposit Customer A 100 5 40 $6,000 Customer B 200 29 1,500 $6,000 Required: a. Compute RSB&T's operating profits. b. Compute the profit from Customer A and Customer B, assuming that customer costs are based only on deposits. Interest costs - 0.50 percent of deposits, operating costs are 4 percent ($28,500,000/$712,500,000) of deposits c. Compute the profit from Customer A and Customer B, assuming that customer costs are computed using the information in the activity-based costing analysis, Complete this question by entering your answers in the tabs below. Required A Required B Required Compute RSB&T's operating profits. Operating profit Required: a. Compute RSB&T's operating profits. b. Compute the profit from Customer A and Customer B, assuming that customer costs are based only on deposits. Interest costs - 0.50 percent of deposits, operating costs are 4 percent = $28,500,000/$712,500,000) of deposits. c. Compute the profit from Customer A and Customer B, assuming that customer costs are computed using the information in the activity-based costing analysis. Complete this question by entering your answers in the tabs below. Required A Required B Required Compute the profit from Customer A and Customer B, assuming that customer costs are based only on deposits. Interest costs - ((0.5: * *0.00) percent of deposits; operating costs are 4 percent ($28,500,000/$712,500,000) of deposits. (Do not round Intermediate calculations. Round your answers to 2 decimal places.) Profit Per Customer Customer A Customer B c. Compute the profit from Customer A and Customer B, assuming that customer costs are computed using the information in the activity-based costing analysis Complete this question by entering your answers in the tabs below. Required A Required B Required Compute the profit from Customer A and Customer B, assuming that customer costs are computed using the information in the activity-based costing analysis. (Do not round intermediate calculations. Round your answers to 2 decimal places. Loss amounts should be indicated by a minus sign.) Customer A Customer B Sales revenu Interest on deposit Total operating cost Customer profit loss