Question

ROE and recapitalization At the beginning of the year you invest $30,000 of your own money plus $30,000 that you borrowed at 5% interest

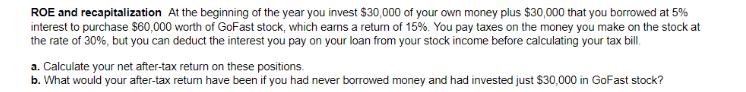

ROE and recapitalization At the beginning of the year you invest $30,000 of your own money plus $30,000 that you borrowed at 5% interest to purchase $60,000 worth of GoFast stock, which earns a return of 15%. You pay taxes on the money you make on the stock at the rate of 30%, but you can deduct the interest you pay on your loan from your stock income before calculating your tax bill a. Calculate your net after-tax return on these positions. b. What would your after-tax return have been if you had never borrowed money and had invested just $30,000 in GoFast stock?

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below a Income statement Amount ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Entrepreneurial Finance

Authors: Philip J. Adelman; Alan M. Marks

6th edition

9780133099096, 133140512, 133099091, 978-0133140514

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App