Answered step by step

Verified Expert Solution

Question

1 Approved Answer

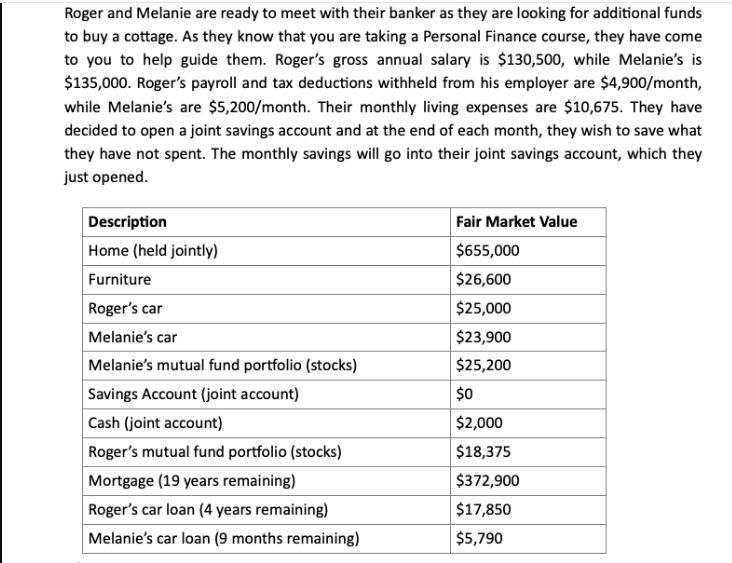

Roger and Melanie are ready to meet with their banker as they are looking for additional funds to buy a cottage. As they know

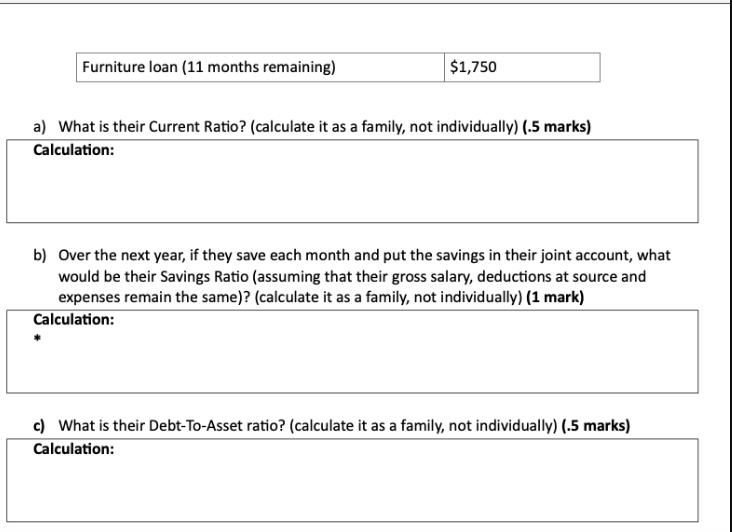

Roger and Melanie are ready to meet with their banker as they are looking for additional funds to buy a cottage. As they know that you are taking a Personal Finance course, they have come to you to help guide them. Roger's gross annual salary is $130,500, while Melanie's is $135,000. Roger's payroll and tax deductions withheld from his employer are $4,900/month, while Melanie's are $5,200/month. Their monthly living expenses are $10,675. They have decided to open a joint savings account and at the end of each month, they wish to save what they have not spent. The monthly savings will go into their joint savings account, which they just opened. Description Home (held jointly) Furniture Roger's car Melanie's car Melanie's mutual fund portfolio (stocks) Savings Account (joint account) Cash (joint account) Roger's mutual fund portfolio (stocks) Mortgage (19 years remaining) Roger's car loan (4 years remaining) Melanie's car loan (9 months remaining) Fair Market Value $655,000 $26,600 $25,000 $23,900 $25,200 $0 $2,000 $18,375 $372,900 $17,850 $5,790 Furniture loan (11 months remaining) $1,750 a) What is their Current Ratio? (calculate it as a family, not individually) (.5 marks) Calculation: b) Over the next year, if they save each month and put the savings in their joint account, what would be their Savings Ratio (assuming that their gross salary, deductions at source and expenses remain the same)? (calculate it as a family, not individually) (1 mark) Calculation: c) What is their Debt-To-Asset ratio? (calculate it as a family, not individually) (.5 marks) Calculation:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Calculations for Roger and Melanies Finances a Current Ratio Step 1 Calculate Total Current Assets C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started