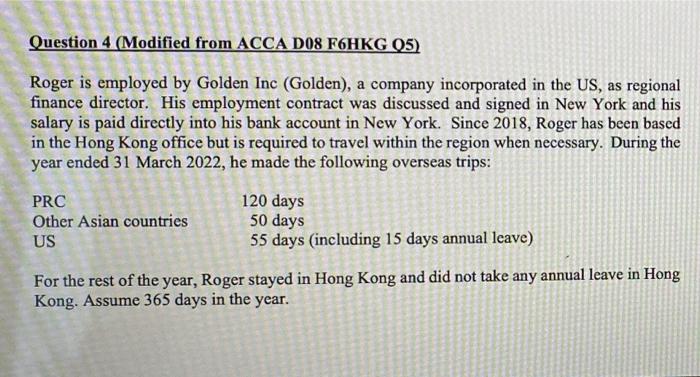

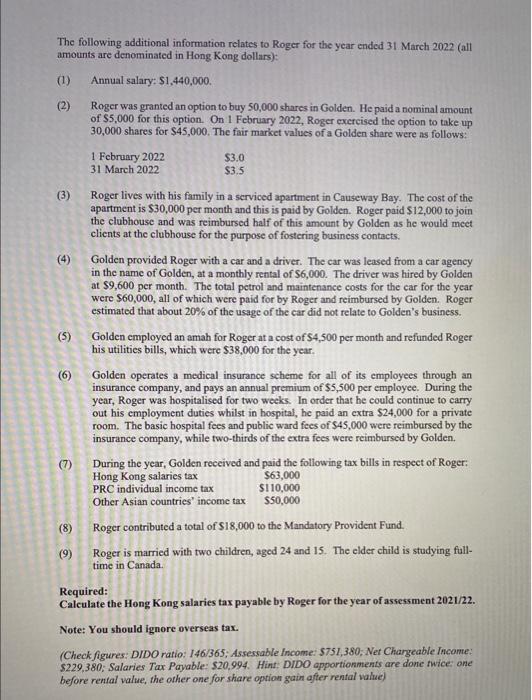

Roger is employed by Golden Inc (Golden), a company incorporated in the US, as regional finance director. His employment contract was discussed and signed in New York and his salary is paid directly into his bank account in New York. Since 2018, Roger has been based in the Hong Kong office but is required to travel within the region when necessary. During the year ended 31 March 2022, he made the following overseas trips: For the rest of the year, Roger stayed in Hong Kong and did not take any annual leave in Hong Kong. Assume 365 days in the year. The following additional information relates to Roger for the year ended 31 March 2022 (all amounts are denominated in Hong Kong dollars): (1) Annual salary: $1,440,000. (2) Roger was granted an option to buy 50,000 shares in Golden. He paid a nominal amount of $5,000 for this option. On 1 February 2022, Roger excreised the option to take up 30,000 shares for $45,000. The fair market values of a Golden share were ns follows: apartment is $30,000 per month and this is paid by Golden. Roger paid $12,000 to join the clubhouse and was reimbursed half of this amount by Golden as he would meet clients at the clubhouse for the purpose of fostering business contacts. (4) Golden provided Roger with a car and a driver. The car was leased from a car agency in the name of Golden, at a monthly rental of $6,000. The driver was hired by Golden at $9,600 per month. The total petrol and maintenance costs for the car for the year were $60,000, all of which were paid for by Roger and reimbursed by Golden. Roger estimated that about 20% of the usage of the car did not relate to Golden's business. (5) Golden employed an amah for Roger at a cost of $4,500 per month and refunded Roger his utilities bills, which were $38,000 for the year. (6) Golden operates a medical insurance scheme for all of its employees through an insurance company, and pays an annual premium of $5,500 per employee. During the year, Roger was hospitalised for two weeks. In order that he could continue to carry out his cmployment duties whilst in hospital, he paid an extra $24,000 for a private room. The basic hospital fees and public ward fees of $45,000 were reimbursed by the insurance company, while two-thirds of the extra fees were reimbursed by Golden. (7) During the year, Golden received and paid the following tax bills in respect of Roger: HongKongsalariestaxPRCindividualincometaxOtherAsiancountriesincometax$63,000$110,000$50,000 (8) Roger contributed a total of $18,000 to the Mandatory Provident Fund. (9) Roger is married with two children, aged 24 and 15. The elder child is studying fulltime in Canada. Required: Calculate the Hong Kong salaries tax payable by Roger for the year of assessment 2021/22. Note: You should ignore overseas tax. (Check figures: DIDO ratio: 146/365; Assessable income: 5751,380 ; Net Chargeable Income: \$229,380; Salaries Tax Payable: \$20,994. Hint: DIDO apportionments are done twice: one before rental value, the other one for share option gain after rental value) Roger is employed by Golden Inc (Golden), a company incorporated in the US, as regional finance director. His employment contract was discussed and signed in New York and his salary is paid directly into his bank account in New York. Since 2018, Roger has been based in the Hong Kong office but is required to travel within the region when necessary. During the year ended 31 March 2022, he made the following overseas trips: For the rest of the year, Roger stayed in Hong Kong and did not take any annual leave in Hong Kong. Assume 365 days in the year. The following additional information relates to Roger for the year ended 31 March 2022 (all amounts are denominated in Hong Kong dollars): (1) Annual salary: $1,440,000. (2) Roger was granted an option to buy 50,000 shares in Golden. He paid a nominal amount of $5,000 for this option. On 1 February 2022, Roger excreised the option to take up 30,000 shares for $45,000. The fair market values of a Golden share were ns follows: apartment is $30,000 per month and this is paid by Golden. Roger paid $12,000 to join the clubhouse and was reimbursed half of this amount by Golden as he would meet clients at the clubhouse for the purpose of fostering business contacts. (4) Golden provided Roger with a car and a driver. The car was leased from a car agency in the name of Golden, at a monthly rental of $6,000. The driver was hired by Golden at $9,600 per month. The total petrol and maintenance costs for the car for the year were $60,000, all of which were paid for by Roger and reimbursed by Golden. Roger estimated that about 20% of the usage of the car did not relate to Golden's business. (5) Golden employed an amah for Roger at a cost of $4,500 per month and refunded Roger his utilities bills, which were $38,000 for the year. (6) Golden operates a medical insurance scheme for all of its employees through an insurance company, and pays an annual premium of $5,500 per employee. During the year, Roger was hospitalised for two weeks. In order that he could continue to carry out his cmployment duties whilst in hospital, he paid an extra $24,000 for a private room. The basic hospital fees and public ward fees of $45,000 were reimbursed by the insurance company, while two-thirds of the extra fees were reimbursed by Golden. (7) During the year, Golden received and paid the following tax bills in respect of Roger: HongKongsalariestaxPRCindividualincometaxOtherAsiancountriesincometax$63,000$110,000$50,000 (8) Roger contributed a total of $18,000 to the Mandatory Provident Fund. (9) Roger is married with two children, aged 24 and 15. The elder child is studying fulltime in Canada. Required: Calculate the Hong Kong salaries tax payable by Roger for the year of assessment 2021/22. Note: You should ignore overseas tax. (Check figures: DIDO ratio: 146/365; Assessable income: 5751,380 ; Net Chargeable Income: \$229,380; Salaries Tax Payable: \$20,994. Hint: DIDO apportionments are done twice: one before rental value, the other one for share option gain after rental value)