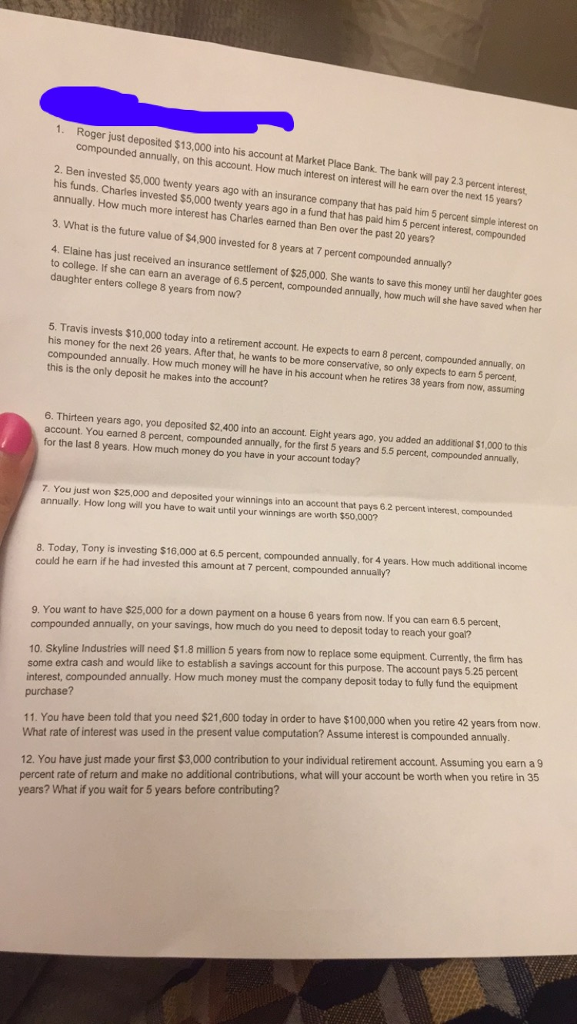

Roger just deposited $13,000 into his account at Market Place Bank. The bank will pay 2.3 percent interest. compounded annually, on this account. How much interest on interest will he earn over the next 15 years? Ben invested $5,000 twenty years ago with an insurance company that has paid him 5 percent simple interest on his funds annually. Charles invested $5,000 twenty years ago in a fund that has paid him 5 percent interest, compounded annually. How much more interest has Charles earned than Ben over the past 20 years? What is the future value of $4, 900 invested for 8 years at 7 percent compounded annually? Elaine has just received an insurance settlement of $25,000. She wants to save this money until her daughter goes to college. If she can earn an average of 6.5 percent, compounded annually, how much will she have saved when her daughter enters college 8 years from now? Travis invests $10,000 today into a retirement account. He expects to earn 8 percent, compounded annually, on his money for the next 26 years. After that, he wants to be more conservative, so only expects to earn 5 percent, compounded annually. How much money will he have in his account when he retires 38 years from now, assuming this is the only deposit he makes into the account? Thirteen years ago, you deposited $2.400 into an account. Eight years ago, you added an additional $1,000 to his account. You earned 8 percent, compounded annually, for the first 5 years and 5.5 percent, Compounds annually, for the last 8 years. How much money do you have in your account today? You just won $25,000 and deposited your winnings into an account that pays 6.2 percent interest, compounded annually. How long will you have to wait until your winnings are worth $50,000? Today, Tony is investing $16,000 at 6.5 percent, compounded annually, for 4 years. How much additional income could he earn if he had invested this amount at 7 percent, compounded annually? You want to have $25,000 for a down payment on a house 6 years from now. If you can earn 6.5 percent compounded annually, on your savings, how much do you need to deposit today to reach your goal? Skyline Industries will need $1.8 million 5 years from now to replace some equipment. Currently, the firm has some extra cash and would like to establish a savings account for this purpose. The account pays 5.25 percent interest, compounded annually. How much money must the company deposit today to fully fund the equipment purchase? You have been told that you need $21, 600 today in order to have $100,000 when you retire 42 years from now What rate of interest was used in the present value computation? Assume interest is compounded annually. You have just made your first $3,000 contribution to your individual retirement account. Assuming you earn a 9 percent rate of return and make no additional contributions, what will your account be worth when you retire in 35 years? What if you wait for 5 years before contributing