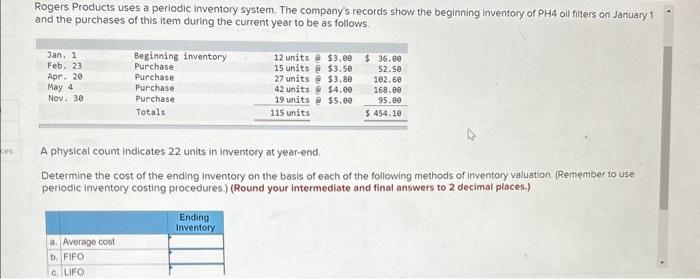

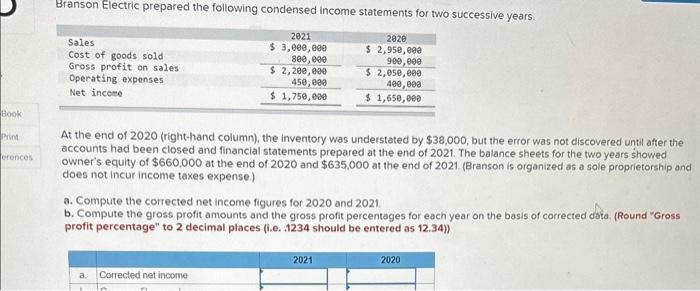

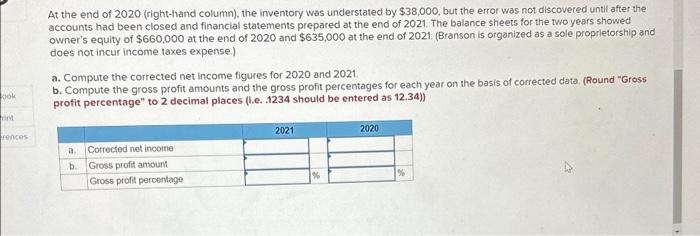

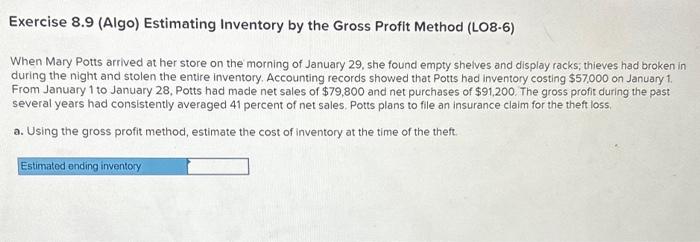

Rogers Products uses a periodic inventory system. The company's records show the beginning inventory of PH4 oil filters on January 1 and the purchases of this item during the current year to be as follows. A physical count indicates 22 units in inventory at year-end. Determine the cost of the ending inventory on the basis of each of the following methods of inventory valuation. (Remember to use periodic inventory costing procedures) (Round your intermediate and final answers to 2 decimal places.) At the end of 2020 (right-hand column), the inventory was understated by $38,000, but the error was not discovered until after the accounts had been closed and financial statements prepared at the end of 2021 . The balance sheets for the two years showed owner's equity of $660,000 at the end of 2020 and $635,000 at the end of 2021 . (Bransan is organized as a sole proprietorship and does not incur income taxes expense.) a. Compute the corrected net income figures for 2020 and 2021 b. Compute the gross profit amounts and the gross profit percentages for each year on the basis of corrected data. (Round "Gross profit percentage" to 2 decimal places (i.e. 1234 should be entered as 12.34)) At the end of 2020 (right-hand column), the inventory was understated by $38,000, but the error was not discovered until after the accounts had been closed and financial statements prepared at the end of 2021 . The balance sheets for the two years showed owner's equity of $660,000 at the end of 2020 and $635,000 at the end of 2021 . (Branson is organized as a sole proprletorship and does not incur income taxes expense.) a. Compute the corrected net income figures for 2020 and 2021 . b. Compute the gross profit amounts and the gross profit percentages for each year on the basis of corrected data. (Round "Gross profit percentage" to 2 decimal places (i.e. 1234 should be entered as 12.34)) Exercise 8.9 (Algo) Estimating Inventory by the Gross Profit Method (LO8-6) When Mary Potts arrived at her store on the morning of January 29 , she found empty shelves and display racks, thieves had broken in during the night and stolen the entire inventory. Accounting records showed that Potts had inventory costing $57,000 on January 1 . From January 1 to January 28, Potts had made net sales of $79,800 and net purchases of $91,200. The gross profit during the past several years had consistently averaged 41 percent of net sales. Potts plans to file an insurance claim for the theft loss. a. Using the gross profit method, estimate the cost of inventory at the time of the theft