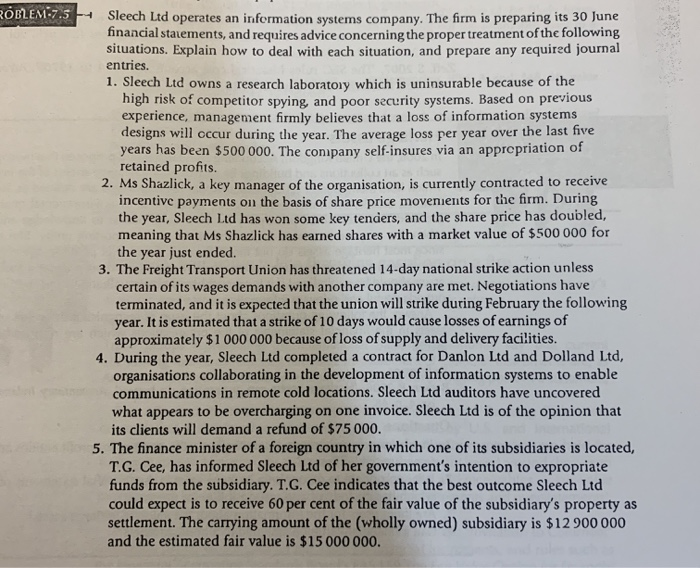

ROLEM7.5 Sleech Ltd operates an information systems company. The firm is preparing its 30 June financial stauements, and requires advice concerning the proper treatment of the following situations. Explain how to deal with each situation, and prepare any required journal entries 1. Sleech Ltd owns a research laboratory which is uninsurable because of the high risk of competitor spying, and poor security systems. Based on previous experience, management firmly believes that a loss of information systems designs will cccur during the year. The average loss per year over the last five years has been $500 000. The conpany self-insures via an apprepriation of retained profits. 2. Ms Shazlick, a key manager of the organisation, is currently contracted to receive incentive payments on the basis of share price movenients for the firm. During the year, Sleech Ltd has won some key tenders, and the share price has doubled, meaning that Ms Shazlick has earned shares with a market value of $500 000 for the year just ended. 3. The Freight Transport Union has threatened 14-day national strike action unless certain of its wages demands with another company are met. Negotiations have terminated, and it is expected that the union will strike during February the following year. It is estimated that a strike of 10 days would cause losses of earnings of approximately $1 000 000 because of loss of supply and delivery faci!ities. 4. During the year, Sleech Ltd completed a contract for Danlon Ltd and Dolland Ltd, organisations collaborating in the development of information systems to enable communications in remote cold locations. Sleech Ltd auditors have uncovered what appears to be overcharging on one invoice. Sleech Ltd is of the opinion that its clients will demand a refund of $75 000. 5. The finance minister of a foreign country in which one of its subsidiaries is located, T.G. Cee, has informed Sleech Ltd of her government's intention to expropriate funds from the subsidiary. T.G. Cee indicates that the best outcome Sleech Ltd could expect is to receive 60 per cent of the fair value of the subsidiary's property as settlement. The carrying amount of the (wholly owned) subsidiary is $12 900 000 and the estimated fair value is $15 000 000. ROLEM7.5 Sleech Ltd operates an information systems company. The firm is preparing its 30 June financial stauements, and requires advice concerning the proper treatment of the following situations. Explain how to deal with each situation, and prepare any required journal entries 1. Sleech Ltd owns a research laboratory which is uninsurable because of the high risk of competitor spying, and poor security systems. Based on previous experience, management firmly believes that a loss of information systems designs will cccur during the year. The average loss per year over the last five years has been $500 000. The conpany self-insures via an apprepriation of retained profits. 2. Ms Shazlick, a key manager of the organisation, is currently contracted to receive incentive payments on the basis of share price movenients for the firm. During the year, Sleech Ltd has won some key tenders, and the share price has doubled, meaning that Ms Shazlick has earned shares with a market value of $500 000 for the year just ended. 3. The Freight Transport Union has threatened 14-day national strike action unless certain of its wages demands with another company are met. Negotiations have terminated, and it is expected that the union will strike during February the following year. It is estimated that a strike of 10 days would cause losses of earnings of approximately $1 000 000 because of loss of supply and delivery faci!ities. 4. During the year, Sleech Ltd completed a contract for Danlon Ltd and Dolland Ltd, organisations collaborating in the development of information systems to enable communications in remote cold locations. Sleech Ltd auditors have uncovered what appears to be overcharging on one invoice. Sleech Ltd is of the opinion that its clients will demand a refund of $75 000. 5. The finance minister of a foreign country in which one of its subsidiaries is located, T.G. Cee, has informed Sleech Ltd of her government's intention to expropriate funds from the subsidiary. T.G. Cee indicates that the best outcome Sleech Ltd could expect is to receive 60 per cent of the fair value of the subsidiary's property as settlement. The carrying amount of the (wholly owned) subsidiary is $12 900 000 and the estimated fair value is $15 000 000