Question

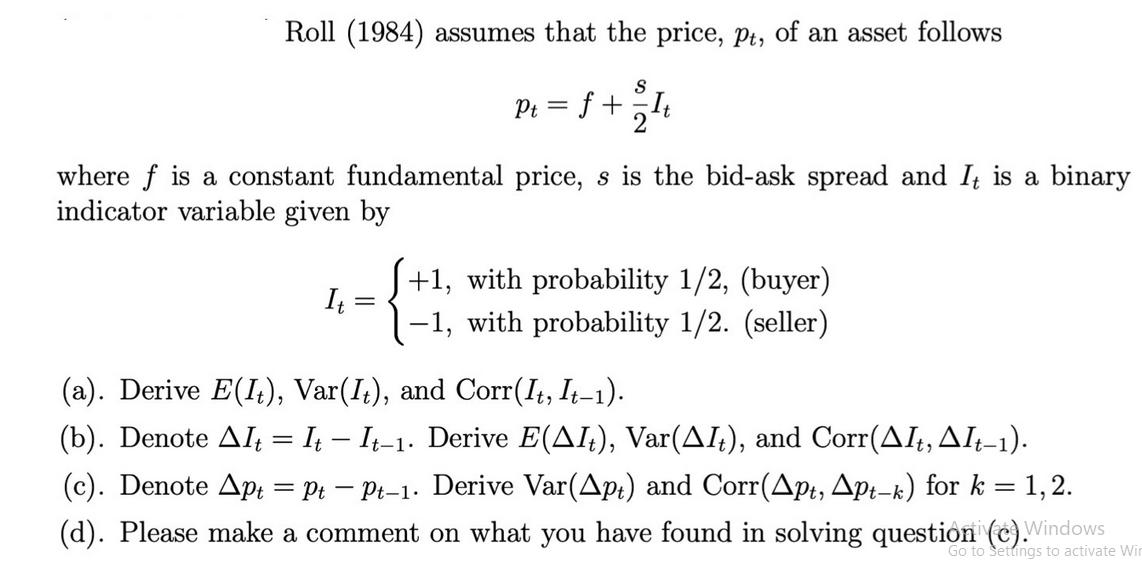

Roll (1984) assumes that the price, pt, of an asset follows where f is a constant fundamental price, s is the bid-ask spread and

Roll (1984) assumes that the price, pt, of an asset follows where f is a constant fundamental price, s is the bid-ask spread and It is a binary indicator variable given by It S Pt = f + It = +1, with probability 1/2, (buyer) -1, with probability 1/2. (seller) (a). Derive E(It), Var(It), and Corr(It, It-1). (b). Denote Alt = It It-1. Derive E(AI), Var(AIt), and Corr(Alt, Alt1). (c). Denote Apt = Pt - Pt-1. Derive Var (Apt) and Corr(Apt, Apt-k) for k = 1,2. (d). Please make a comment on what you have found in solving question (c). Windows Go to Settings to activate Wir

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To solve the given questions lets go step by step a Deriving EIt VarIt and CorrIt It1 We are given t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Optimization Models

Authors: Giuseppe C. Calafiore, Laurent El Ghaoui

1st Edition

1107050871, 9781107050877

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App