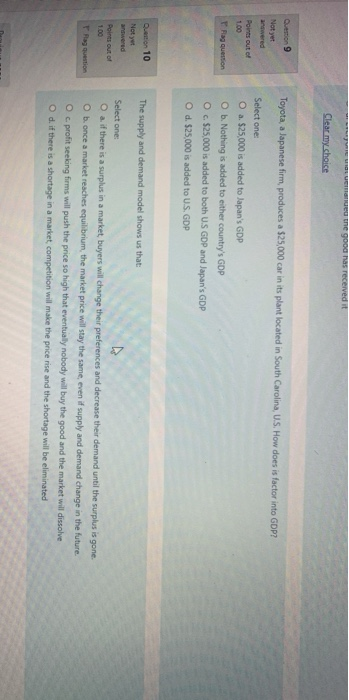

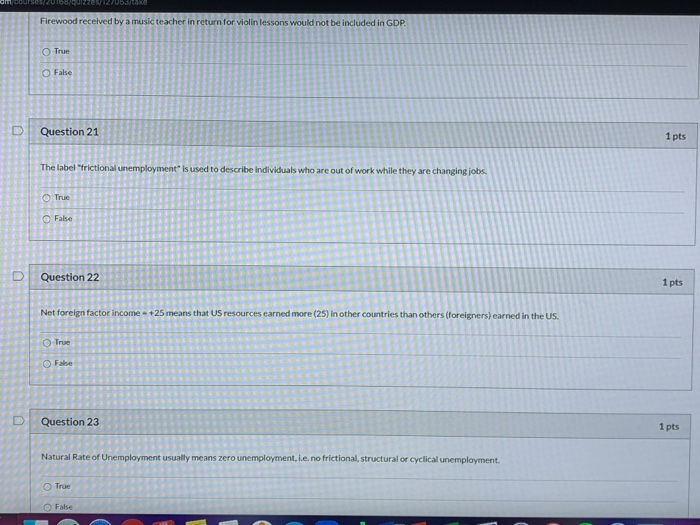

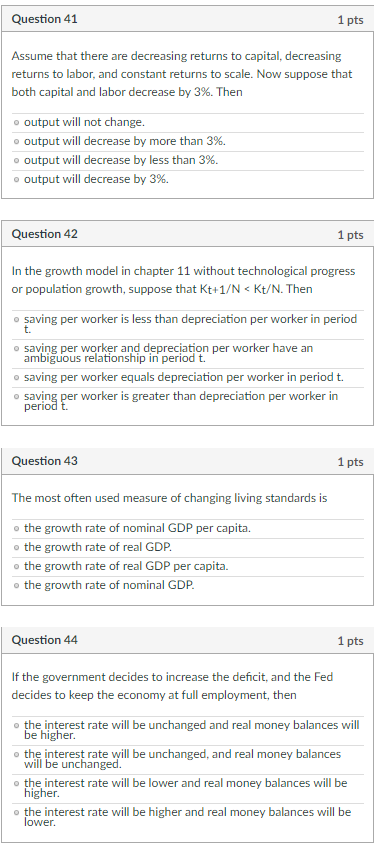

Question

Ron and Janice Mawson are now both 55 years old but Ron was disabled for eight years which resulted in excess medical costs so they

"Ron and Janice Mawson are now both 55 years old but Ron was disabled for eight years which resulted in excess medical costs so they had to refinance the house. The current mortgage is $150,000 and the house has a market value of $800,000. They also have two children aged 12 and 14 and they continue to work in their current positions.

They currently have no liabilities other than the mortgage and they continue to invest in their RRSPs on a monthly basis. Ron has grown his RRSP to $300,000 and Janice has $350,000 in her RRSP. They each contribute $800 per month to these plans and will continue to do so until their planned retirement at age 65. These registered plans are currently invested 30% income and 70% equity."

And these are the questions:

Assuming 6% annual compound growth, what will the value of Ron and Janice's RRSPs be at age 65? Show these amounts separately for both Ron and Janice. (4 Marks)

If they leave their asset allocation the same and continue to earn 6% per year what income could they each pay themselves from these plans at age 65 without encroaching on capital? Assume a 5% withdrawal rate. (4 Marks)

If they convert their RRSPs to a RRIF what is the minimum payment required based on their age 65? What is the minimum if they wait to withdraw the funds at age 72? (2 Marks)

I've answered the first question:

1.With RRSPs accounts containing $300,000.00 and $350,000 respectively, at 55 years of age, plus their monthly investment of $800.00 each, at 6% compounded annually, Ron and Janice's investments will be worth $667,233.06 and $756,775.45 after 10 years (at age 65). Ron will have total interest earned of $271,233.06 and Janice, $310,775.45.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started