Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ronald Blimp is a billionaire from the country of Bulimia. In the last 50 years he has paid taxes only once. In Bulimia, the

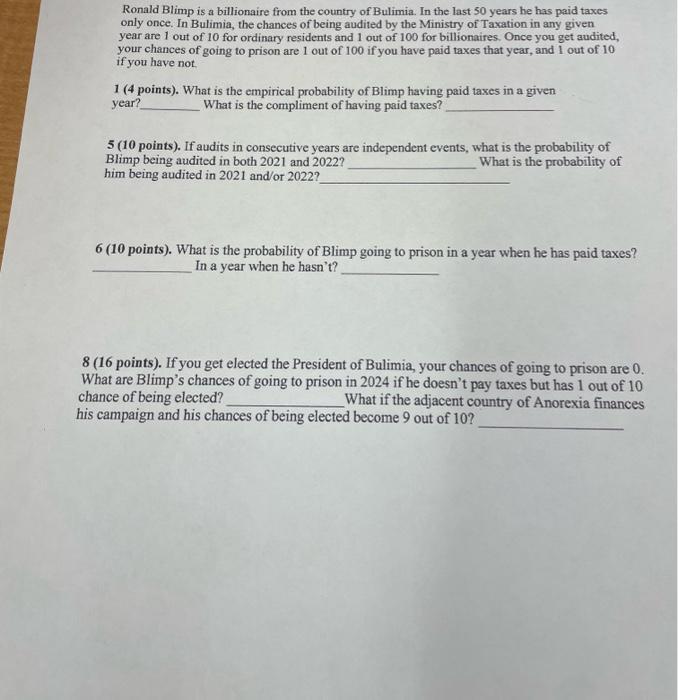

Ronald Blimp is a billionaire from the country of Bulimia. In the last 50 years he has paid taxes only once. In Bulimia, the chances of being audited by the Ministry of Taxation in any given year are 1 out of 10 for ordinary residents and 1 out of 100 for billionaires. Once you get audited, your chances of going to prison are 1 out of 100 if you have paid taxes that year, and I out of 10 if you have not. 1 (4 points). What is the empirical probability of Blimp having paid taxes in a given year? What is the compliment of having paid taxes? 5 (10 points). If audits in consecutive years are independent events, what is the probability of Blimp being audited in both 2021 and 2022? What is the probability of him being audited in 2021 and/or 20227 6 (10 points). What is the probability of Blimp going to prison in a year when he has paid taxes? In a year when he hasn't? 8 (16 points). If you get elected the President of Bulimia, your chances of going to prison are 0. What are Blimp's chances of going to prison in 2024 if he doesn't pay taxes but has 1 out of 10 chance of being elected? What if the adjacent country of Anorexia finances his campaign and his chances of being elected become 9 out of 10?

Step by Step Solution

★★★★★

3.31 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

1The empirical probability of Blimp having paid taxes in a given year can be calculated by considering the chances of being audited and going to prison based on whether he has paid taxes or not Lets d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started