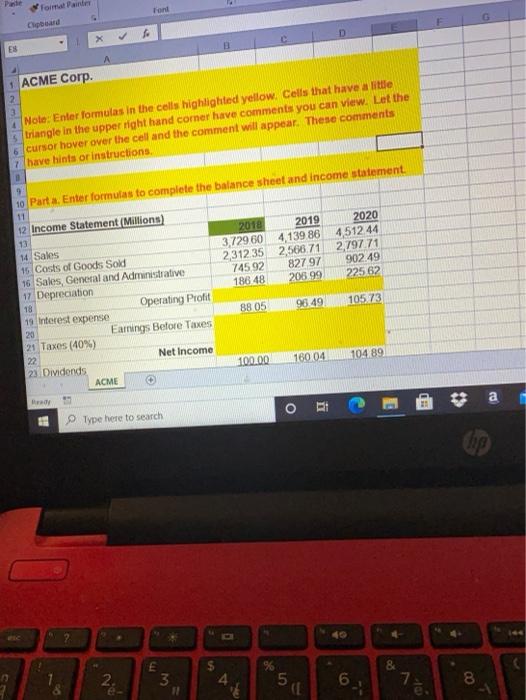

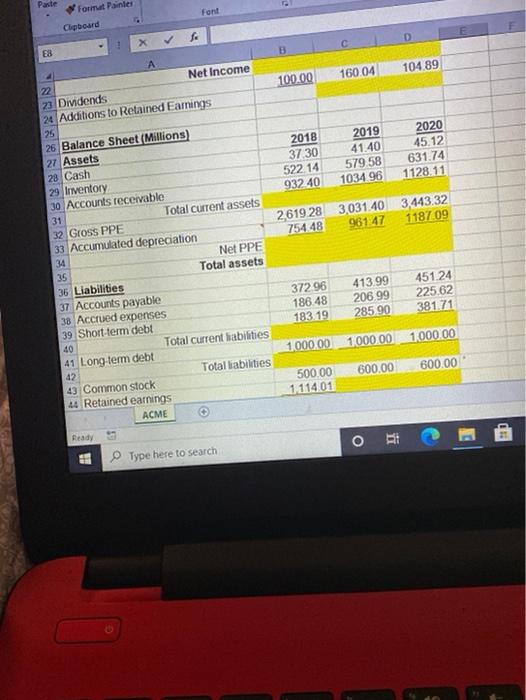

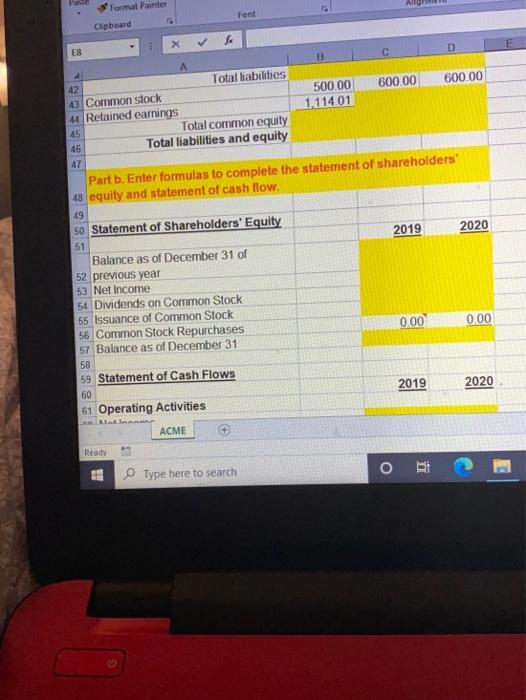

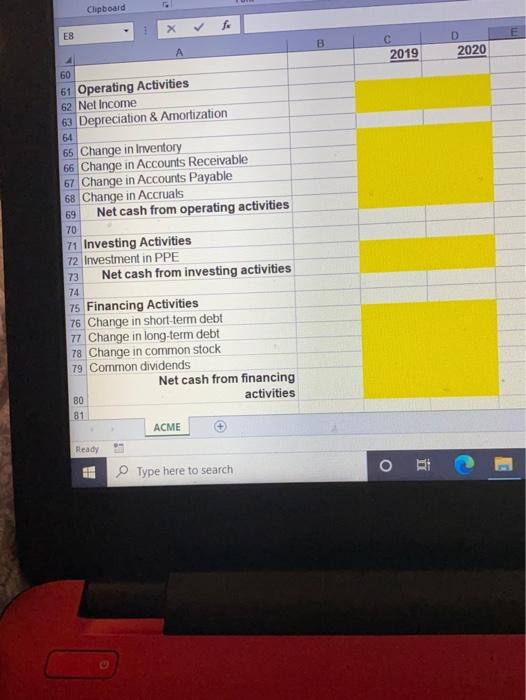

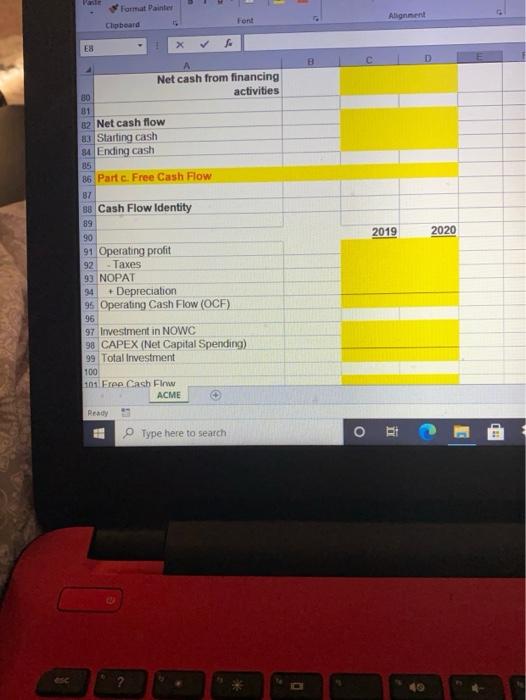

rond Format Paint Coward X ES A 1 ACME Corp. 2 Note: Enter formulas in the cells highlighted yellow. Cells that have a little s triangle in the upper right hand corner have comments you can view. Let the 6 cursor hover over the cell and the comment will appear. These comments 7/ have hints or instructions, 9 10 Parta. Enter formulas to complete the balance sheet and income statement 11 12 Income Statement (Millions 2018 2019 2020 14 Sales 3,729 60 4,139 86 4512 44 15 Costs of Goods Sold 231235 2,566.71 2,797.71 16 Sales General and Administrative 745 92 827 97 902 49 17 Depreciation 188 48 205 99 225 62 18 Operating Profit 19 Interest expense 88 05 98.49 105 73 20 Earnings Before Taxes 21 Taxes (40%) 22 Net Income 23. Dividends 100.00 180 04 104 89 ACME By Type here to search a RI 40 % 2. 3 5 6 7 8 (L 8 Paste Font Format Painter Clipboard D X E8 B 10489 100.00 160.04 2018 3730 522 14 93240 2019 41.40 579 58 1034 96 2020 45.12 631.74 1128.11 2619 28 754 48 3,031.40 3.443.32 961:47 1187 09 Net Income 22 23 Dividends 24 Additions to Retained Earnings 25 26 Balance Sheet (Millions) 27 Assets 28 Cash 29 Driventory 30 Accounts receivable 31 Total current assets 32 Gross PPE 33 Accumulated depreciation 34 Net PPE 35 Total assets 36 Liabilities 37 Accounts payable 38 Accrued expenses 39 Short term debt 40 Total current liabilities 41 Long-tem debt 42 Total liabilities 43 Common stock 44 Retained earnings ACME 372 96 186.48 183 19 413.99 206.99 285.90 451.24 225.62 381.71 1.000.00 1000.00 1000 00 600.00 600.00 500.00 1114 01 du Ready e Type here to search Format Painter Clipboard Font E EB A Total liabilities 42 600 00 500.00 600.00 43 Common stock 44 Retained earnings 1.114.01 45 Total common equity 46 Total liabilities and equity 47 Part b. Enter formulas to complete the statement of shareholders 48 equity and statement of cash flow. 49 50 Statement of Shareholders' Equity 51 2019 2020 Balance as of December 31 of 52 previous year 53 Net Income 54 Dividends on Common Stock 55 Issuance of Common Stock 56 Common Stock Repurchases 0.00 0.00 57 Balance as of December 31 58 59 Statement of Cash Flows 60 2019 2020 61 Operating Activities ACME Ready Type here to search o 2 Clipboard ES 2019 D 2020 60 61 Operating Activities 62 Net Income 63 Depreciation & Amortization 64 69 70 65 Change in Inventory 66 Change in Accounts Receivable 67 Change in Accounts Payable 68 Change in Accruals Net cash from operating activities 71 Investing Activities 72 Investment in PPE Net cash from investing activities 75 Financing Activities 76 Change in short-term debt 77 Change in long-term debt 78 Change in common stock 79 Common dividends Net cash from financing activities 73 74 80 81 ACME Ready Type here to search o Format Painter Font Alignment Chipboard ES D Net cash from financing 80 activities 31 82 Net cash flow 8 Starting cash 84 Ending cash 15 86 Partc. Free Cash Flow 2019 2020 87 38 Cash Flow Identity 89 90 91 Operating profit 92 - Taxes 93 NOPAT 34 Depreciation 95 Operating Cash Flow (OCF) 96 97 Investment in NOWC 98 CAPEX (Net Capital Spending) 99 Total Investment 100 101 Free Cash Flow ACME Ready Type here to search o