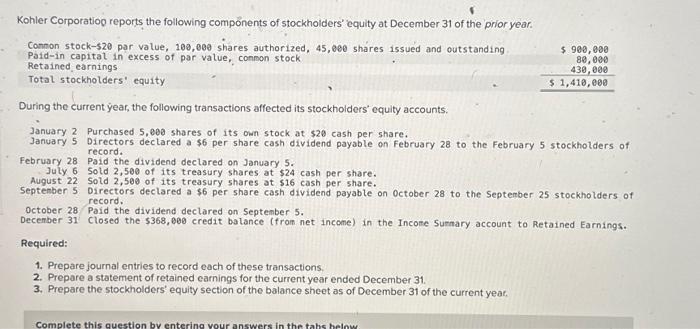

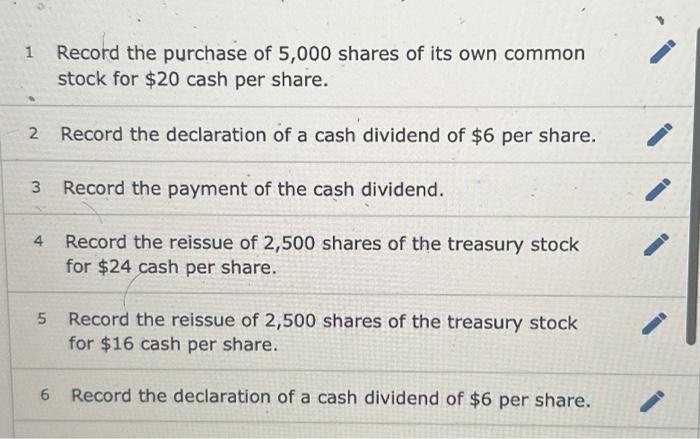

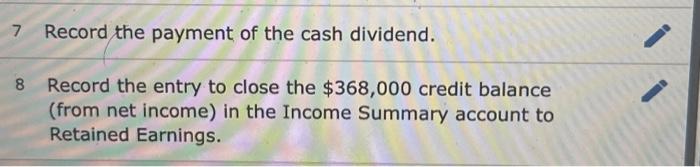

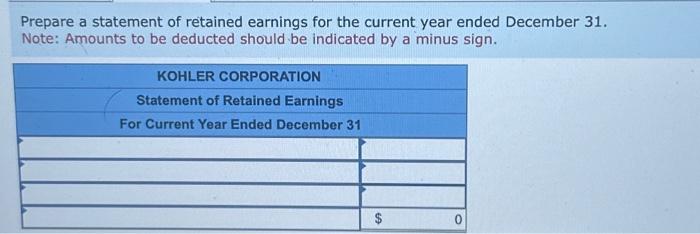

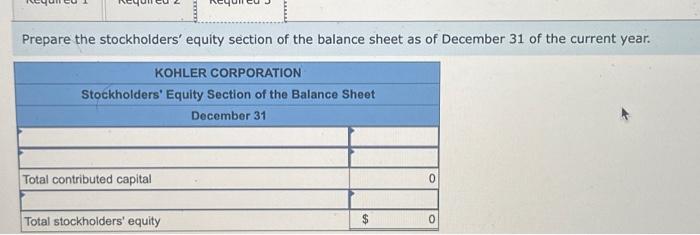

Ronier Corporatiog reports the following components of stockholders' equity at December 31 of the prior year. Connon stock-520 par value, 100,000 shares authorized, 45,000 shares issued and outstanding Paid-in capital in excess of par value, conmon stock Retained earnings Total stockholders' equity $900,000 80,000 439,000 $1,410,000 During the current year, the following transactions affected its stockholders' equity accounts. January 2 Purchased 5 , 000 shares of its own stock at $20 cash per share. January 5 Directors dectared a $6 per share cash dividend payable on February 28 to the February 5 stockholders of record. February 28 Paid the dividend declared on January 5. Juty 6 Sold 2,500 of its treasury shares at $24 cash per share. August 22 Sold 2,500 of its treasury shares at $16 cash per share. septenber 5 oirectors declared a $6 per share cash dividend payable on october 28 to the September 25 stockholders of record. record. October 28 Paid the dividend declared on September 5 . Decenber 31 Closed the $368,000 credit balance (from net incone) in the Income Surnary account to Retained Earnings. Required: 1. Prepare journal entries to record each of these transactions. 2. Prepare a statement of retained carnings for the current year ended December 31 . 3. Prepare the stockholders' equity section of the balance sheet as of December 31 of the current yeat, 1 Record the purchase of 5,000 shares of its own common stock for $20 cash per share. 2 Record the declaration of a cash dividend of $6 per share. 3 Record the payment of the cash dividend. 4 Record the reissue of 2,500 shares of the treasury stock for $24 cash per share. 5 Record the reissue of 2,500 shares of the treasury stock for $16 cash per share. 6 Record the declaration of a cash dividend of $6 per share. 7 Record the payment of the cash dividend. 8 Record the entry to close the $368,000 credit balance (from net income) in the Income Summary account to Retained Earnings. Prepare a statement of retained earnings for the current year ended December 31 . Note: Amounts to be deducted should be indicated by a minus sign. Prepare the stockholders' equity section of the balance sheet as of December 31 of the current year