Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ronny is your client and has come to you to prepare his tax return. During the 2018-19 financial year, Ronny has disposed of the

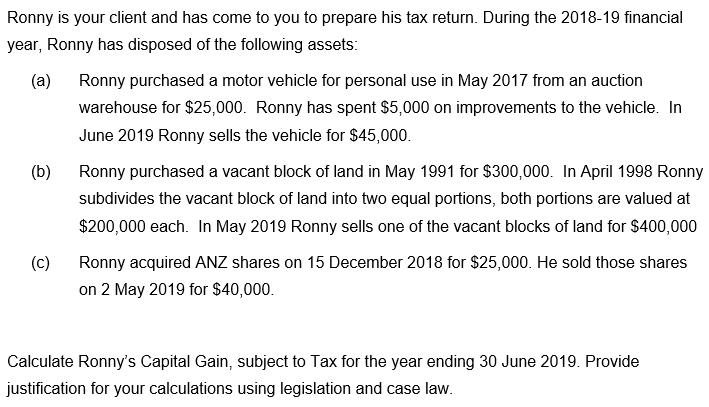

Ronny is your client and has come to you to prepare his tax return. During the 2018-19 financial year, Ronny has disposed of the following assets: (a) Ronny purchased a motor vehicle for personal use in May 2017 from an auction warehouse for $25,000. Ronny has spent $5,000 on improvements to the vehicle. In June 2019 Ronny sells the vehicle for $45,000. (b) Ronny purchased a vacant block of land in May 1991 for $300,000. In April 1998 Ronny subdivides the vacant block of land into two equal portions, both portions are valued at $200,000 each. In May 2019 Ronny sells one of the vacant blocks of land for $400,000 (c) Ronny acquired ANZ shares on 15 December 2018 for $25,000. He sold those shares on 2 May 2019 for $40,000. Calculate Ronny's Capital Gain, subject to Tax for the year ending 30 June 2019. Provide justification for your calculations using legislation and case law.

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Capital gain on the Sale of Car is exempt from Tax Cost ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started