Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rory Company has an old machine with a book value of $123,000 and a remaining five- year useful life. Rory is considering purchasing a

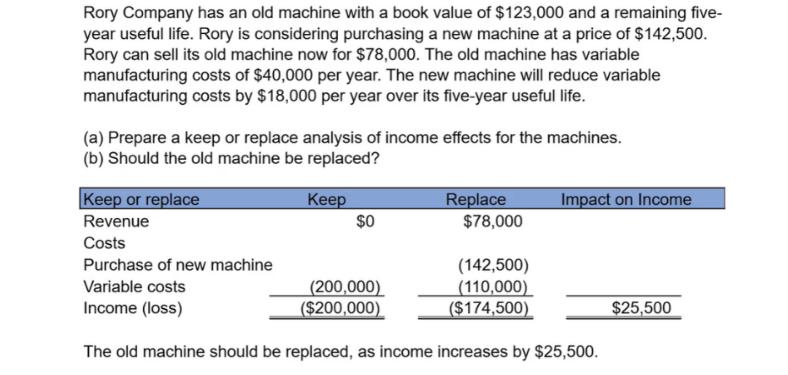

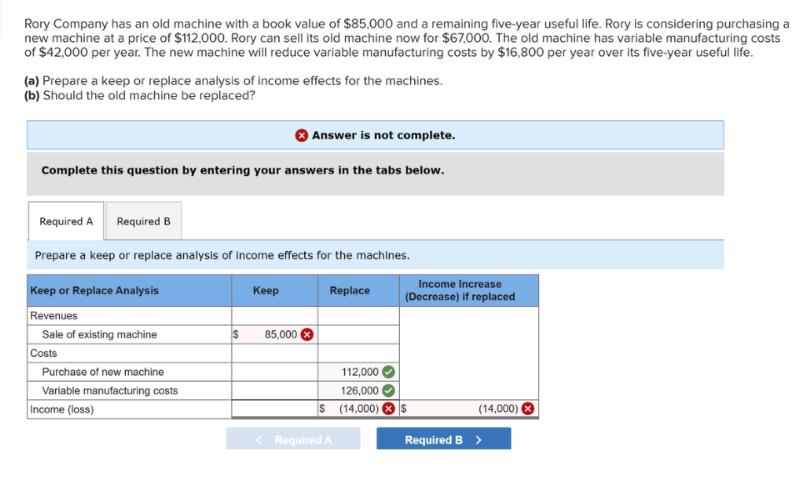

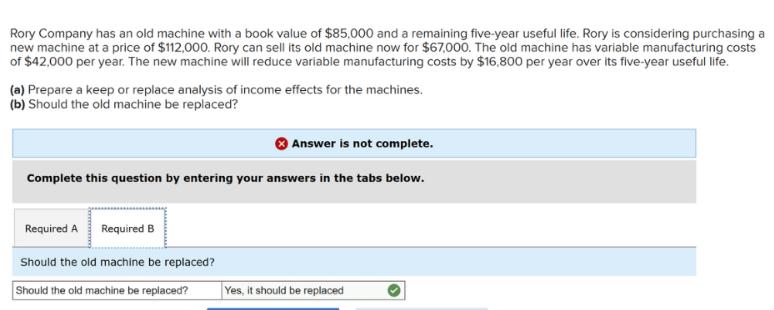

Rory Company has an old machine with a book value of $123,000 and a remaining five- year useful life. Rory is considering purchasing a new machine at a price of $142,500. Rory can sell its old machine now for $78,000. The old machine has variable manufacturing costs of $40,000 per year. The new machine will reduce variable manufacturing costs by $18,000 per year over its five-year useful life. (a) Prepare a keep or replace analysis of income effects for the machines. (b) Should the old machine be replaced? Keep Replace Impact on Income $0 $78,000 (142,500) (110,000) ($174,500) $25,500 Keep or replace Revenue Costs Purchase of new machine Variable costs (200,000) Income (loss) ($200,000) The old machine should be replaced, as income increases by $25,500. Rory Company has an old machine with a book value of $85,000 and a remaining five-year useful life. Rory is considering purchasing a new machine at a price of $112,000. Rory can sell its old machine now for $67,000. The old machine has variable manufacturing costs of $42,000 per year. The new machine will reduce variable manufacturing costs by $16,800 per year over its five-year useful life. (a) Prepare a keep or replace analysis of income effects for the machines. (b) Should the old machine be replaced? Answer is not complete. Complete this question by entering your answers in the tabs below. Required A Required B Prepare a keep or replace analysis of income effects for the machines. Keep Replace Income Increase (Decrease) if replaced Keep or Replace Analysis Revenues Sale of existing machine $ 85,000 Costs Purchase of new machine Variable manufacturing costs Income (loss) 112,000 126,000 $ (14,000) (14,000) Rory Company has an old machine with a book value of $85,000 and a remaining five-year useful life. Rory is considering purchasing a new machine at a price of $112,000. Rory can sell its old machine now for $67,000. The old machine has variable manufacturing costs of $42,000 per year. The new machine will reduce variable manufacturing costs by $16,800 per year over its five-year useful life. (a) Prepare a keep or replace analysis of income effects for the machines. (b) Should the old machine be replaced? Answer is not complete. Complete this question by entering your answers in the tabs below. Required A Required B Should the old machine be replaced? Should the old machine be replaced? Yes, it should be replaced

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a Prepare a keep or replace analysis of income effects for the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

6642db2f33461_973586.pdf

180 KBs PDF File

6642db2f33461_973586.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started