Rosa and her husband Ned separated in March of 2020. Ned and Rosa had jobs that paid well. They maintained separate finances, each paying

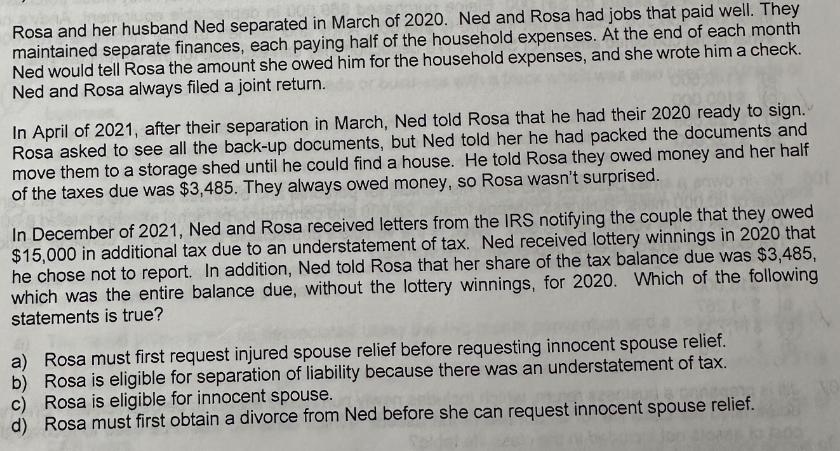

Rosa and her husband Ned separated in March of 2020. Ned and Rosa had jobs that paid well. They maintained separate finances, each paying half of the household expenses. At the end of each month Ned would tell Rosa the amount she owed him for the household expenses, and she wrote him a check. Ned and Rosa always filed a joint return. In April of 2021, after their separation in March, Ned told Rosa that he had their 2020 ready to sign. Rosa asked to see all the back-up documents, but Ned told her he had packed the documents and move them to a storage shed until he could find a house. He told Rosa they owed money and her half of the taxes due was $3,485. They always owed money, so Rosa wasn't surprised. In December of 2021, Ned and Rosa received letters from the IRS notifying the couple that they owed $15,000 in additional tax due to an understatement of tax. Ned received lottery winnings in 2020 that he chose not to report. In addition, Ned told Rosa that her share of the tax balance due was $3,485, which was the entire balance due, without the lottery winnings, for 2020. Which of the following statements is true? a) Rosa must first request injured spouse relief before requesting innocent spouse relief. b) Rosa is eligible for separation of liability because there was an understatement of tax. c) Rosa is eligible for innocent spouse. d) Rosa must first obtain a divorce from Ned before she can request innocent spouse relief.

Step by Step Solution

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started