Answered step by step

Verified Expert Solution

Question

1 Approved Answer

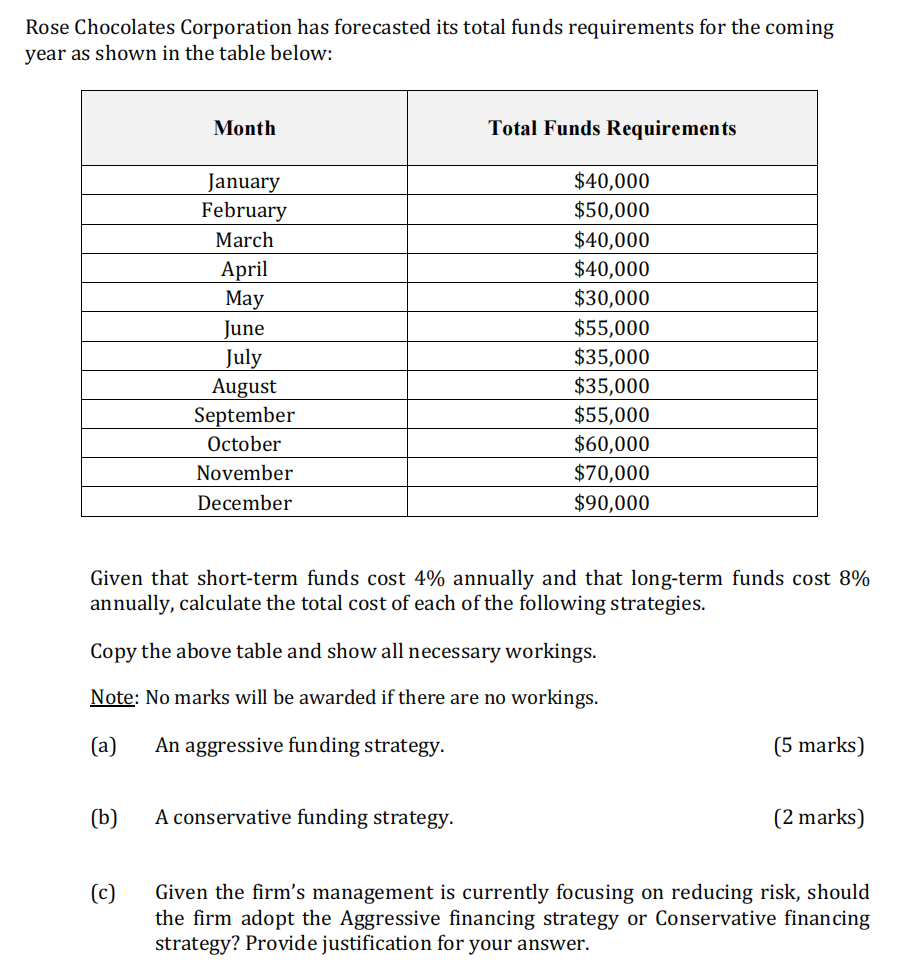

Rose Chocolates Corporation has forecasted its total funds requirements for the coming year as shown in the table below: (b) Month (c) January February

Rose Chocolates Corporation has forecasted its total funds requirements for the coming year as shown in the table below: (b) Month (c) January February March April May June July August September October November December Total Funds Requirements A conservative funding strategy. $40,000 $50,000 Given that short-term funds cost 4% annually and that long-term funds cost 8% annually, calculate the total cost of each of the following strategies. Copy the above table and show all necessary workings. Note: No marks will be awarded if there are no workings. (a) An aggressive funding strategy. $40,000 $40,000 $30,000 $55,000 $35,000 $35,000 $55,000 $60,000 $70,000 $90,000 (5 marks) (2 marks) Given the firm's management is currently focusing on reducing risk, should the firm adopt the Aggressive financing strategy or Conservative financing strategy? Provide justification for your answer.

Step by Step Solution

★★★★★

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the total cost of each financing strategy we need to determine how much shortterm and l...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started