Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Rose Limited (ROL) owns two properties as at 1 April 2021, the beginning of the current year: Tower A is an office building occupied

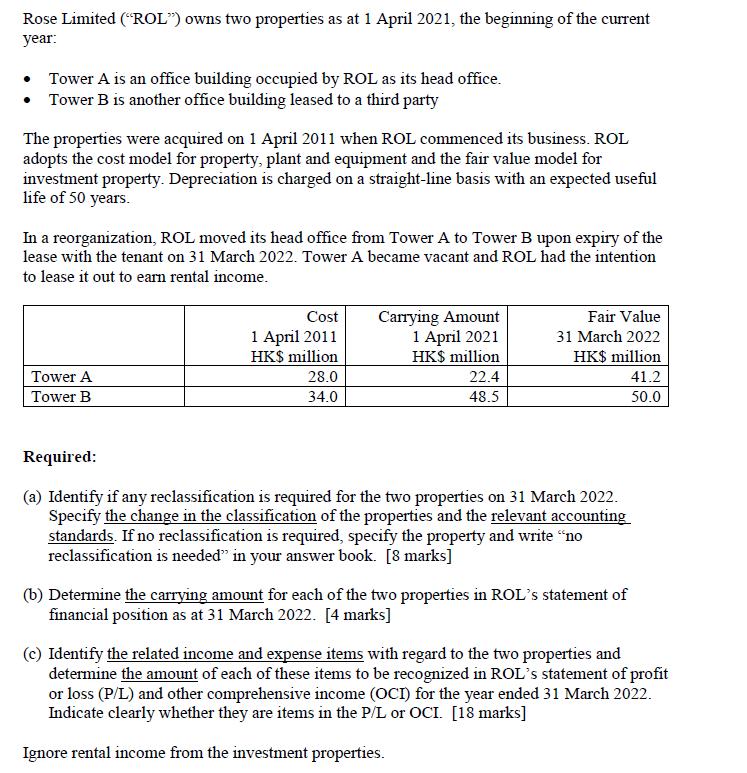

Rose Limited ("ROL") owns two properties as at 1 April 2021, the beginning of the current year: Tower A is an office building occupied by ROL as its head office. Tower B is another office building leased to a third party The properties were acquired on 1 April 2011 when ROL commenced its business. ROL adopts the cost model for property, plant and equipment and the fair value model for investment property. Depreciation is charged on a straight-line basis with an expected useful life of 50 years. In a reorganization, ROL moved its head office from Tower A to Tower B upon expiry of the lease with the tenant on 31 March 2022. Tower A became vacant and ROL had the intention to lease it out to earn rental income. Tower A Tower B Cost 1 April 2011 HK$ million 28.0 34.0 Carrying Amount 1 April 2021 HK$ million 22.4 48.5 Fair Value 31 March 2022 HK$ million 41.2 50.0 Required: (a) Identify if any reclassification is required for the two properties on 31 March 2022. Specify the change in the classification of the properties and the relevant accounting standards. If no reclassification is required, specify the property and write "no reclassification is needed" in your answer book. [8 marks] (b) Determine the carrying amount for each of the two properties in ROL's statement of financial position as at 31 March 2022. [4 marks] (c) Identify the related income and expense items with regard to the two properties and determine the amount of each of these items to be recognized in ROL's statement of profit or loss (P/L) and other comprehensive income (OCI) for the year ended 31 March 2022. Indicate clearly whether they are items in the P/L or OCI. [18 marks] Ignore rental income from the investment properties.

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

1 Tower A will be reclassified as an investment property as it is vacant and ROL had the intention t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started