Answered step by step

Verified Expert Solution

Question

1 Approved Answer

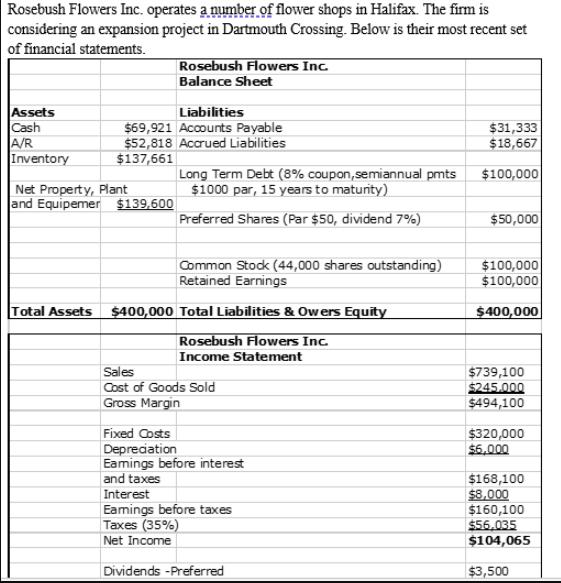

Rosebush Flowers Inc. operates a number of flower shops in Halifax. The firm is considering an expansion project in Dartmouth Crossing. Below is their

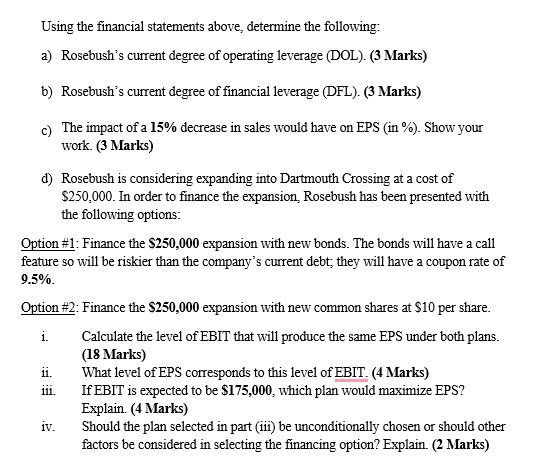

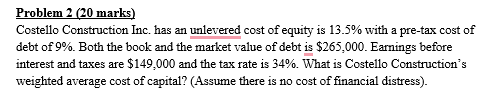

Rosebush Flowers Inc. operates a number of flower shops in Halifax. The firm is considering an expansion project in Dartmouth Crossing. Below is their most recent set of financial statements. Rosebush Flowers Inc. Balance Sheet Liabilities Assets Cash A/R $69,921 Accounts Payable $52,818 Accrued Liabilities $31,333 $18,667 Inventory $137,661 Net Property, Plant Long Term Debt (8% coupon,semiannual pmts $1000 par, 15 years to maturity) $100,000 and Equipemer $139,600 Preferred Shares (Par $50, dividend 7%) $50,000 Common Stock (44,000 shares outstanding) Retained Earnings $100,000 $100,000 Total Assets $400,000 Total Liabilities & Owers Equity $400,000 Rosebush Flowers Inc. Income Statement Sales Cost of Goods Sold Gross Margin Fixed Costs Depreciation Eamings before interest and taxes Interest Eamings before taxes Taxes (35%) Net Income Dividends -Preferred $739,100 $245.000 $494,100 $320,000 $6,000 $168,100 $8,000 $160,100 $56.035 $104,065 $3,500 Using the financial statements above, determine the following: a) Rosebush's current degree of operating leverage (DOL). (3 Marks) b) Rosebush's current degree of financial leverage (DFL). (3 Marks) c) The impact of a 15% decrease in sales would have on EPS (in %). Show your work. (3 Marks) d) Rosebush is considering expanding into Dartmouth Crossing at a cost of $250,000. In order to finance the expansion, Rosebush has been presented with the following options: Option #1: Finance the $250,000 expansion with new bonds. The bonds will have a call feature so will be riskier than the company's current debt; they will have a coupon rate of 9.5%. Option #2: Finance the $250,000 expansion with new common shares at $10 per share. i. ii. 111. iv. Calculate the level of EBIT that will produce the same EPS under both plans. (18 Marks) What level of EPS corresponds to this level of EBIT. (4 Marks) If EBIT is expected to be $175,000, which plan would maximize EPS? Explain. (4 Marks) Should the plan selected in part (iii) be unconditionally chosen or should other factors be considered in selecting the financing option? Explain. (2 Marks) Problem 2 (20 marks) Costello Construction Inc. has an unlevered cost of equity is 13.5% with a pre-tax cost of debt of 9%. Both the book and the market value of debt is $265,000. Earnings before interest and taxes are $149,000 and the tax rate is 34%. What is Costello Construction's weighted average cost of capital? (Assume there is no cost of financial distress). Problem 3 (43 marks) Texas Inc. has an EBIT of $450,000 that it expects it will earn forever, and it pays all of its earnings as dividends to shareholders (i.e., no growth). The firm has a corporate tax rate of 40% and has an un-levered beta of .90. The firm has 92,656 common shares issued and outstanding. In the market, you observe that Government T-bills are being sold to yield 4% and the S&P/TSX Composite Index is expected to yield 10%. Assume a world of taxes and a cost for the risk of default. a) Calculate the value of the firm. (7 marks) b) Calculate the WACC for the firm. (4 marks) c) What is the value of a share in the company and what is the EPS? (4 marks) d) What is the value of the firm if the firm issues $600,000 of bonds at par with a coupon rate of 7.5%? The beta for the equity of the leveraged firm is 1.02. (10 marks) e) What is the value of the firm if the firm issues $700,000 of bonds at par with a coupon rate of 8.5%? The beta for the equity of the leveraged firm is 1.40. (10 marks) f) What is the optimal level of debt, $600,000 or $700,000? Explain. (4 marks) g) What is the WACC for the firm at the optimal level of debt? (4 marks) 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started