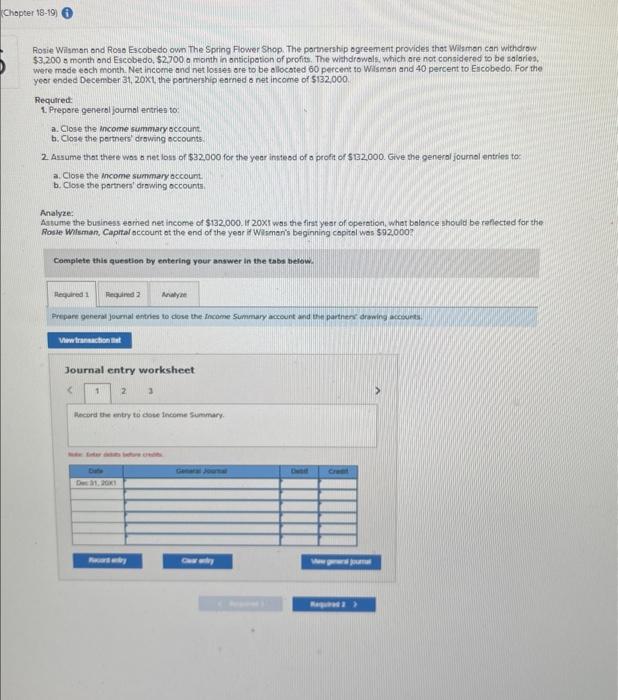

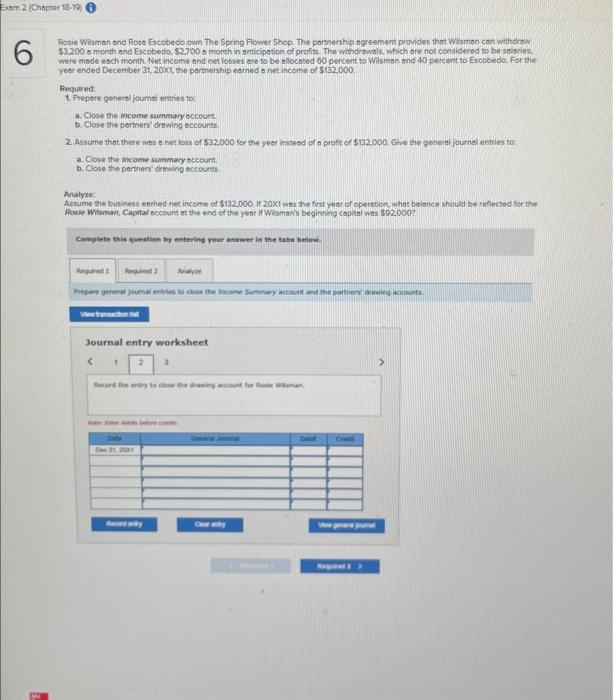

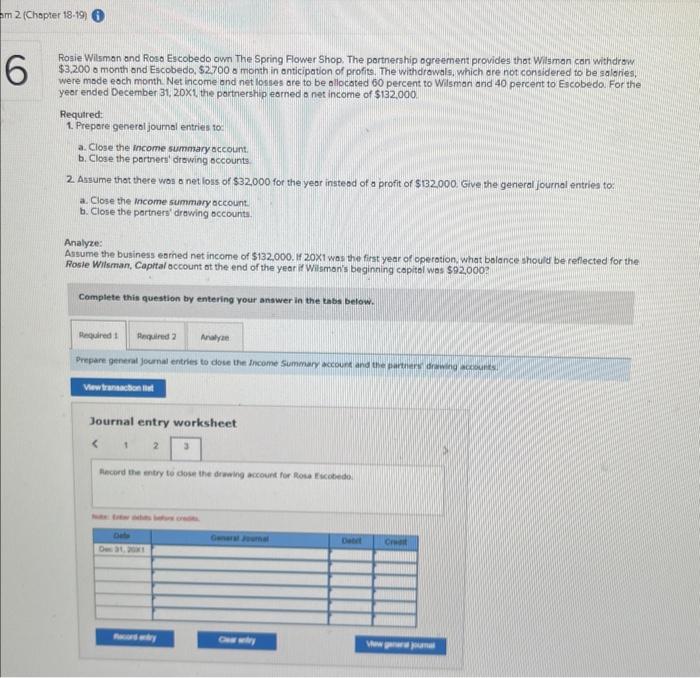

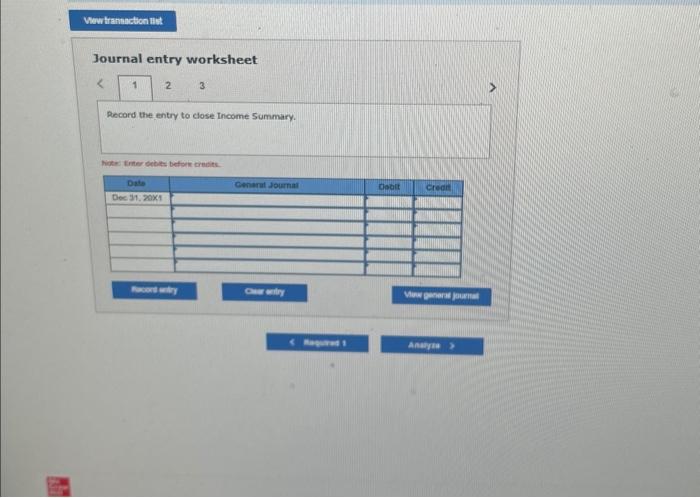

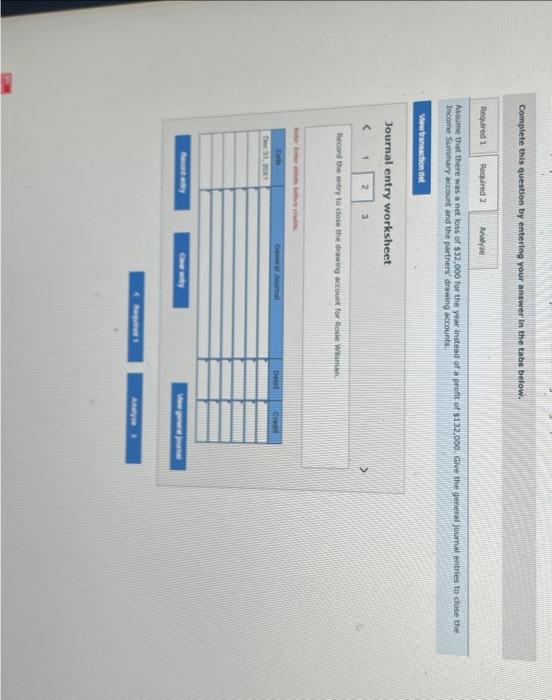

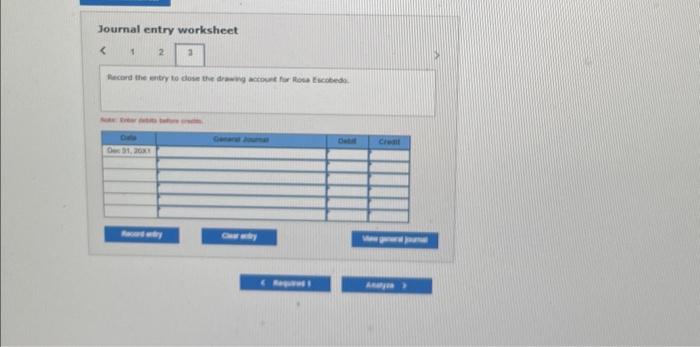

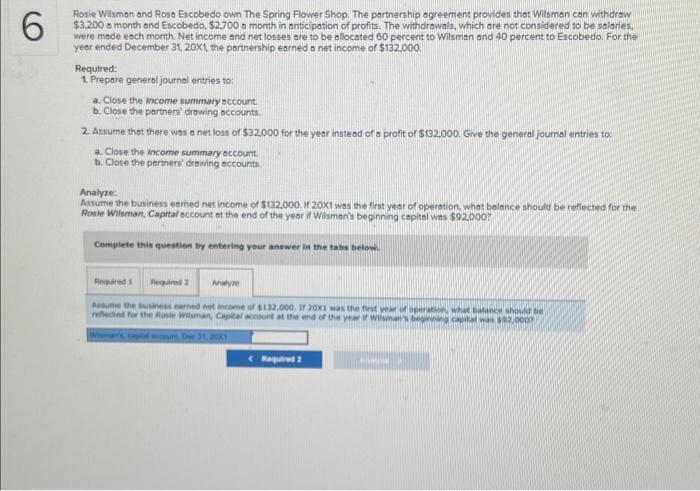

Rosie Wilsman ond Rose Escobedo own The Spring Flower Shop. The pornership ogreement provides thet Wistan can withdrow $3,200 o month ond Escobedo, \$2,700 o month in onticipotion of profits. The withdrowals, which are not considered to be solaries, were made eoch month. Net incorne and net losses ore to be ollocoted 60 percent to Wilsmon and 40 percent to Eicobedo, For the year ended December 31, 20Xt, the parthership earned o net income of $132.000. Required: 1. Prepore generol journal entries to: a. Close the income summaryoccount. b. Close the porthers' drowing occounts. 2 Assume that thete wos o net loss of $32,000 for the year insteed of a profit of $32,000. Give the general joumol entrios to: a. Close the income summary account. b. Close the partners' drowing occounts. Analyze: Astume the business eorned net income of $132,000. If 20xf ws the fint yest of operation, whet balance should be reflected for the Rosse Whismen, Capital occount ot the end of the year it Whamaris beginning copital was $92,000 ? Complete this question by entering your answer in the tabs below. Frepare generat joumal enthes to clove the Income Summary account zid the partners drowing accsurts. Journal entry worksheet Aecord the entry to dose Income siomary. Rosie Wismon ond Rosa Escobedo own The Spring Flower Shop, The pornecship ogreement providen thet Wismon con withdrew $3,200 o month and Escobeda, $2700 o month in onticipotion of profis. The withdrowals, which ore not conaldered to be selspits. were mode each morth. Net income and net losses ore to be allocated 60 percent to Wilsman and 40 percent to Eicobedo. For the yeor ended December 3t, 20xt the partnership earned a net income of $132,000. Aequired: 1 Prepore generol joumal entries to: a. Close the income sumeraryoccount b. Close the portners' drowing occounts. 2. Assume that there wos onet loss of $32.000 lor the yeor instesd of s profic of $132.000. Eive the general journal entries to: a. Close the income sammary occourn. b. Clone the portener' drtwing occounts. Analyre: Posie Whenan, Caprtal sccount et the end of the yeor if Wisman's beginning capital was $92,000 ? Complete this question by entering vour nower in the tabs beipw. Journal entry worksheet 3 Rosie Wilsman and Roso Escobedo own The Spring Flower Shop. The portnership ogreement provides thot Wilsman can withdrow $3,200 o month and Escobedo, \$2700 o month in anticipation of profits. The withdrawals, which ore not considered to be salaries, were mode eoch momth. Net income and net loyses are to be ollocated 60 percent to Wilsman and 40 percent to Escobeda. For the year ended December 31, 20X1, the portnership earned o net income of $132,000. Required: 1. Prepore generol journal entries to: a. Close the income summary occount. b. Close the portnert' dirowing occounts. 2 Assume that there wos o net loss of $32,000 for the yeor insteod of a profit of $132000. Give the general journal entries to: a. Close the income summary occount: b. Close the portners' drawing occounts. Analyze: Assume the business eorned net income of $132,000. If 201 was the first year of operotion, what balance should be reflected for the Rosle Wilsman, Capital account ot the end of the year if Wismon's beginning copitol was $92,000 ? Complete this question by entering your answer in the tabs below. Journal entry worksheet Journal entry worksheet 3 Record the entry to close Income Summary. Niote: tiner sebits befoen crenties. Complete this question by entering vour answer in the tabs below. thcome Sumimary account ind the parthers' drawing accounts Journal entry worksheet Journal entry worksheet Rosie Wisman and Rose Escobedo own The Spring Flower Shop. The partnership ogreement prowiden that Wisman can withdrow $3,200 o month and Excobedo, $2,700 o month in anticipotion of profits. The withdrowals, which ore not considered so be salories, were mode eoch month. Net income and net losses are to be alocoted 60 percent to Wilsman and 40 percent to Escobedo. For the year ended December 31, 20x1, the parthership earned a net income of $132.000. Required: 1. Prepare general journol entries to: a. Close the income summary account. b. Close the parthers' drawing occounts 2. Astume that there was onet loss of $32,000 for the year insteod of o profit of $132,000. Give the general journal entries to: a. Close the income summary occount. b. Close the perthers' drowing occounts. Analyze: Assume the business earhed net income of $132,000. If 20x i was the firnt yest of operstion, whot bolance inculd be reflected for the Poule Wileman, Caprtal occoumt of the end of the yest if Wilsmaris beginning coplial was $92000 ? Complete this question by entering your antwer in tre tabs betow