Ross Co. is an oil and gas company located in the Western United States. Ross follows U.S. GAAP in recording and reporting its financial transactions

Ross Co. is an oil and gas company located in the Western United States. Ross follows U.S. GAAP in recording and reporting its financial transactions and has a year-end of 12/31. During the fiscal year-end close, Kyle Larsen (assistant controller) is reviewing accounts payable and accrued liabilities, including the company's asset retirement obligation and cost at 12/31 Year 1. He is noting identified adjustments needed to accounts payable on the year-end account reconciliation, and he is preparing the journal entries for the retirement obligation.

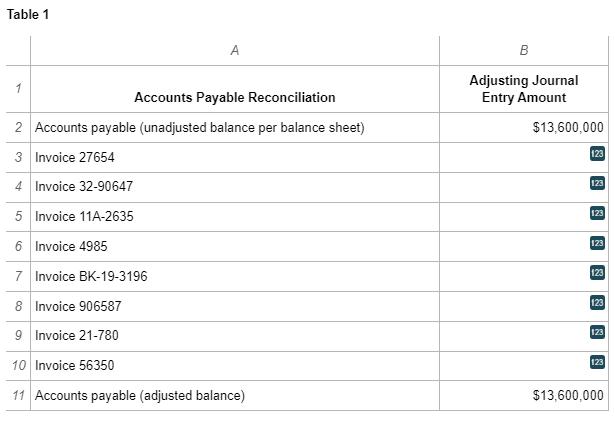

In Table 1, use exhibit 1 to identify adjustments to accounts payable at 12/31. In column B, enter the amount of the adjustment for each invoice to properly state the ending accounts payable balance. If the adjustment increases the balance, use a positive number. If the adjustment decreases the balance, use a negative number. Enter a zero where no adjustment is needed.

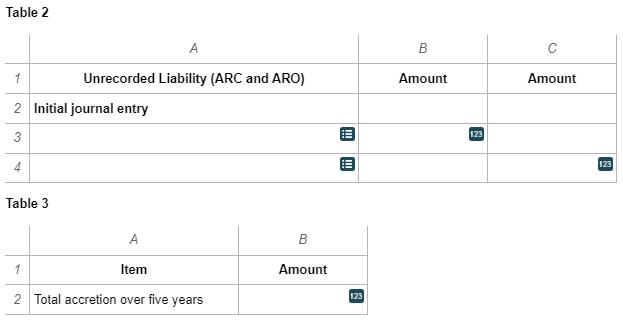

In Table 2, populate the information related to the asset retirement cost (ARC) and asset retirement obligation (ARO) at 12/31 Year 1. In column A, select the account name to record the journal entry. In column B, enter the amount of the debit. In column C, enter the amount of the credit.

In Table 3, enter the amount of ARC and ARO accretion over five years in Column B.

Table 1 A Accounts Payable Reconciliation 2 Accounts payable (unadjusted balance per balance sheet) 3 Invoice 27654 4 Invoice 32-90647 5 Invoice 11A-2635 6 Invoice 4985 7 Invoice BK-19-3196 8 Invoice 906587 9 Invoice 21-780 10 Invoice 56350 11 Accounts payable (adjusted balance) B Adjusting Journal Entry Amount $13,600,000 123 123 123 123 123 123 123 123 $13,600,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

You have provided the tables needed to complete the answer Based on the information you have provided here is a revised answer Table 1 Accounts Payabl...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started