Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ross Co., Westerfield, Inc., and Jordan Company announced a new agreement to market their respective products in China on July 18, February 12, and

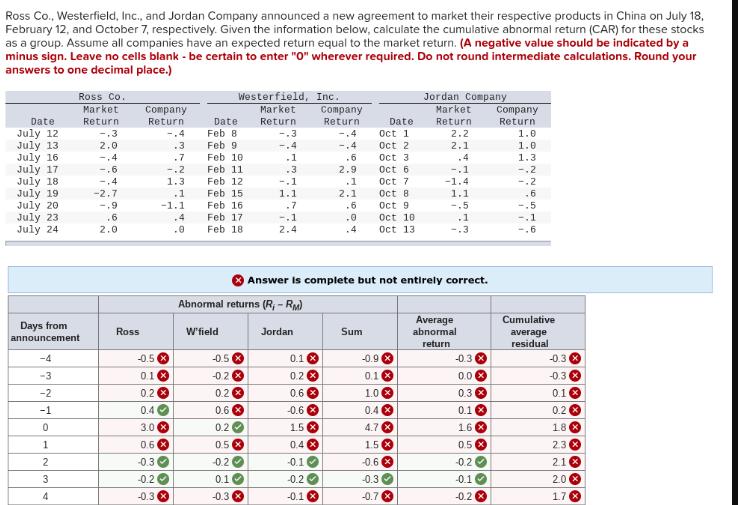

Ross Co., Westerfield, Inc., and Jordan Company announced a new agreement to market their respective products in China on July 18, February 12, and October 7, respectively. Given the information below, calculate the cumulative abnormal return (CAR) for these stocks as a group. Assume all companies have an expected return equal to the market return. (A negative value should be indicated by a minus sign. Leave no cells blank - be certain to enter "O" wherever required. Do not round intermediate calculations. Round your answers to one decimal place.) Westerfield, Inc. Date Ross Co. Market Return Jordan Company Company Return Date Market Return Company Return Date Market Return Company Return July 12 -.3 -.4 Feb 81 -.3 -.4 Oct 1 2.2 1.0 July 13 2.0 .3 Feb 9 .4 -.4 Oct 2 2.1 1.0 July 16 -.4 .7 Feb 10 .1 .6 Oct 3 .4 1.3 July 17 -.6 -.2 Feb 11 .3 2.9 Oct 6 -.1 -.2 July 18. -.4. 1.3 Feb 12 -.1 .1 Oct 7 -1.4 -.2 July 19 -2.7 .1 Feb 15 1.1 2.1 Oct 8 1.1 .6 July 201 .9 -1.1 Feb 16 .7 .6 Oct 9 -.5 -.5 July 23 July .6 .4 Feb 17 -.1 .0 Oct 10 .1 -1 241 2.0 .0 Feb 18 2.4 4 Oct 13 -.3 -.6 Answer is complete but not entirely correct. Abnormal returns (R,-RM) Days from announcement Ross W'field Jordan Sum Average abnormal Cumulative return average residual -4 0.5 X -0.5 x 0.1 * -0.9 -0.3 x -0.3 -3 01x -02 x 0.2 0.1 0.0 -0.3 -2 0.2 0.2 0.6 1.0 0.3 0.1 -1 0.4 0.6 -0.6 0.4 0.1 0.2 0 3.0 x 0.2 1.5 x 4.7 x 16 x 18 1 0.6 0.5 0.4 1.50 0.5 x 2.3 2 -0.3 -0.2 -0.1 -0.6 x -0.2 21x 3 -0.2 0.1 -0.2 -0.3 -0.1 2.0 4 -0.3 -0.3 -0.1 -0.7 -0.2 1.7

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the cumulative abnormal return CAR for the group of stocks we need to calculate the abn...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started