Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ross Company is a C corporation providing property management services. Ross has used the cash method since inception because its gross receipts did not

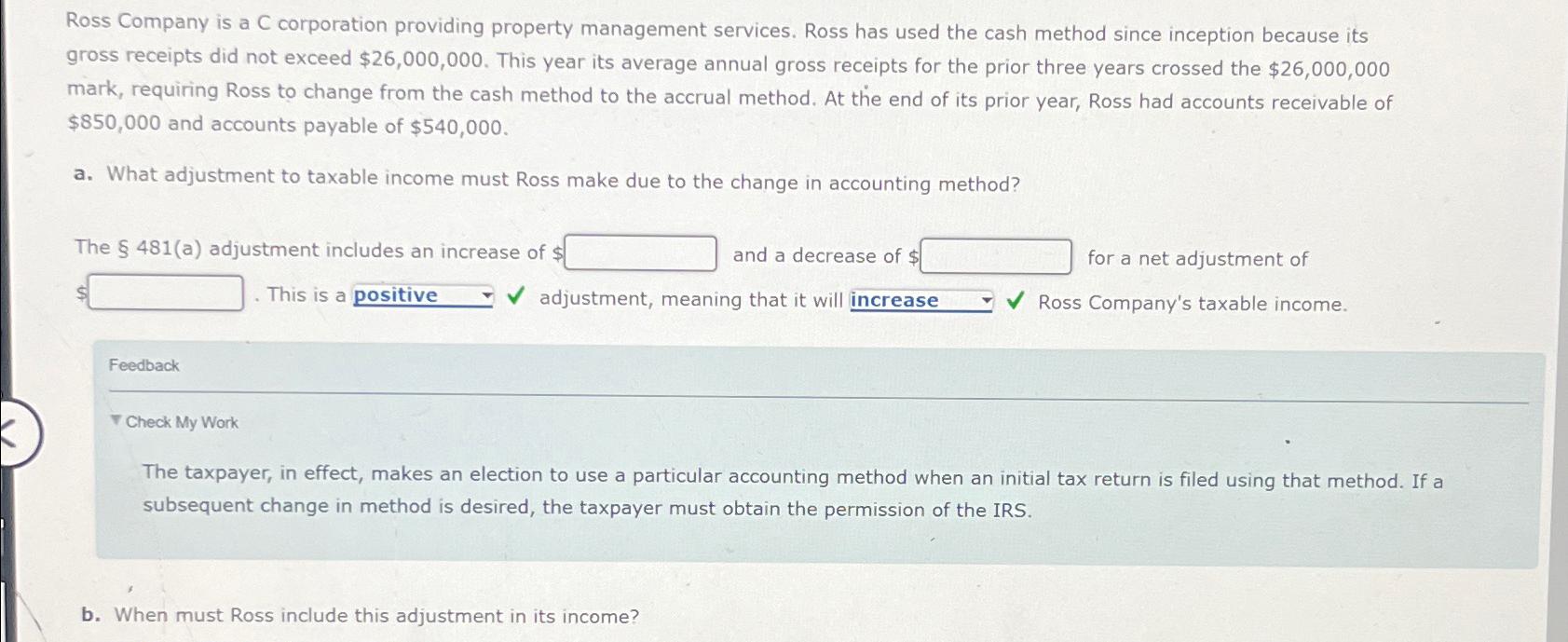

Ross Company is a C corporation providing property management services. Ross has used the cash method since inception because its gross receipts did not exceed $26,000,000. This year its average annual gross receipts for the prior three years crossed the $26,000,000 mark, requiring Ross to change from the cash method to the accrual method. At the end of its prior year, Ross had accounts receivable of $850,000 and accounts payable of $540,000. a. What adjustment to taxable income must Ross make due to the change in accounting method? The 481(a) adjustment includes an increase of $ This is a positive for a net adjustment of and a decrease of $ adjustment, meaning that it will increase Ross Company's taxable income. Feedback Check My Work The taxpayer, in effect, makes an election to use a particular accounting method when an initial tax return is filed using that method. If a subsequent change in method is desired, the taxpayer must obtain the permission of the IRS. b. When must Ross include this adjustment in its income?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started