Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ross Refrigeration manufactures luxury commercial refrigerators. K-Ross completed but did not sell one refrigerator (Fridge A) worth $9,500 during the last period. K-Ross did

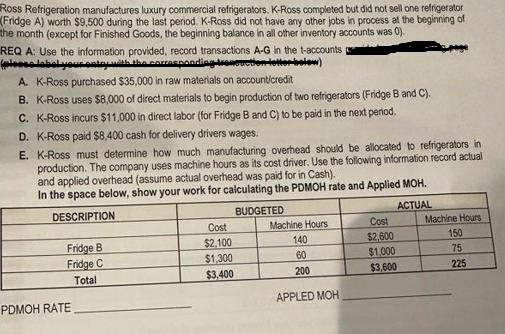

Ross Refrigeration manufactures luxury commercial refrigerators. K-Ross completed but did not sell one refrigerator (Fridge A) worth $9,500 during the last period. K-Ross did not have any other jobs in process at the beginning of the month (except for Finished Goods, the beginning balance in all other inventory accounts was 0). REQ A: Use the information provided, record transactions A-G in the t-accounts (pleese label your entry with the ensuction letter-below) A. K-Ross purchased $35,000 in raw materials on account/credit B. K-Ross uses $8,000 of direct materials to begin production of two refrigerators (Fridge B and C). C. K-Ross incurs $11,000 in direct labor (for Fridge B and C) to be paid in the next period. D. K-Ross paid $8,400 cash for delivery drivers wages. E. K-Ross must determine how much manufacturing overhead should be allocated to refrigerators in production. The company uses machine hours as its cost driver. Use the following information record actual and applied overhead (assume actual overhead was paid for in Cash). In the space below, show your work for calculating the PDMOH rate and Applied MOH. DESCRIPTION BUDGETED ACTUAL Fridge B Fridge C Total PDMOH RATE Cost $2,100 $1,300 $3,400 Machine Hours 140 60 200 APPLED MOH Cost $2,600 $1,000 $3,600 Machine Hours 150 75 225 F. K-Ross completed production of Fridge B. Costs attributable to Fridge B include $4,200 of direct material $5,000 of direct labor, and applied manufacturing overhead. G. K-Ross sold Fridge A on account for $10,300.

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

A Raw Materials 35000 Accounts Payable B WorkinProcess Inventory 8000 Raw Materials C WorkinProcess ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started