Answered step by step

Verified Expert Solution

Question

1 Approved Answer

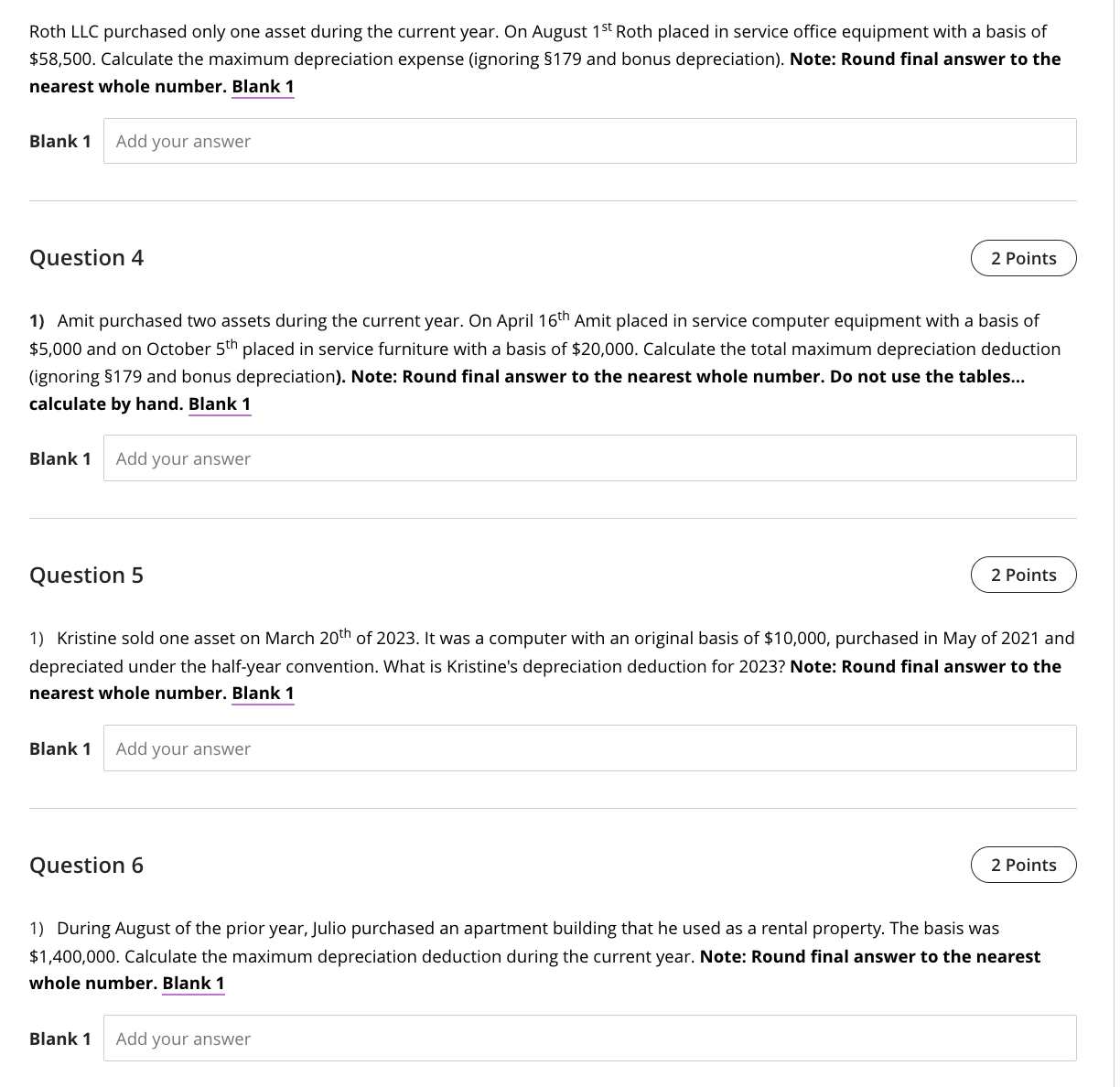

Roth LLC purchased only one asset during the current year. On August 1 s t Roth placed in service office equipment with a basis of

Roth LLC purchased only one asset during the current year. On August Roth placed in service office equipment with a basis of

$ Calculate the maximum depreciation expense ignoring $ and bonus depreciation Note: Round final answer to the

nearest whole number. Blank

Blank

Question

Amit purchased two assets during the current year. On April Amit placed in service computer equipment with a basis of

$ and on October placed in service furniture with a basis of $ Calculate the total maximum depreciation deduction

ignoring $ and bonus depreciation Note: Round final answer to the nearest whole number. Do not use the tables...

calculate by hand. Blank

Blank

Question

Kristine sold one asset on March of It was a computer with an original basis of $ purchased in May of and

depreciated under the halfyear convention. What is Kristine's depreciation deduction for Note: Round final answer to the

nearest whole number. Blank

Blank

Question

During August of the prior year, Julio purchased an apartment building that he used as a rental property. The basis was

$ Calculate the maximum depreciation deduction during the current year. Note: Round final answer to the nearest

whole number. Blank

Blank Add

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started